Risk and Reward Ratio: A Simple Approach to Calculating the Loss/Profit Ratio in Stock Trading

Traders just starting out on the stock exchange generally think only about the size of the profit they will receive and rarely plan for potential losses.

At the same time, the ratio of acceptable loss to planned profit plays a key role in planning successful transactions.

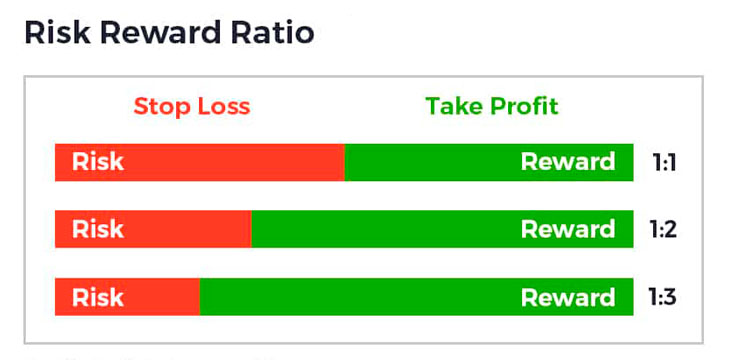

Often, such a ratio is expressed through the following formula – risk/reward ratio, which allows you to evaluate the prospects of a transaction.

Typically, both parameters involved in the formula are set using stop orders, so you can imagine that:

Risk is the amount of loss you set before opening a trade using the stop loss order parameter.

In this case, the most important factor is the choice of location for setting stop loss and take profit - https://time-forex.com/vopros/stop-loss-i-teyk-profit

Profit and loss ratio

The main recommendation for the risk-to-reward ratio is that the profit amount should be greater than the planned loss.

It's most common to recommend setting a stop-loss order size at least half the size of a take-profit order. This means the profit-to-loss ratio should be at least 1:2.

When planning a buy trade, it would look like this: take profit 400 points, and stop loss 200 points:

But the market situation does not always correspond to the recommended parameters.

For example, in the presented situation, the stop loss can be left at 1.06820, since there is a high probability that after breaking this mark, the price will continue to fall, but the take profit can be placed much higher, in the region of 1.07880, increasing the size of the potential profit.

As a result, our proportion will change and the profit to loss ratio will now be 200 to 800 or 1:4, meaning you will make a profit even if you make only one successful trade out of four open ones.

It is for this reason that you should try to get as much profit as possible from an open transaction and not rush to close successful positions.

Many traders fear that the price won't be able to reach a distant take profit, but nothing prevents you from moving the stop loss order if you want to lock in profits while still leaving room for more profit.

Based on this, we can say that the risk/reward ratio is not a fixed value, and it should not interfere when choosing where to place stop orders.

price highs and lows , resistance and support lines play a major role

Once you have determined the best places to set stop loss and take profit, you can move on to calculating the risk/reward ratio.