How worthwhile is long-term investment in Bitcoin?

Bitcoin is a digital currency created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

This cryptocurrency has no central issuer, and its issuance and transactions are regulated by a network of nodes running the Bitcoin software.

Bitcoin has quickly become popular among investors who see it as an opportunity to profit from its high volatility.

The reason for its popularity is the unprecedented rise in the price of this digital asset from $0.03 after its launch to a maximum of $68,000.

Why you shouldn't take out a loan for investment

Everyone is familiar with the phrase “Money makes money,” which means that in order to earn decent money you need a lot of money.

That's why many novice traders believe that the key to success in investing is a large sum of money.

Everything is logically explained simply: any investment has a certain percentage of profit, and the more money is invested in it, the larger the amount the investor will ultimately receive.

Currently, there are many investment projects offering good interest rates on deposits, and the amount of the promised reward far exceeds the interest rates on bank loans.

Correct long-term investments in company shares

If you have some spare cash, you always want to invest it to the maximum benefit to generate passive income.

One of the most interesting and popular investment options is company shares. The current situation on the stock market is quite challenging, so choosing an investment should be taken very seriously.

Today I want to talk not about short-term speculation on the stock market, but about long-term investments in shares, so that the investments made become an alternative to a traditional pension.

There are numerous criteria that serve as guidelines when choosing the most promising company to invest in. It's the company, not the stock, that's important. Purchasing securities solely based on technical analysis and faceless numbers is a mistake.

Cryptocurrency Staking: Is It Worth Attention?

The global economic situation is forcing more and more people to store their assets in cryptocurrencies.

However, not everyone knows that even just storing tokens in your wallet can earn you a good amount of interest, and cryptocurrency staking helps with this.

Cryptocurrency staking is the practice of earning profits by storing a specific category of coins. Users utilize the Proof of Stake algorithm, which protects the blockchain from tampering.

But the point isn't in the principles of the process itself, but in the fact that you can earn real money simply by placing cryptocurrency on a deposit-like platform.

Which stocks should you avoid buying in 2022?

There is nothing worse than if you bought promising securities, and they began to rapidly fall in price, thereby eating into your savings.

So, if you're betting on stock market investments, it's a good idea to know which ones could result in record losses in 2022.

In these turbulent times, a company's share price can not only change by a couple of percent, but literally plummet several times.

So which securities today can be considered risky assets and which ones should not be purchased for the long term?

What is an IPO, or how to make money on a company's initial public offering?

Despite the global economic crisis, the stock market continues to attract potential investors.

After all, the best time for investment has always been considered to be when the price is at its minimum; it is at these moments that one can acquire assets with the greatest growth prospects.

One of the most interesting assets in the current situation are new shares of companies that are just beginning to be traded on the stock exchange.

IPO (Initial Public Offering) is the initial placement of securities on the stock exchange, as a result of which a closed joint-stock company becomes open to any investor.

Is it possible to insure your investments in the Forex or stock market?

If you live in Europe or America, you quickly realize that they insure almost everything, from real estate to financial risks and personal liability.

A reasonable question arises: is it possible to insure yourself against losses resulting from stock trading or investments?

In this case, investments will receive the maximum degree of protection, and you will not have to worry about losses if the price changes for the worse.

Indeed, this type of insurance does exist, and you can insure your investments if you wish, albeit with a host of caveats and limitations.

The highest interest rates on dollar deposits, get up to 23 percent per annum

To protect your savings from inflation, you need to not just keep your money at home, but invest it in something; only in this way can you compensate for the depreciation of your capital.

The simplest investment option has always been an interest-bearing deposit; in addition to providing a stable income, this option is considered the least risky and most liquid.

It's best to use a deposit in US dollars or another hard currency; this will allow you to avoid losses from the fall of the national currency and avoid the stress of its next collapse.

The only drawback of dollar deposits has always been considered the low interest rate at which deposits are placed, but there are exceptions to this rule.

Investing in digital art is one of the most promising investment options

Over the past month, many people have changed their views on investing, with events in Ukraine affecting most investors.

I myself have seen how risky it is to invest in real estate, since it is practically impossible to sell existing apartments or land if necessary.

The situation is similar with the securities market: stock prices have gone down, and no one is talking about paying dividends anymore.

At this time, people are beginning to pay attention to non-standard investment options, and in addition to traditional cryptocurrencies, digital art is gaining increasing popularity.

How to choose company stocks to make a profitable investment for the future

Securities have always been one of the most popular and promising options for investing money.

