Which stocks should you avoid buying in 2022?

There is nothing worse than if you bought promising securities, and they began to rapidly fall in price, thereby eating into your savings.

So, if you're betting on stock market investments, it's a good idea to know which ones could result in record losses in 2022.

In these turbulent times, a company's share price can not only change by a couple of percent, but literally plummet several times.

So which securities today can be considered risky assets and which ones should not be purchased for the long term?

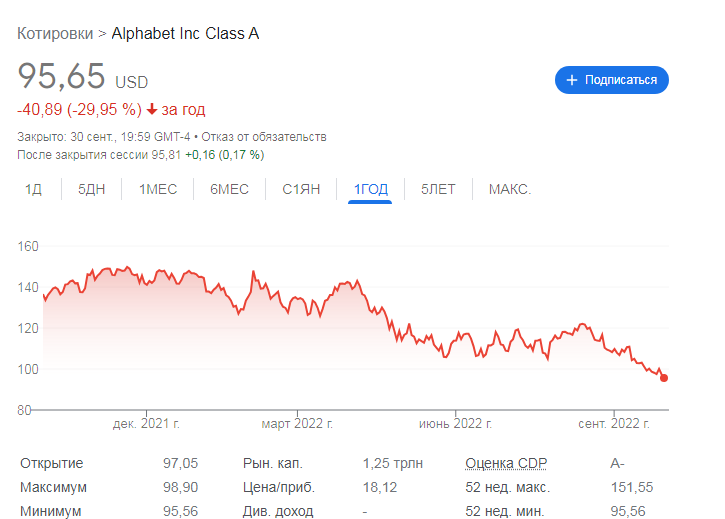

The company has already fallen almost 30% in value over the past year, and there's no sign of any price growth in the near future. Its market capitalization is $1.25 trillion, a staggering figure considering the company's primary assets are virtual.

Meta Platforms Inc is a social network better known to us as Facebook, and is one of the most valuable IT companies:

Meta Platforms Inc.'s market capitalization is currently $365 billion, and Facebook's stock has seen a record drop of more than 60% over the past year.

Adobe, Inc. is a company familiar to many computer users, a leading software developer:

A year ago, Adobe, Inc. shares traded at close to $700; now they're trading at just $275. The company's total value is $128 billion.

Shares of other companies involved in software development are also at risk, and it is still too early to talk about the price bottoming out.

During geopolitical instability, investors prefer to invest in more tangible assets, such as the military industry, medicine, and food production, rather than in virtual assets that have no real backing.

Therefore, it can be said that IT sector securities will remain under pressure until the end of the military conflict in Ukraine, which is only just gaining momentum.

At the same time, no one prevents you from using such assets for short-term trading or for short-term transactions on trading platforms - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka