An affordable alternative to a bank deposit

The simplest and most accessible investment option at the moment remains a bank deposit.

However, a bank deposit can be blocked as a result of court decisions and other problems, so it is often necessary to find a worthy alternative to a bank deposit that cannot be accessed by enforcement authorities.

It's true that there aren't many decent options, but they do exist, and they're not difficult to use.

These options include staking for cryptocurrency deposits, deposits with stock brokers, and storing funds in financial institutions.

Cryptocurrency staking as an alternative to a bank deposit

Unlike other options for earning money on cryptocurrencies, cryptocurrency staking is considered one of the least risky, especially when it comes to investing in stablecoins .

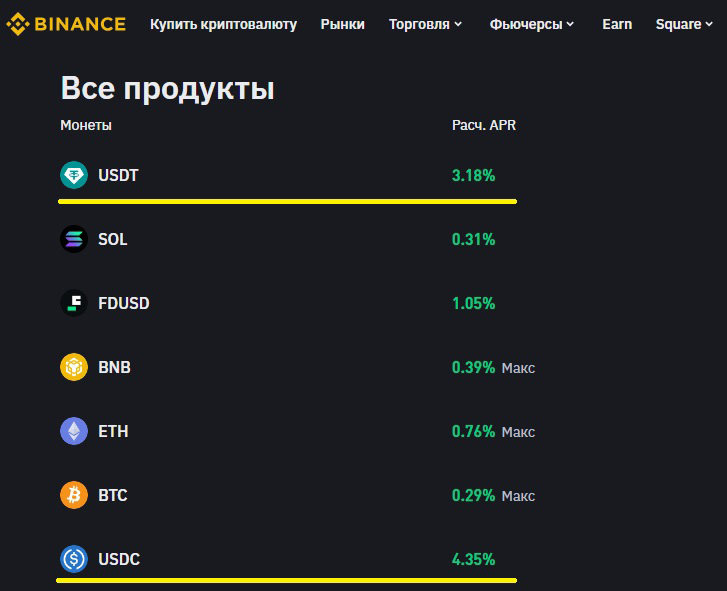

Unfortunately, you can't earn much from such an investment:

Earnings from staking stablecoins rarely exceed 5% per annum, but the low return on investment is offset by the reliability of this investment.

Staking is available on virtually any crypto exchange, and the interest rate depends on the type of exchange and the cryptocurrency you stake.

The main drawback of staking is that some exchanges limit the amount you can invest for the maximum interest rate. For example, you receive a maximum 4% interest on 2,000 USDT, but if you invest 5,000 USDT, the annual interest rate drops to 2%.

Deposit with a broker as an alternative to a bank

A stockbroker account isn't designed for simply storing funds, but with a little ingenuity, it can be an excellent alternative to a bank deposit. Especially since international brokerage firms don't file reports with tax authorities.

Many brokers pay quite good interest on account balances that are not used in transactions:

InstaForex Broker – 6% per annum on the account balance

NPBFX Broker – up to 23% per annum on account balance

Broker RoboForex – up to 10% per annum on the account balance

The interest rates are quite high, but to earn them, you need to periodically open exchange trades. This isn't a problem, as you can use hedging to mitigate the risk by simultaneously opening trades on the same asset in different directions.

As a result, you'll trade with zero profits, but also without losses, and your profit will come from the interest on your deposit. Another advantage of this option is that you can store fairly large sums of money discreetly.

Financial institutions as an alternative to bank deposits

Today, there are many different financial institutions that are not banks, but at the same time provide the opportunity to store money with them and receive interest on the deposit.

For example, Wise offers cashback on balances in the amount of:

- 2.28% for funds in euros

- 3.31% for funds in GBP

- 3.85% for funds in US dollars

You don't need to do anything; simply deposit funds in your account. You'll also receive a payment card for payments and the ability to quickly exchange one currency for another. Similar terms are available at other financial institutions.

As you can see, there are many alternatives to bank deposits that will protect your funds from seizure by enforcement authorities. All you have to do is choose which option is right for you.