This is not surprising, since the price of some shares has increased tenfold in just a few years, and in addition, dividends paid in this case also serve as additional income.

But it's not that simple. There are securities whose prices not only rise but also fall. As a result, instead of profit, you could lose your investment.

Therefore, the question “How to choose company shares” is especially relevant if you decide to invest your capital in this way.

Is it true that passive income does not exist?

Passive income is the dream of most people, because in the opinion of many, there is nothing better than not working, but just enjoying life.

Receiving money regularly and doing nothing is a dream not only for older people, but also for those who have just turned 20.

Moreover, most people don’t even suspect that there are practically no options for truly passive income.

The truth of this statement can quickly be confirmed if you try to invest your spare money yourself.

Currently, most bloggers cite dividends, real estate, investments in PAMM accounts, and deposits as sources of passive income.

Stock dividend calculator, calculate your investment return

Most investors who buy company securities expect to receive profits in the form of dividends.

Before purchasing, it is advisable to know in advance such important parameters as what profit can be expected and when this profit will be accrued.

That is, the frequency of dividend accrual, the date of register recording and the amount depending on the number of shares purchased.

You can find out more information on the exchanges where the selected securities are traded, but it is much easier to use a special stock dividend calculator.

Crypto deposit in Tether as an alternative to a regular bank deposit

Despite new investment options, the most popular was and remains a bank deposit.

Most people choose deposits because of their simplicity and reliability. The terms and conditions are clearly described, and you can immediately calculate how much money you'll receive as a result of your investment.

Availability of funds also plays a significant role; most deposit agreements can be terminated before the end of the term and your money can be quickly returned.

After the emergence of cryptocurrencies, it is quite logical that sooner or later cryptocurrency deposits will also appear.

How can an individual buy securities online?

If we analyze the income of the middle class now and twenty years ago, we can clearly say that the well-being of our population has increased.

And increased incomes lead to increased savings, although not all citizens are inclined to keep their savings under the pillow or in bank deposits.

Many beginning investors consider investing in securities, as it is not only possible, but also profitable.

And thanks to the Internet, investing in securities has become incredibly simple; in just a few clicks, you can buy or sell your favorite stocks and bonds.

Where should a beginning investor invest money?

Private investment is experiencing a real boom all over the world.

Last year and the beginning of this year were marked by a rapid growth in the number of private investors.

This trend has not bypassed Russia either – 8.8 million new investors in 2020 and more than 15 million in January 2021 alone, according to the Moscow Exchange.

But the desire to invest is not enough. To achieve real returns and minimize risks, you need to invest wisely.

Should you buy gold in 2021? Current price and near-term prospects

Despite the growing popularity of new investment products, gold remains in demand among investors.

In the summer, its price peaked at $2,090 per Troitsk ounce, an all-time high.

This upward trend has persisted for hundreds of years; gold prices always rise over the long term, but downward corrections do occur,

as happened in 2013-2014 and after the most recent price increase in 2020.

Therefore, despite the precious metal's investment appeal, many investors are wondering whether they should buy gold in 2021.

The most promising and least promising investments in 2021

As always, on the eve of the New Year, most people take stock and think about where to invest their money in the coming year.

2020 was quite a challenging year for investments, but despite the crisis, it brought joy to those who invested in technology stocks and cryptocurrencies.

Investors' returns amounted to tens of percent, which is quite a good result given the current global economic situation.

However, with the arrival of the New Year, the situation could change dramatically, and profitable assets could begin to incur losses.

Dividend taxation and how to minimize it

Investing in securities has long been one of the most attractive investment options.

After all, with the right choice of investment, you can profit not only from the share price appreciation but also from dividends.

of investment, you can profit not only from the share price appreciation but also from dividends.

Moreover, if you invest in a foreign company, you will receive dividends in a foreign currency, typically US dollars.

This type of income, like other personal income, is also subject to taxation, and this issue should not be ignored.

Dividend taxation is a rather complex topic, and it is often necessary to resolve this issue independently, without waiting for assistance from the relevant authorities.

Investments as an alternative to pensions

The older you get, the more you think about how you'll live when you can't work full-time.

I'm used to living pretty well, but the prospect of surviving on a pension of a couple hundred dollars doesn't inspire much optimism.

I'd like to put something aside for a rainy day and not worry about my meager pension not being enough to pay for rent, medicine, and groceries.

But everyone understands that simply saving money, especially in the national currency, can lead to retirement with a box full of useless papers.

The ruble is rapidly declining, and now no one is surprised by the exchange rate of 80 rubles to the dollar and 90 to the euro.

