Stock dividend calculator, calculate your investment return

Most investors who buy company securities expect to receive profits in the form of dividends.

Before purchasing, it is advisable to know in advance such important parameters as what profit can be expected and when this profit will be accrued.

That is, the frequency of dividend accrual, the date of register recording and the amount depending on the number of shares purchased.

You can find out more information on the exchanges where the selected securities are traded, but it is much easier to use a special stock dividend calculator.

In addition to displaying information on register closing dates, the dividend calculator also calculates the amount of compensation depending on the number of shares purchased.

How to use the dividend calculator

To use this tool, go to the InstaForex broker website - https://www.instaforex.com/ru/ and enter the necessary data for the calculation:

What needs to be entered and how to decipher the initial data:

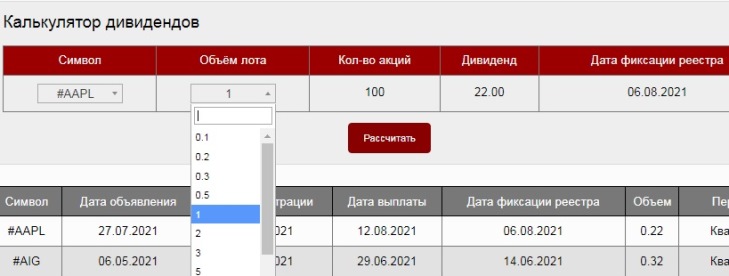

Symbol – here you should select the shares of the company you want to purchase from the drop-down list; the names are presented in abbreviated form.

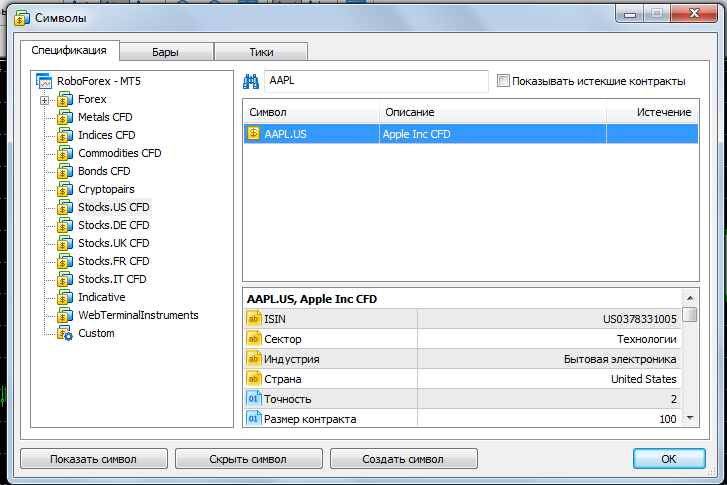

For example, the abbreviation AAPL stands for Apple shares. You can view the abbreviation in the MetaTrader 5 trading platform by right-clicking on the market window and selecting "Symbols" from the list that appears:

To avoid searching for the symbol you need, use the search function. In our case, searching for AAPL immediately yielded Apple Inc CFD . You can also simply use an internet search for the symbol.

Lot size is the number of shares you intend to buy or own. 1 lot equals 100 shares, 0.1 lot equals 10 shares, and so on.

Dividend – the calculated dividend amount will appear here depending on the number of shares you own and the amount set by the company that issued them.

The register fixing date is the date on which the register is closed, after which dividends are accrued; that is, at this point you must own the security.

In addition to the stock dividend calculator, the website also has a ready-made list with similar data.

The only drawback of the instrument is the small number of stocks presented; these are mainly only the most popular securities.

The best alternative

It should be noted that no matter how attractive dividends may be as income, they are far from being the main source of profit.

Many companies that do not pay their shareholders compensation for owning securities have seen their prices rise by hundreds of percent in just a few years.

A more interesting option is to invest money when a company first enters the stock market, the so-called IPO - https://time-forex.com/inv/akcii-ipo