Netting or hedging account: what is the difference between these two types of accounts?

Hedging and netting accounts are the two main types of accounts used in forex or stock market trading.

A hedging account is a type of trading account that allows traders to simultaneously open positions in different directions on a single currency pair.

The main feature of this type of account is the ability to hed or lock positions , which allows you to reduce exchange rate risks when using certain strategies.

With this type of account, you can simultaneously open multiple buy and sell orders for one currency pair.

A netting account is a type of Forex trading account that allows traders to open only one position per currency pair at a time.

For example, you opened a buy position on our beloved EURUSD currency pair for 1 lot , and a couple of minutes later you open another buy position for 0.5 lots. However, in the trading platform, you don't have two orders of 1 and 0.5 lots, but only one for 1.5 lots.

If you open one long position of 2 lots and then a short position on the same asset of 0.8 lots, instead of two orders, you will have only one buy order of 1.2 lots.

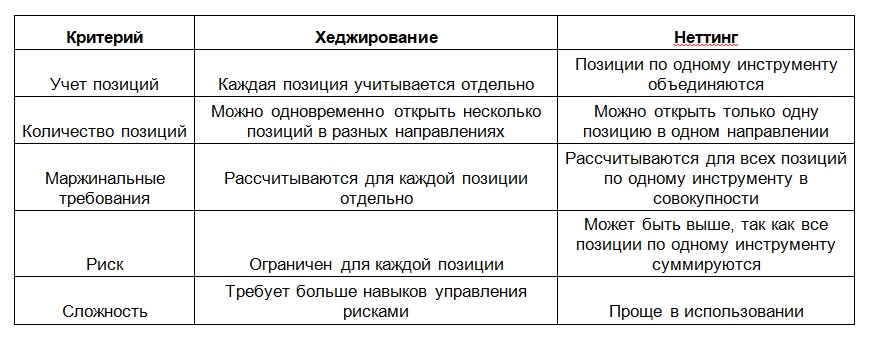

Key differences between hedging and netting accounts

At the same time, there are some similarities in the work on these accounts:

- Both systems allow you to open positions on the same currency pair in different directions.

- They use margin trading , which makes it possible to increase potential profits using broker credit.

- Offer access to a wide range of trading instruments.

Which account type is best for trading?

Here, one could say, there are as many opinions as there are people. Some people prefer to have only one open order in one direction and simply adjust its volume. Others prefer to have multiple positions, sometimes in opposite directions.

For example, I prefer hedging accounts because they offer more options and I'm already used to this type of trading.

It's not easy to find a broker who offers a netting account; most international brokerage companies allow you to open an account with hedging capabilities.

How to distinguish a hedge account from a netting account?

The easiest option is if the account type is specified in its description as Hedge or Netting. If this is not specified, then we look in the account description to see whether the margin amount is specified for covering the position or for the margin for locked positions.

If this information is also missing, you can look at the asset specification in the trading platform to find the hedged margin indicator. If it is present, then hedging is permitted.

Well, the easiest option is to ask the broker's support manager what types of accounts they have and whether hedging is allowed on them.