Myths and Truths about Real Estate Investing

Having acquired some spare cash, most people think about how to preserve and grow it.

Almost everyone wants to earn passive income, with minimal effort and only counting the profits.

Real estate investments are considered the most popular, with advertisements everywhere claiming that real estate is constantly rising in value.

Furthermore, by purchasing an apartment or house, you can rent it out and earn additional income without much effort.

But all this seems quite tempting, only if you don't experience it firsthand.

Is it true that real estate is constantly rising in price?

Yes, this statement is partly true if we consider domestic real estate and prices in Russian rubles.

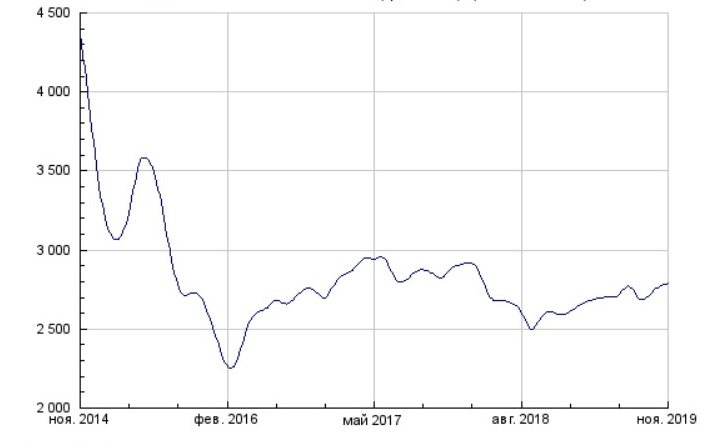

But if we take a more creative approach, we'll notice that if we look at the price per square meter in Moscow in dollars, we're witnessing a record-breaking collapse:

The price dropped from $4,300 per square meter to $2,800, meaning the losses are colossal, and it would have been more profitable to simply keep the money in foreign currency.

The price dropped from $4,300 per square meter to $2,800, meaning the losses are colossal, and it would have been more profitable to simply keep the money in foreign currency.

But you can buy an apartment abroad, where everything is definitely more expensive, for example, in Spain.

Yes, in recent years, real estate prices in this country have begun to rise steadily by several percent per year, but before that, they were also falling steadily, so no one can guarantee you won't be caught in the middle of a new decline.

Furthermore, in Spain, there's a practice of squatting empty apartments; upon returning, you might find your apartment occupied by new tenants. This can lead to years of court proceedings and hefty legal bills, as well as wasted energy and health.

Buying real estate in other countries isn't easy either; in some places, it's simply not sold to foreigners, while in others, you'll have to pay a hefty tax upon purchase and an annual ownership fee.

Poland is perhaps one exception. Foreigners can buy property there without any hassle, and annual taxes are around $0.25 per square meter. Real estate prices in Poland have been steadily rising recently.

What is the situation with the issue of housing for rent?

This is the option considered by those dreaming of passive income, as it's so profitable to rent out property and earn money for it:

First, you need to calculate how profitable it is:

First, you need to calculate how profitable it is:

An apartment worth $100,000 brings in a maximum net income of $3,600 per year, and you need to subtract:

• Realtor's commission, which is usually the equivalent of $400 per month's rent.

• Insurance - about another $100.

• Rent tax, which is at least $300 from our amount.

And so $3,600 - $800 = $2,800 net per year, and this is assuming that your apartment will not be empty, tenants will not run away without paying, or you will not have to do major repairs after them. You should also subtract the costs incurred when purchasing the property itself (tax and realtor's commission, notary).

That is, in the first year, at best, you will break even.

If you take the above information into account when purchasing investment property, you should carefully calculate how profitable it is and whether it would be better to choose a more profitable and less problematic investment option.

You might be interested in:

- Passive Income Online - http://time-forex.com/inv/passivnyj-dohod

- Earnings on investments in bonds - http://time-forex.com/inv/procent-obligacii