Notes on Investing: A book about investing in our current reality

If you have a good, stable job and manage your earnings wisely, after a while you'll face the question of where to invest it.

The topic of investing is quite relevant in the modern world, as properly and timely invested capital can lay the foundation for a comfortable retirement.

Most people think there's nothing complicated about investing, as long as you have something to invest.

However, those who have faced this challenge understand how challenging this is. Unfortunately, good books on investing are few and far between.

Those that are available are primarily aimed at people working in investment funds and are written in professional language.

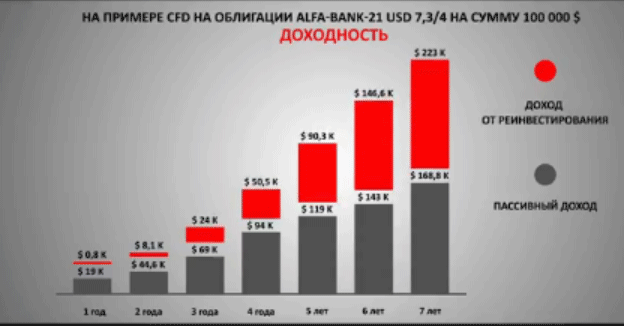

Eurobonds – an investment tool

Sooner or later, private investors reach the point of wanting to invest in high-yield assets

that offer the opportunity to earn more than bank interest on foreign currency deposits or deposits in the national currency.

Fixed foreign exchange income, typically in dollars, can be achieved by purchasing Eurobonds.

This investment provides protection against unexpected events that occur in the foreign exchange market, such as inflation, devaluation, or fluctuations in exchange rates.

What are Eurobonds?

Eurobonds are a special type of Eurobond. The simplest definition of Eurobonds is that they are debt securities denominated in a currency that is foreign to the government or company issuing them.

Investment risks

It seems that the most important thing for an investor is to find the most suitable investment, and then just calculate the profit.

But in reality, there is such a thing as investment risks, which are inherent in any type of investment activity.

That is, no matter what you invest in, there is almost always a risk of losing part or all of your investment.

Therefore, it is always better to prepare for the unexpected than to deal with its consequences later. First, let's look at how these risks are classified.

Types of investment risks

Credit risk is the likelihood that the other party to a transaction will default on their obligations. The company whose shares you bought will declare bankruptcy, the government will refuse to pay its debts, or the bank will freeze your deposits.

Where to buy gold during a pandemic?

During a crisis, everyone who has money tries to preserve it, and one of the generally accepted safe havens is investing in gold.

We're talking about bank gold of the highest purity (999), not the jewelry grade you find in costume jewelry.

After all, this precious metal always remains valuable, regardless of what's happening in the world—war, epidemics, or natural disasters.

This time, no surprise, the price of real gold soared by 30-40 percent, depending on the bank or company selling the bullion.

Global demand for the precious metal was so high that gold bullion simply disappeared from the market; at best, gold coins are now the only viable option.

Investing in a crisis: how to save your earnings

It's become a fact that economic crises have been recurring with surprising regularity in recent years.

There are countless reasons for this – unstable political situations, trade wars, collapses in energy markets, and now global pandemics.

Exchange rates are plummeting, real estate is losing value, and company stocks are plummeting. In such a situation, it's no longer about making money; the primary goal is to at least hold on to what you have.

Markets are so unpredictable that even the most reliable asset no longer inspires confidence, and investments in it can lose their value.

What should you invest in during a crisis?

When everything is falling, it can be quite difficult to choose an investment, especially since the prices of the most attractive assets at the moment are already at their maximum.

Myths and Truths about Real Estate Investing

Having acquired some spare cash, most people think about how to preserve and grow it.

Almost everyone wants to earn passive income, with minimal effort and only counting the profits.

Real estate investments are considered the most popular, with advertisements everywhere claiming that real estate is constantly rising in value.

Furthermore, by purchasing an apartment or house, you can rent it out and earn additional income without much effort.

But all this seems quite tempting, only if you don't experience it firsthand.

Passive income online.

Making money is difficult enough, but putting your existing savings to work is even more challenging.

This topic is especially relevant during the looming crisis, as inflation and exchange rate risks can lead not only to increased capital but also to the loss of existing capital.

Therefore, the topic of passive income has become quite relevant today, as many analysts predict a rather challenging economic situation in 2019.

Investment options for generating passive income are changing over time, but first, let's understand the essence of this concept.

Passive income is the generation of a stable income with minimal effort, with this effort required only at the initial stage.

Comparison of interest rates on government bonds.

