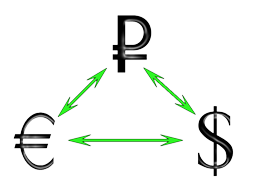

Forex cross pairs

The US dollar remains the primary instrument on the currency exchange, serving as the second currency in most transactions. Such currency pairs on Forex are called direct and typically have the smallest spreads.

most transactions. Such currency pairs on Forex are called direct and typically have the smallest spreads.

However, the US dollar isn't always involved in a transaction. For example, if you want to buy euros with Swiss francs (EUR/CHF), the quote will no longer be direct.

This type of transaction is called a cross pair, and essentially refers to all transactions that don't involve the US dollar.

That is, such pairs include AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, GBPAUD, GBPCAD, GBPCHF, GBPCZK, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPZAR, NZDCHF, NZDJPY, etc.

The assessment of the value of one currency against another is implied to occur in two stages: first, each currency is assessed against the dollar, and the resulting result is divided or multiplied.

In this case, the concept of a cross rate .

For example, to convert the value of the euro into Swiss francs, a simple formula is used:

EUR/CHF = EUR/USD x USD/CHF.

For example, currently, EUR/CHF = 1.0973 x 0.9594 = 1.0527 Swiss francs per euro.

Special calculators are most often used for calculations, which will easily show the price of the desired quote at the current exchange rate. The easiest way is to look at ready-made forex quotes for the selected cross pair.

Are there any differences between trading direct and cross pairs on Forex?

Technically, there aren't, but you will have to pay a slightly higher commission than when working with direct currency pairs. But the liquidity of the chosen instrument also plays a significant role here; sometimes, even cross pairs offer low spreads .

As for trading, there's virtually no difference. Direct currency pairs are a bit easier to understand, but after a few days of trading, you'll hardly notice the difference.

Technical analysis is used in most cases, as trading on the news doesn't always yield good results.

Due to the difference in interest rates, cross pairs are most often used in the carry trade strategy on Forex.