Currency pairs for swap profits using the Carry Trade strategy

Most Forex beginners perceive the overnight fee as just an additional expense.

However, a swap can be either negative or positive, which can lead to profit. It all depends on the difference in interest rates between the currencies in the currency pair and the direction of the trade.

If we recall the principle of calculating swap, we can say that when making a purchase transaction, you acquire the base currency and borrow the quoted currency.

That is, in the case when you buy a currency with a higher interest rate and a positive swap value appears.

Currency pairs for carry trade in 2022-2023

2022 was a record year for changes in national bank interest rates. Due to rising inflation rates, most national banks raised their interest rates:

Therefore, the list of pairs traditionally used for the carry trade strategy has also changed. There are two options for selecting a suitable currency pair for swap profits.

In the first case, we simply study the table of central bank interest rates:

Then we select the currencies with the largest rate difference and determine the direction of the transaction for which a positive swap will be accrued.

For example, the US dollar rate is 4.5%, while the Japanese yen rate is 0.10%, meaning we need to buy dollars for yen. In other words, buying the USD/JPY currency pair can yield up to 4.5% per annum.

The biggest difference is observed if the currency pair consists of a hard currency and an exotic currency , in which case the difference can be more than 10%.

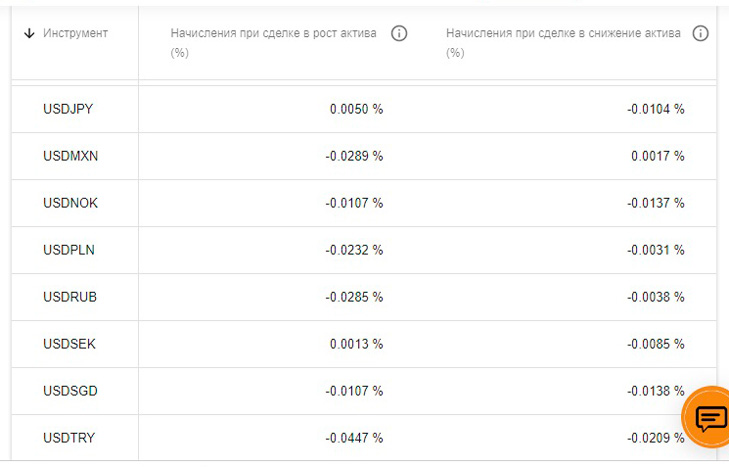

A more precise option is the broker's specification for currency pairs, which usually indicates the swap for a particular currency pair per day:

This option is more accurate, since brokers calculate swaps using their own formulas, and therefore the fee for transferring a position may differ between companies.

If we talk about currency pairs that are suitable for carry trade today, these are:

USD/JPY – buy trade

EUR/CAD – sell trade

EUR/MXN – Sell trade

EUR/PLN – sell trade

USD/CHF – buy trade

That is, if you want to earn additional income through a positive swap, you should wait for the specified trend direction and only then open a trade.

You can also check the current swap value directly in the MetaTrader trading platform by viewing the specifications for the selected asset. Since this indicator changes frequently, the trading platform will display the most current swap value.