Stocks or real estate: which investment will yield greater returns over 10 years?

Those who have money understand very well that earning capital is only half the battle; it is much more difficult to preserve the funds you have.

The simplest option is to keep your money on deposit, but when it comes to foreign currency deposits, the interest rate is usually lower than the inflation rate, and as a result, your savings depreciate.

Therefore, many potential investors are thinking about investing in real estate or buying company shares.

But this raises the question: What will bring more profit, stocks or real estate, in the long term?

Comparing investment growth when investing in stocks or real estate

To compare the growth in cost, let's take the cost per square meter of housing in a country like Poland and the data on the cost of the American stock index S&P 500 .

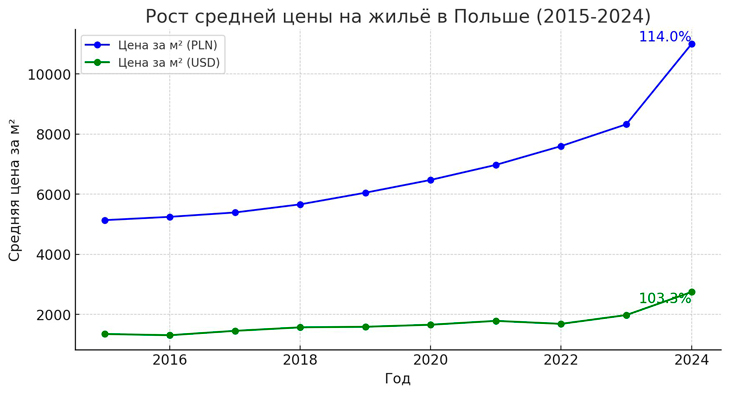

The average price per square meter of housing in Poland has increased by 103% over 10 years when measured in US dollars:

That is, it can be said that, on average, an investment in real estate brought in 10% per annum, without taking into account additional maintenance costs.

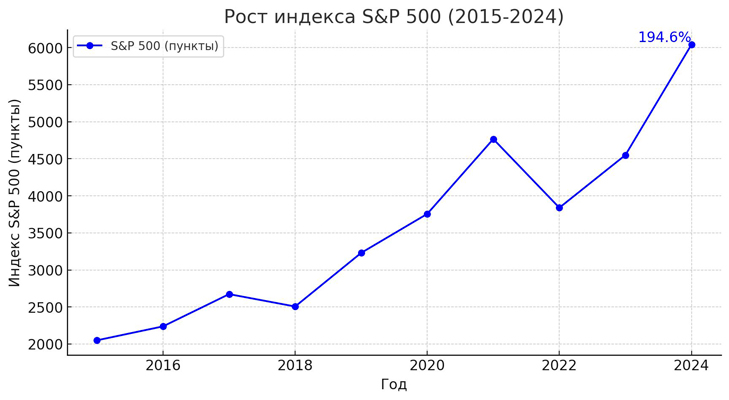

While buying a portfolio of stocks included in the S&P 500 index could have returned 194% over the ten years from 2015 to 2025:

This means that the return on investment in American stocks is 19.4% per annum, which is almost twice the return on investment in real estate, which is only 10% per annum.

But, in addition to price growth, one should also consider aspects such as dividends and rental income, as these are the indicators that investors often focus on.

Comparing the returns of stocks and bonds

It's quite difficult to compare the profitability of stocks and real estate, but we'll try to do it anyway.

Taking into account all commissions, the profit from long-term rental of an apartment in Poland amounts to 5% per annum of the investment:

For example, renting out an apartment worth $100,000 would net you about $5,000 in rent, of which you'd pay 8.5% in taxes. That leaves you with a net interest of 4.6% per annum, or 46% over 10 years.

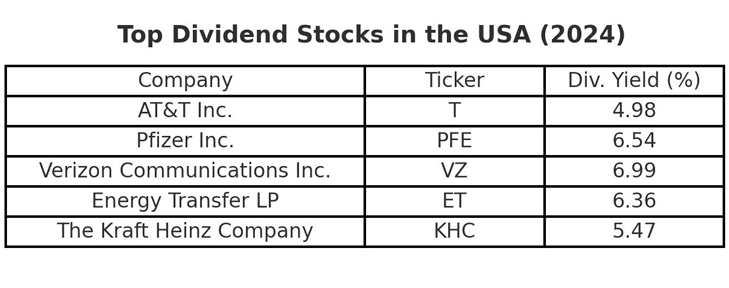

When it comes to shares, passive income comes in the form of dividends, which not all companies pay.

The average dividend payout for S&P 500 companies in 2024 is just 1.2%, or $1,200 per $100,000. But taxes should also be considered: dividend tax in Poland is 19%, so the net payout is $972, or 0.97% per annum.

Obviously, all calculations are quite approximate, and if you wish, you can build your portfolio exclusively from stocks with high dividend yields. In this case, you can increase your net dividend yield to 4% or more.

Conclusion: From the analysis conducted, it is clear that investments in company shares clearly have higher profitability than investments in real estate.

In addition, real estate requires much more attention than investing in shares – finding new tenants, carrying out repairs, paying utility bills when the property is not rented.

Brokers for buying American stocks

Remember that any investment involves risk, so diversify your investments across different assets.