Dollar currency pairs and trading them.

Every asset has its own characteristics and behavior patterns, so before you begin trading using any trading strategy, you should triple-check whether your tactics are suitable for potential price changes, volatility, and chart behavior during different trading sessions.

using any trading strategy, you should triple-check whether your tactics are suitable for potential price changes, volatility, and chart behavior during different trading sessions.

Before we begin our review of various dollar instruments, we would like to remind you of the three main groups of quotes against the dollar: direct, inverse, and cross rates.

A typical example of a direct quote is USD/JPY due to its widespread use, but to make sure you understand, in a direct quote the USD symbol always comes first, followed by the symbol of the other currency.

A direct quote shows how much of a certain currency must be given for one dollar.

In an inverse quote, the USD symbol is placed after another currency, for example GBP/USD, and shows us how many dollars we need to pay for 1 unit of currency, or in our case, for 1 pound.

The cross rate is characterized by the fact that the USD is simply absent from this currency pair. Understanding the difference between these types of quotes is essential for correctly interpreting news, fundamental analysis , and technical analysis.

The most common and frequently used dollar currency pair is the EUR/USD. Many resources recommend it to all beginners. However, before you begin trading, you should understand that technical analysis is very weak on this instrument, and the pair is sensitive to news and rumors.

As you've probably already realized, we're dealing with an inverse quote, so if bad news appears on the USD, the currency pair's chart will trend upward, while if there's positive news, the chart will trend downward. Due to the large trading volume, you won't see strong speculative movements, as you might see with exotic currency pairs. However, the pair has moderate volatility and often moves unpredictably within a day.

In terms of trading session links, EUR/USD is very active during the European and American trading sessions, but during the Asian session the currency pair goes dormant and moves within a range of 5 to 15 pips.

The GBP/USD is considered the second most popular dollar currency pair due to the pound being the third-largest currency in the world by turnover. The pair is characterized by very high volatility, and while a 200-pip move is rare for the EUR/USD, such a daily move is considered normal for the GBP/USD.

This currency pair is extremely dangerous for traders who use technical analysis due to its strong and unpredictable price swings and immediate pullbacks. However, it does react sensitively to news releases from the UK and US, with high activity only seen during the European and American trading sessions.

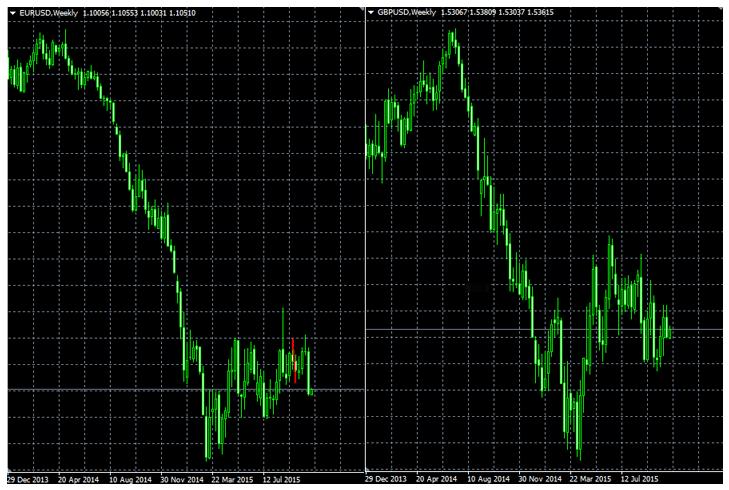

GBP/USD is a very complex currency pair, so I recommend that beginners avoid it altogether. Another characteristic of this currency pair is its high correlation with EUR/USD, so if you get a sell signal for one currency pair and a buy signal for another, you should consider the fact that the charts are moving almost identically and something is wrong. The correlation between the pairs is shown in the image below:

The third frequently used dollar currency pair is USD/JPY. This currency pair's popularity stems from the yen itself, as it is the main currency in Asia. A distinctive feature of this pair is its high activity during the Asian trading session, which means that most of the movement occurs at night.

The third frequently used dollar currency pair is USD/JPY. This currency pair's popularity stems from the yen itself, as it is the main currency in Asia. A distinctive feature of this pair is its high activity during the Asian trading session, which means that most of the movement occurs at night.

The instrument is highly volatile and unpredictable, but responds well to US economic news and is sensitive to statements by the Bank of Japan's governor. This dollar-denominated currency pair is primarily attractive to scalpers who profit from such unpredictable markets.

Also of great interest to most traders are currency pairs such as USD/CAD and AUD/USD. I deliberately combined them into one group because both Canada and Australia are considered highly dependent on commodity prices, as both countries are major exporters. However, the behavior of these currency pairs is radically different: while CAD rises with rising oil prices, AUD rises with rising metals and mineral prices.

An interesting feature of USD/CAD trading is its mirror correlation with the EUR/USD currency pair, with most activity occurring during the American trading session. AUD/USD is very popular among investors, as we've been observing a downward trend since mid-2013. This currency pair doesn't have a specific trading session relationship, and its chart movements are highly predictable.

Technical analysis works well on both instruments, complemented by major fundamental dollar news. I suggest looking at the weekly AUD/USD chart to understand the profitability of trading this instrument:

Another dollar-denominated currency pair worth highlighting is the NZD/USD, which is also considered a commodity. However, unlike the two pairs listed above, its rate is proportionally dependent on the price of copper. As copper prices rise, the NZD/USD pair also rises. This currency pair has medium volatility , lends itself very well to technical analysis, and is characterized by consistent trend movements, making it attractive to both novice and seasoned investors. From mid-2014 to the present, the weekly chart has shown a clear downward trend, which you can see in the image below:

Another dollar-denominated currency pair worth highlighting is the NZD/USD, which is also considered a commodity. However, unlike the two pairs listed above, its rate is proportionally dependent on the price of copper. As copper prices rise, the NZD/USD pair also rises. This currency pair has medium volatility , lends itself very well to technical analysis, and is characterized by consistent trend movements, making it attractive to both novice and seasoned investors. From mid-2014 to the present, the weekly chart has shown a clear downward trend, which you can see in the image below:

In general, each dollar currency pair has its own unique characteristics that must be taken into account. However, when choosing an instrument, try to focus on your deposit capabilities, as the more exotic and less popular the pair, the higher its spread. Also, don't neglect our recommendations and trade with poorly predictable and highly volatile currency pairs , which are very difficult to apply technical analysis .

In general, each dollar currency pair has its own unique characteristics that must be taken into account. However, when choosing an instrument, try to focus on your deposit capabilities, as the more exotic and less popular the pair, the higher its spread. Also, don't neglect our recommendations and trade with poorly predictable and highly volatile currency pairs , which are very difficult to apply technical analysis .