Principles of price formation in the Forex currency market

When starting to trade Forex, many traders completely ignore the theoretical foundations of the foreign exchange market, relying only on indicator signals.

Moreover, they do this completely in vain, because knowledge of the principles of price formation allows you to understand what is currently happening on the stock exchange and can serve as an excellent filter for false signals when making the right decision.

The essence of the process is that each indicator signal in the trading platform must be based on a specific event.

That is, if the script gives a signal for a trend reversal, and there are no strong events in the news feed, you need to think carefully before opening a deal.

It is not for nothing that the foreign exchange market is called a market, since market laws apply to it. This means that exchange rates are formed solely under the influence of supply and demand.

There are two parties in this process - buyers and sellers, the former want to buy currency, and the latter want to sell it. In this case, the main role is played by the ratio of buyers and sellers.

If a large number of people want to buy a currency appear on the market, and its supply is limited, then the price begins to rise, the situation is to some extent reminiscent of trading at an auction. Each purchase is made at a higher price, and rising prices attract even more buyers.

Once buyers have exhausted their resources and no longer want to make purchases at the existing, usually inflated price, the exchange rate begins to decline.

This is where sellers come into play, rushing to sell the currency they have at a high price. The number of sellers in the market increases and supply exceeds existing demand.

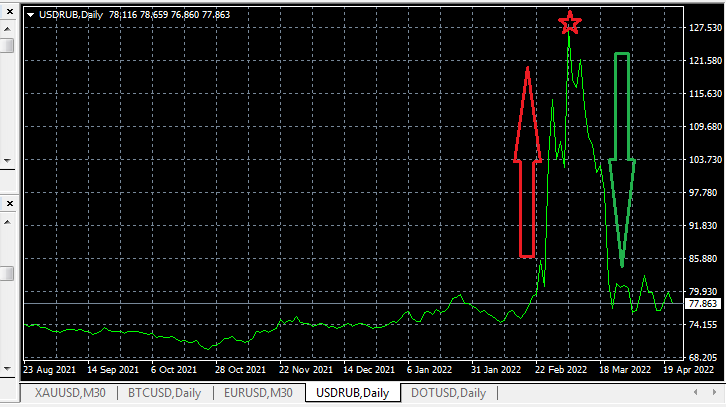

The easiest way to understand the principles of price formation is to use specific examples, let’s take at least the latest situation with the Russian ruble:

After information appeared in the news about the beginning of hostilities in Ukraine, Russians traditionally rushed to exchange rubles for dollars. The increase in demand for the American dollar marked the beginning of an increase in its exchange rate.

And after the government introduced a ban on cash currency, the price completely soared to maximum values, because with huge demand there was no supply.

But gradually, those who wanted to purchase currency at any price satisfied their needs, which caused a decrease in demand. At this time, the government again allowed the sale of currency, and the price almost returned to its original levels. In this situation, it is clearly visible how supply and demand shape exchange rates.

The exchange rate itself is formed on the interbank market; banks and brokers try to fulfill their clients’ requests for the purchase and sale of currency. Applications are submitted electronically, the rate is formed depending on the number of applications for purchase and sale.

If the volume of buy orders predominates, then the rate rises, and vice versa, with large volumes of sell orders, the price falls.

Your task is to learn to understand what is currently happening in the foreign exchange market and what are the reasons for the changes taking place.