RAMM investing advantages and disadvantages

The RAMM system is an innovative investment product developed and implemented by the brokerage company Amarkets . RAMM is a platform that connects ambitious and profitable traders with investors.

For many, this service raises quite a few questions. To summarize the system briefly, the RAMM mechanism is a kind of symbiosis of the familiar PAMM accounts and the signal copying service.

The essence of the RAMM system

As mentioned earlier, RAMM is a symbiosis of the PAMM system and signal copying services, leveraging only the positive properties of both systems. The fundamental principle underlying the entire service is copying the signals of successful traders.

The problem with all signal copying services is that positions are often not opened in a timely manner on the manager's account and on the copyee's account. This situation results in many investors receiving signals with a delay, significantly reducing profitability.

For example, consider the monitoring of the popular signal copying service ZULU, where the charts of fairly successful managers are accompanied by dozens of negative reviews from investors who lost money.

Because investors' trades were opened late, they suffered losses, despite the manager's system being truly effective. Therefore, the first thing the RAMM system developers took care of was ensuring a complete match between the opening and closing prices of trades in both the manager's and the investor's accounts.

This completely eliminates the gap in profitability, meaning that if the manager received 5 percent of the deposit, then you will also receive the same profitability and not a percentage less.

The second drawback of the signal copying service was the disproportionate deposit of the manager and investor.

If you've worked with copy trading services, you've likely encountered situations where your deposit is simply insufficient to copy a manager, and when this happens, you experience huge drawdowns .

To avoid this, services come up with all sorts of multipliers and the like, but it's precisely this imbalance in capital that consistently leads to investor losses. Unlike traditional services, the RAMM system completely eliminates this problem. The calculation of stop order lots, etc., is entirely dependent on the system and will not affect your profitability.

For example, if a trader with a $10,000 deposit makes 5 percent at the end of the week, then you, having invested $10 in him, will receive your 5 percent, while the difference in capital will not affect you, and the system will automatically open positions with a reduced lot, so that everything is proportional in profitability.

Another major drawback of copy trading services is that you, as an investor, pay a certain commission regardless of the results you achieve.

The PAMM system is designed so that you share only your profits with the manager under specific trading conditions as stipulated in the PAMM account services. This means you pay the manager only for the results, not for the process itself.

The process of investing in RAMM

Like any signal copying service, you'll see a range of strategies with clear reporting on returns, drawdowns, and risks. The system itself has its own rating system. Your task is to get to know each manager in more detail by reviewing their statistics.

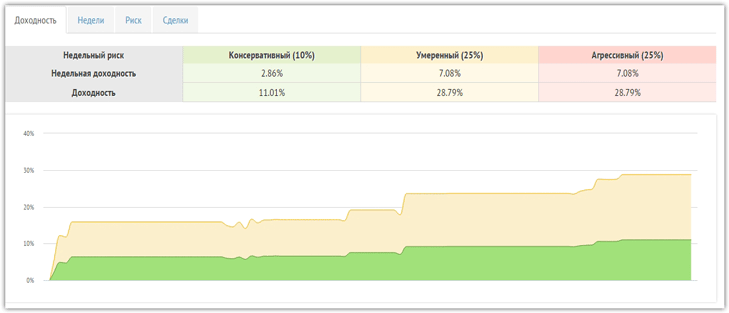

The system automatically calculates risks and potential returns in a table above the return chart. When investing, you can choose one of three plans: conservative, moderate, and aggressive. This essentially limits your risk.

Once you've selected a strategy, click Invest and enter an amount with a specific risk limit:

Very important! The minimum investment for each strategy is just $10, making this platform accessible to everyone.

Pros and cons of RAMM

So, after reviewing the new service's features, we can highlight the following advantages of RAMM investing:

1) You pay only for income, sharing the profit with the manager.

2) You receive the same percentage of return as the manager.

3) You know your risks in advance, limiting them when investing.

4) You can instantly exit your investment by automatically closing all positions. The funds remain in your account, not with the manager.

Cons:

1) You have virtually no real influence on the trader's transactions, namely, you cannot open additional positions or change those already open.

2) From a mathematical perspective, the system immediately warns you that the potential risk per week is much higher than the return. The only thing it doesn't take into account is the account's longevity, which no one knows.

3) Lack of popularity of the service

In conclusion, I would like to note that RAMM investing has undeniable advantages over the usual investment in PAMM accounts or signal copying services.

However, due to the service's specific risk limitations, the RAMM system is not particularly popular among traders, especially compared to signal copying services or traditional PAMM systems, which lack such restrictions.

All details can be found at the link - https://www.amarkets.org/