New investment product – Eurobonds

At a time of severe devaluation of the ruble and hryvnia, with the crisis looming large over countries, the issue of money security and wise investment becomes a top priority for responsible individuals.

While it was previously possible to deposit dollars in a safe deposit box at a favorable interest rate, now, due to the rapid devaluation of national currencies, few banks can offer a favorable program, and the usual speculation on the currency exchange market is highly risky for an inexperienced trader.

So where is it profitable to invest money so that inflation doesn't consume it, and the return can provide at least some capital growth?

New investment product – Eurobonds.

What's so interesting about bonds for the average investor? As you probably already know, any large company issues Eurobonds to borrow a large sum for the long term, under which the company commits to paying a certain interest rate.

Simply put, by purchasing a company's Eurobonds, you're buying out its debt, which you will naturally be paid for. This type of investment allows you to hold the securities while receiving predetermined interest over a specified period, with interest on Eurobonds accrued in foreign currency.

What is the advantage of this offer?

If you delve deeper into this issue, you will find out that bonds have a fairly high cost, despite the fact that you need to have various permits and go through a complex registration procedure.

We offer trading not with the underlying asset, but with CFDs, which allow you to earn not only on interest, but also on the market price of a given Eurobond.

Why is investing in Eurobonds so profitable?

So, the first and most compelling argument for investing in Eurobonds is the minimal risk. It's worth noting that regardless of whether the company ends the month profitable or unprofitable, you'll receive a predetermined interest rate, since the company must repay its debts.

The only risk is that you might not receive your interest due to bankruptcy or liquidation of the company, which almost never happens with large corporations. The second significant advantage is the daily accrual of profits due to swaps.

You will receive interest daily according to the terms of the contract.

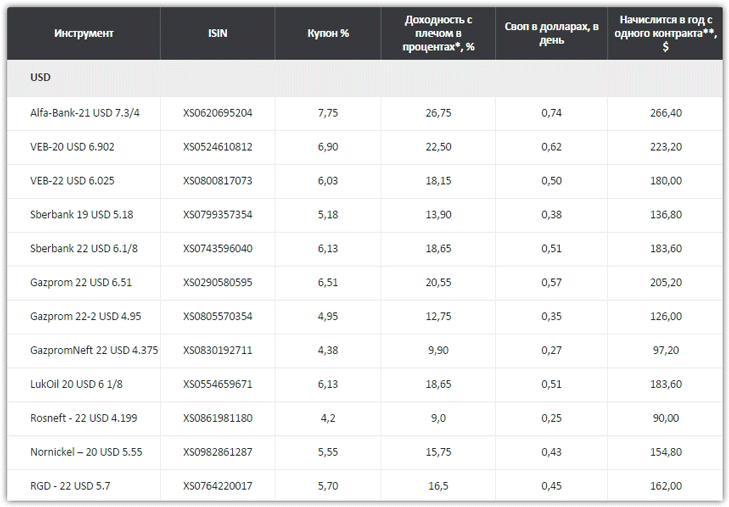

You can find more detailed information on annual yield percentages, as well as daily deposits when purchasing various Eurobonds, in the image below:

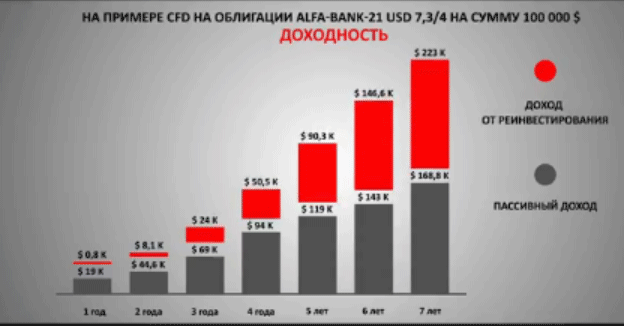

Investing in Eurobonds is not only safe from an investor's perspective, but also quite profitable, as evidenced by the percentage of return in the table above.

Investing in Eurobonds is not only safe from an investor's perspective, but also quite profitable, as evidenced by the percentage of return in the table above.