Model portfolios are a new word in investments

Investment instruments present on the Forex market are designed for a short period of time, and they require active participation.

If we look at the most popular platforms, the entire mechanism is based on either copying the trades of successful traders or entrusting them with management.

Therefore, investors are constantly forced to select successful traders, analyze their statistics, and find entry points when the trader experiences minimal drawdowns.

However, this approach to Forex investing, in addition to the risk of asset price fluctuations, carries another risk: the stability and efficiency of the trader themselves.

Investment success largely depends on the trader's discipline and ability to consistently follow their strategy, rather than turning a conservative account into an aggressive one, and the trading process into a roulette wheel.

Model portfolios are a completely new investment approach in the forex market from Forex Club broker.

The essence of which is to open one-time positions in promising areas, thus forming a portfolio of open positions that will offset each other's risks.

Investing in model portfolios is characterized by extremely low risks and the complete absence of the managing trader's influence.

This is because open positions are held in the market for an entire quarter and require no trading.

Introduction to model portfolios from Forex Club.

The principle of investing in model portfolios is very simple: by connecting to one, trades are opened in a specific sector, which is the basis for the portfolio.

It's worth noting that model portfolios are suitable only for medium- and long-term investors seeking minimal risks and conservative returns. So, let's briefly review the model portfolios offered by Forex Club.

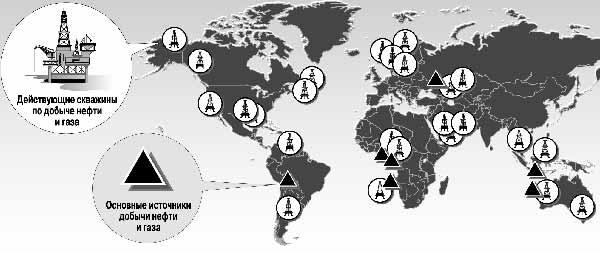

1. Commodity Cube.

This investment portfolio is based on assets in the agricultural and energy sectors. According to the terms and conditions, a minimum deposit of $500 is required to activate access. In return, you will receive up-to-date information and signals for two quarters.

The potential return of this portfolio is 75 percent per annum, with a profit forecast of 45 percent and a loss forecast of 25 percent.

2. Stock Assets Cube.

This portfolio can be considered one of the most conservative, as the basis for building positions is not individual trading assets by industry, but entire stock indices that reflect the state of economies and industries as a whole.

The potential return of this portfolio is 45 percent per annum.

3. Currency Cube.

The "Currencies" portfolio consists of major currency pairs and key cryptocurrencies. By joining this portfolio, a trader with a minimum deposit of $500 will receive precise recommendations for opening positions on the previously mentioned asset group for two months.

The potential annual return is 34 percent, and at the beginning of the first quarter, the portfolio demonstrated 10 percent growth.

4. Metals Cube.

This investment portfolio is based on assets from the "Metals" group, namely gold, silver, copper, and others.

Subscription to this portfolio is available with a minimum deposit of just $500, in exchange for which you will receive trading recommendations and your funds will be actively involved in trading.

The potential return on this portfolio is 42 percent per annum, with growth of two and a half percent already observed.

5. CryptoCube.

The portfolio is based on major cryptocurrencies and their crosses. It's worth noting that for this type of portfolio, a trader must have a minimum deposit of $1,500 to sign up and receive recommendations. The potential return on the portfolio is 90 percent per annum.

6. Nobel Portfolios 2018.

A special type of investment asset based on the principles invented by Nobel laureate Harry Markowitz. It's worth noting that this portfolio offers free thirty-day demo access.

The portfolio's potential return is 120 percent per annum, with a minimum deposit requirement of $5,000.

Finally, it's worth noting that each investment portfolio is also divided by risk level into aggressive, moderate, and conservative. This allows investors to achieve the desired return proportionate to their risk.

Forex Club broker website: www.fxclub.org