Sometimes earning money is easier than preserving it. Every wealthy person dreams of a stable passive income.

Unfortunately, the interest rate on bank deposits is so low that it barely compensates for the depreciation of the currency in which the deposit is held.

The situation with government bonds is completely different. Their yields sometimes exceed 10% per annum, and that's in hard currency, to say nothing of supporting developing economies.

To get an idea of how much you can earn by buying government bonds, compare current interest rates.

The size of interest rates on government bonds.

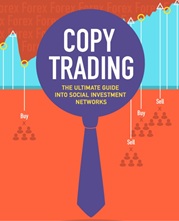

Model portfolios are a new word in investments

Investment instruments present on the Forex market are designed for a short period of time, and they require active participation.

If we look at the most popular platforms, the entire mechanism is based on either copying the trades of successful traders or entrusting them with management.

Therefore, investors are constantly forced to select successful traders, analyze their statistics, and find entry points when the trader experiences minimal drawdowns.

However, this approach to Forex investing, in addition to the risk of asset price fluctuations, carries another risk: the stability and efficiency of the trader themselves.

Investment success largely depends on the trader's discipline and ability to consistently follow their strategy, rather than turning a conservative account into an aggressive one, and the trading process into a roulette wheel.

Exchange trading of agricultural commodities.

Due to massive advertising, many investors have come to associate stock trading exclusively with currency and stock trading.

Surprisingly, these two assets are more difficult to predict; their only advantage is high liquidity and extremely high volatility.

While most professional traders make money on more stable assets, agricultural commodities are one such asset.

It is clear that these assets have their own trading characteristics:

• The simplest trading option is CFD contracts in the trader's trading terminal.

• Available for trading: wheat, corn, soybeans, coffee, sugar, cocoa.

• Strict work schedule – depending on the exchange where trading is conducted.

Gold or Bitcoin.

The most daring forecasts from analysts, according to which the leading cryptocurrency could grow to tens of thousands of dollars, are made Bitcoin quite an attractive investment instrument.

The best advertisement is the historical data of the Bitcoin price, which has grown by tens of thousands of percent in just a few years.

Could cryptocurrency become a more attractive investment than real gold? This question is on the minds of many investors.

Advantages of gold over cryptocurrencies.

• The real value of the asset itself – gold has real value.

Copper and the Chilean Peso Correlation: An Investment in the Future

The Forex market is considered one of the most unpredictable, as exchange rates can be influenced by a variety of factors, ranging from domestic monetary policy to various external factors.

Such unpredictability is primarily observed in the largest global currencies such as the dollar, euro and pound.

At the same time, easily predictable exotic instruments lie practically on the surface, where either an industry or commodity relationship can be traced.

The Chilean peso has one of the most pronounced correlations between metal prices and the national currency exchange rate, and in this article, you will learn how to use this correlation to your advantage.

Copper and Pesso: Reasons for Growth

Copper is not considered a precious metal like gold and silver, but despite this, its price has been rising for several years.

Stock trading with a small deposit

Stock trading on the exchange platform is gradually gaining popularity among traders. This is not surprising, as it offers many more opportunities than simply buying and selling securities.

First of all, it is that to actually buy ations, a fairly decent amount is required, which usually exceeds $10,000.

In online trading, there are also two types of participants: traders and investors.

The former use high leverage and make money on short-term trades, while the latter invest for the long term with minimal risk.

Long-term investments don't involve leverage, or it's limited to a minimum of 1:1 - 1:5.

Therefore, to achieve significant profits, an investor must have substantial capital. Furthermore, it's important to remember the specifics of stock trading:

PAMM accounts or ForexCopy.

Active development of various services brokerage companies This has given rise to the emergence of excellent projects that allow not only traders but also ordinary people with no understanding of stock trading to earn money.

The first breakthrough in this area was the emergence of PAMM services, the essence of which boiled down to the fact that you invested in a specific person, and they managed the funds and split the profits equally.

However, this service had one huge drawback: the manager's greed and desire to attract the maximum possible capital.

As a result, traders were not at all sparing of investors' money and neglected risks, which led to even accounts with millions of investments suddenly disappearing into oblivion due to the manager's fault.

ForexCopy Account Monitoring from InstaForex

ForexCopy account monitoring is a simple rating table with a list of managing traders whose signals you can copy.

Typically, the system determines the top accounts to monitor based on profitability, but you can customize the criteria and select managers based on your preferences.

When it comes to selection criteria directly in the monitoring, you can set criteria based on the managing trader's balance, funds, the number of open trades at the moment, or the total number of trades.

