What is an IPO, or how to make money on a company's initial public offering?

Despite the global economic crisis, the stock market continues to attract potential investors.

After all, the best time for investment has always been considered to be when the price is at its minimum; it is at these moments that one can acquire assets with the greatest growth prospects.

One of the most interesting assets in the current situation are new shares of companies that are just beginning to be traded on the stock exchange.

IPO (Initial Public Offering) is the initial placement of securities on the stock exchange, as a result of which a closed joint-stock company becomes open to any investor.

How to make money on an IPO?

To make money on an initial public offering (IPO), you need to find a promising company that is about to go public.

First, you need to open an account with one of the brokerage companies - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka

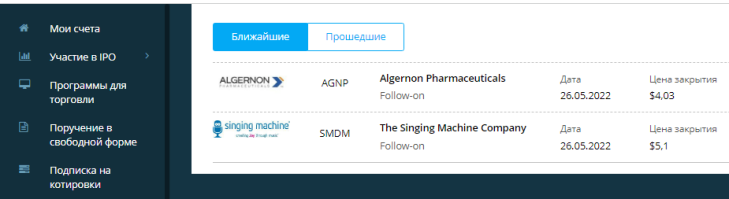

Then you should submit an application to participate in the upcoming placement, wait for the start of trading and act depending on where the price goes.

Very often, after the start of free circulation of shares, their price increases by tens of percent; promising companies are always in great demand on the stock exchange, and investing in them is considered a good investment.

After purchasing, shares can be sold without additional commissions only after 30 days, otherwise you will have to pay 1.75% of the sale amount.

How to choose the right company for investment

In our case, this is the most important question, since new shares do not always immediately begin to rise in price after entering the market; there are known cases where the price fell and never reached the placement price:

Therefore, the issue of choosing an IPO must be approached with the utmost responsibility. There are several aspects that require attention:

• The reputation of the underwriter —the company that assessed the shares before they entered the market. Since an underwriter with a personal interest can significantly inflate the price of a security.

• Popularity of the product being manufactured – investors are much more willing to buy securities of companies producing well-known brands. Product recognition plays a role here.

High demand helps drive up prices during the first few days of trading and increases the potential profit potential.

• Financial condition – this factor cannot be ignored; it is clear that no one will want to buy shares of a company that ended the previous year with losses.

• The situation in the industry – this factor should also be noted; when planning, one should take into account which market segment the company belongs to and what the general situation is in this sector of the economy.

• News analysis – often the news contains information about the company we need, we should evaluate how positive or negative they are and what impact they can have on the price.

With the right approach, it is entirely possible to purchase securities that will bring tens, and possibly hundreds, of percent profit to their owner.

The main thing is not to rush and choose a truly promising company whose shares you can make money on.