InstaCredit

Many of us sooner or later face the problem of insufficient funds for trading. The reasons vary from person to person: some have suffered a significant drawdown and desperately need a couple hundred dollars to get through a difficult period, while others want to take trading to a higher level by trying their hand at managing a large account.

The reasons vary from person to person: some have suffered a significant drawdown and desperately need a couple hundred dollars to get through a difficult period, while others want to take trading to a higher level by trying their hand at managing a large account.

And what's there to talk about when simple math tells us that if you earn an average of 10 percent of your deposit, then in order to earn an income of $1,000, you need to have a deposit of at least $10,000.

This is a clear example of how much our income depends on the capital we manage.

What should an ordinary person do if, riding the wave of active advertising, he has spent a lot of time on his education, achieved some success, but simply cannot quit his job just because his deposit is too small to be able to live on the interest earned.

Many people quit trading because of this, even though they could have achieved excellent results in this field. Sure, you could run to the bank and take out a loan, but that's too much of a risk.

InstaForex has launched a new, unique service called InstaCredit.

The idea is that with a minimum deposit, a trader can obtain a loan for a specified period at a specified interest rate. You're probably wondering, what's so unique about this?

The company doesn't lend out its own funds, but rather creates a platform where it establishes a direct relationship between investors and traders, charging only a small percentage for their cooperation. The relationship is structured in such a way that the trader immediately pays the agreed-upon percentage of the loan as collateral, and in return receives a certain amount to manage.

Thus, the investor immediately receives profit as interest in their account, and the remaining funds in the trader's account will be transferred to them automatically at the end of the loan period. Now consider the pros and cons of this partnership for both parties.

From an investor's perspective, this service offers a good opportunity to earn money. Unlike traditional PAMM account investing, the agreed-upon profit percentage will immediately appear in your account upon entering into a trade with a trader. As for the downside, as with PAMM accounts, you're not guaranteed against the trader simply losing your account and having no way to repay the money.

Moreover, InstaForex is an intermediary and has no influence over the trader. The only thing you retain is the trader's contribution in the form of a margin percentage. To provide some protection for investors, the service's creators have implemented the ability to set a Critical Loss Level as a percentage. Upon reaching this level, all trades will be automatically closed, and any remaining funds will be returned to your account.

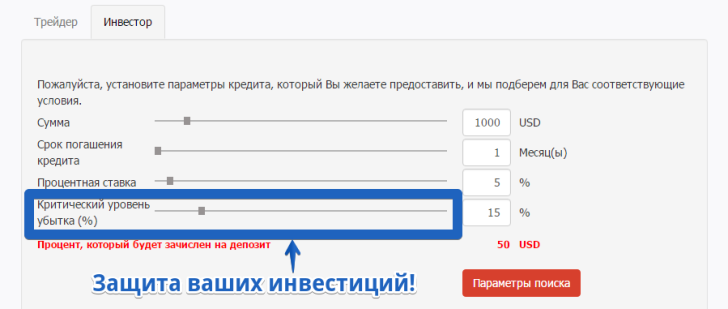

To submit a loan application, log in to your InstaCredit account and switch to the investor tab. Next, simply enter the amount you wish to lend, the interest rate, the repayment term, and the critical loss level. I recommend paying particular attention to the last point, as it's your only protection against unscrupulous traders. You can see an example of the loan application window in the image below:

Now let's look at the service from a trader's perspective. First, I'd like to point out that with a minimum amount of loan interest that must be pledged as collateral, you can receive the required amount from an investor. The calculation is quite simple: if you borrow $1,000 at 10 percent per month, you must pledge $100 as collateral to obtain the loan. It's certainly not a bad idea to risk just $100 to receive that much money under management.

Now, let's talk about the pitfalls you should be aware of. Each investor limits their losses, and if you exceed the maximum drawdown, the system will automatically close all your trades and simply return the remaining funds to the investor. Therefore, before you begin trading, you must carefully assess all the risks.

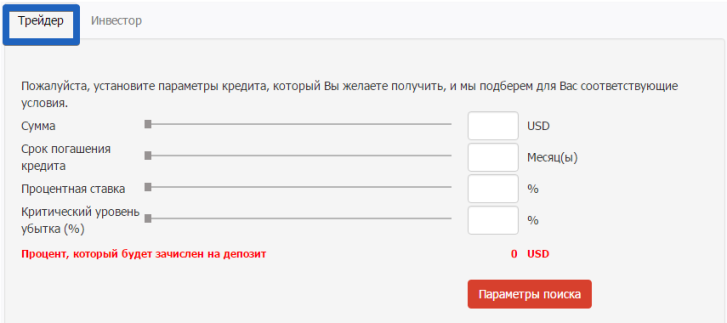

To apply for a loan, log in to the service and switch to the "Trader" tab. Next, enter the desired amount, repayment term, interest rate, and critical loss level in the appropriate fields. Your goal is to obtain the lowest interest rate and the highest risk percentage from the investor, allowing you to trade freely. An example of the loan application window is below:

In conclusion, I'd like to say that this service opens up new opportunities for potential traders. However, a significant drawback for investors is the lack of communication with the trader. Therefore, you have no way of knowing who exactly you're investing in, their strategy, money management, or tactics.

You can use the InstaCredit service at www.instaforex.com

The company also launched a new promotion that allows you to receive up to $1,500 as a bonus for Forex trading, with fairly favorable withdrawal conditions.