You can also filter by the number of investors or the number of signal subscribers, by the daily total (profit in dollars per day), and by account age.

Where to invest money in 2017.

Nowadays, there are not many people willing to invest their spare funds, but those who have them try to make investments with maximum efficiency.

Where should you invest your money in the coming 2017 to ensure not only significant profitability, but also maximum security for your funds?.

Considering the economic and political realities of today, there aren't many options, but they do exist. Furthermore, I'd like to warn readers against risky investment options.

1. Banks – as always, come first. Preference should be given to large financial institutions or even state-owned banks. Avoid small banks that promise higher interest rates.

Pay attention to who you're signing the agreement with—a bank or an unknown entity (and everything happens on the bank's premises with the participation of its employees). Recently, it's become very common for deposit agreements to be signed not by the bank itself, but by an intermediary company.

PAMM or HYIPs: maximum profit or a trap for the gullible

Almost every trader, and even the average person, sooner or later thinks about creating a comfortable future, one where they won't have to work hard or live on pennies in retirement.

Great investment gurus always recommend saving and scaling your money, placing the accumulated sum in a safe deposit box at the bank. To a certain extent, they're right, because if you deposit money in a safe deposit box every month for 20 years, then, mathematically, compound interest will do its job and allow you to grow your capital in retirement.

Unfortunately, however, the economic models of the post-Soviet countries in which we live do not allow us to be confident about the future. Every month, we hear on television how yet another bank has closed, and its owner, having taken tens of millions of dollars from hundreds of defrauded depositors, fled to the Bahamas.

Naturally, law enforcement is looking for him and may put him in jail, but you'll never get your money. Thus, the recommendations of foreign gurus and wealthy individuals are simply not compatible with the economic models we live in. They are being replaced by even riskier online investing methods that can offer high returns with incredible risks.

There are two popular projects on the Internet in which almost every beginning Internet investor usually invests: HYIPs and PAMMs.

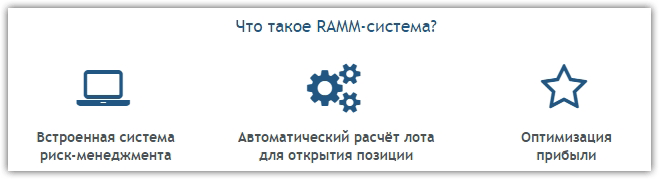

RAMM investing advantages and disadvantages

The RAMM system is an innovative investment product developed and implemented by the brokerage company Amarkets . RAMM is a platform that connects ambitious and profitable traders with investors.

For many, this service raises quite a few questions. To summarize the system briefly, the RAMM mechanism is a kind of symbiosis of the familiar PAMM accounts and the signal copying service.

The Squid Ratio is a simple method for evaluating the effectiveness of trading strategies

Evaluating the effectiveness of a particular trading strategy, advisor, investment in a PAMM account, or hedge fund is one of the most complex processes for making correct and rational decisions.

complex processes for making correct and rational decisions.

You'll agree that relying solely on a trader's profitability chart when choosing a PAMM account is a blind gamble, where the risk of losing everything constantly haunts the investor, since we can't evaluate the effectiveness of the account manager's methodology.

The same situation applies to the selection of automated trading experts, where data on profitability and drawdown can only be obtained from history.

In fact, to evaluate the effectiveness of a particular trading strategy, the well-known Kalmar coefficient was invented. Many investors believe that it solves rather complex problems when choosing an investment object.

The Kalmar ratio was first introduced in one of the most renowned stock market magazines, Futures, by Terry Young, author of a column on asset management and hedge fund investing. This indicator is based on a concept well-known to traders: drawdown.

New investment product – Eurobonds

At a time of severe devaluation of the ruble and hryvnia, with the crisis looming large over countries, the issue of money security and wise investment becomes a top priority for responsible individuals.

While it was previously possible to deposit dollars in a safe deposit box at a favorable interest rate, now, due to the rapid devaluation of national currencies, few banks can offer a favorable program, and the usual speculation on the currency exchange market is highly risky for an inexperienced trader.

Investment project "Partner"

Lately, it's become increasingly difficult to find decent investment projects that don't simply disappear within a month, as happens with most HYIPs, but instead generate stable profits for their investors.

don't simply disappear within a month, as happens with most HYIPs, but instead generate stable profits for their investors.

Lack of real documentation, deliberately false information and highly risky investment areas never reassure potential investors.

The company "Partner" was founded in 2013 by the well-known businessman, international investor Alexander Tsvigun.

Page 2 of 3