Gold – XAUUSD currency pair

Gold is one of the most attractive stock market instruments for investors. Until recently, gold was considered a quiet investor's instrument, as its price has been rapidly rising over many years.

gold was considered a quiet investor's instrument, as its price has been rapidly rising over many years.

However, since the second half of 2012, the instrument has begun its active downward dive and has become one of the most volatile and unpredictable on the Forex currency market.

XAUUSD consists of two elements, namely gold (XAU) and the dollar (USD), which is used to purchase this precious metal.

The XAUUSD currency pair is considered one of the most dangerous due to the poor predictability of its movements and very high volatility, which reaches from 2500 to 3000 points per day.

Consider some freely available advisors

In short, gold's behavior has changed dramatically and has become similar to that of traditional currency pairs, characterized by sideways markets and complete uncertainty. To learn how to trade the XAUUSD currency pair in the current environment, it's necessary to understand the factors that influence it.

What influences the price of gold.

XAU, or gold as it's more readily available and commonly known, is one of the most expensive precious metals, and its mining supply is extremely limited. Gold has historically been a guarantor of the stability of any economy, as it backs the cash issued by national banks.

However, if we put aside sentimentality about the importance of gold and move directly to the factors that influence gold, the following can be identified:

1) Gold is a precious metal that is a safe haven for all investors during times of crisis.

It so happens that gold is considered a safe haven, so if you observe a crisis among global players, you can confidently buy gold, as its price will begin to rise.

In the short term, gold also reacts strongly to terrorist attacks in global players like the US or European countries, which have become more frequent due to the migration crisis. Therefore, if you see a crisis emerging, pay attention to gold.

2) The price of gold is directly dependent on the production volumes of the major mining countries.

Gold is, first and foremost, a metal that has its own origins, where it is actively mined.

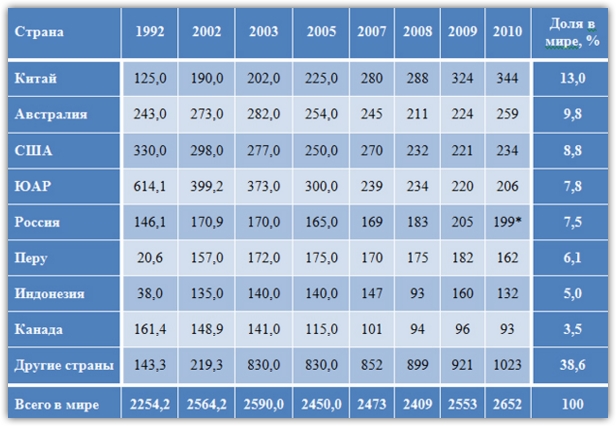

If you see news reports of production cuts by major exporting countries or major companies, you can confidently expect a rise in the price of this metal. Below is a table of annual mining countries by tonnes of this precious metal:

The second element in the currency pair is the US dollar. Since gold is purchased directly with the US dollar, it has a direct impact on the exchange rate of this currency pair. Three main factors influence gold:

1) Macroeconomics

Macroeconomics refers to the release of important statistics, indicators that reflect the stability of the US economy. These factors include GDP, the trade balance, industrial and agricultural sector indicators, unemployment, benefits data, and much more. You can track all of these indicators on the economic calendar.

2) Policies and statements of heads of departments

By this category, we mean statements by key government officials, namely the president, senators, and the head of the Central Bank. Politics itself, and the scandals that accompany it, also affect the dollar.

3) Prices in commodity markets

It's crucial to understand that the United States has the most developed industry, so budget revenues are directly dependent on its success. It's also important to remember that commodity prices are a significant factor influencing the US economy. For example, when oil prices fell sharply, the USD actually gained ground.

In conclusion, I'd like to note that the XAUUSD has always been difficult to predict, but if you monitor the factors that directly influence the currency pair, trading will turn from guesswork into effective trading.