Where to buy Pfizer Inc shares to receive dividends and profit from price growth

During periods of economic instability, pharmaceutical stocks often provide a safe haven, as their value is less dependent on politics and geopolitics.

Pfizer Inc. is one of the largest pharmaceutical companies in the world, with a current market capitalization of approximately US$150 billion.

The company produces drugs and vaccines. In 2024, its revenue was $63.6 billion, a 7% increase from 2023.

Net profit reached $8.03 billion, which is 4 times higher than the 2023 figure. In the fourth quarter of 2024, revenue increased by 21% to $17.8 billion.

The company consistently pays fairly decent dividends; last year, the dividend amount was about 6.65% per annum.

Pfizer is actively expanding into the oncology field, acquiring Seagen for $43 billion. Additionally, cost optimization is underway, which is contributing to increased profitability.

By continuing to develop vaccines and innovative drugs, the company remains one of the strongest players in its industry and remains an attractive long-term investment.

After such a convincing description, the question arises: Where to buy Pfizer Inc shares?

Since shares have the highest liquidity for securities, they can be purchased from almost any stock broker .

Although brokers primarily offer stock trading through CFDs, a steady price increase will quickly offset the swap charges incurred on these transactions. Especially since now is the perfect time to buy, when you can buy Pfizer Inc. shares at a very favorable price.

The stock is currently trading at $25 per share, with its previous high of over $60. Therefore, the stock could potentially rise two and a half times.

The purchase itself is carried out on the MetaTrader trading platform, which allows you to insure the transaction by placing a stop loss or pending order in the opposite direction.

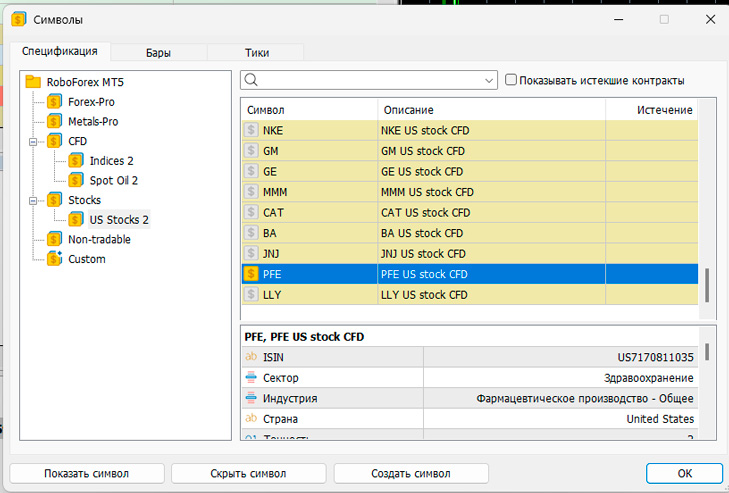

To buy Pfizer Inc., you need to select the asset called PFE. It's often not available in the Market Watch window, so you'll need to add the stock yourself. How to add a new asset to the Market Watch .

To increase profits, you can also use leverage, but if you are aiming for long-term investments, it is advisable not to open trades with leverage greater than 1:2.

After purchasing, all that remains is to wait for the stock price to rise and for dividends to accrue. If desired, you can immediately set a take profit , which will lock in profits if the price rises to the set level.