False breakout

The main undeniable pattern of the market is that the price takes levels into account during its movement.

Yes, whether you are a news trader or an investment banker in one of the largest companies in the world, they all take psychological levels into account.

It is the property of price to take levels into account that has become the key factor on the basis of which hundreds of breakout strategies have been built.

Moreover, it is worth noting that the very principle of trading based on levels, regardless of what content the strategy has, is almost the same.

However, using this obvious pattern in practice is not so easy, because in reality you can more often encounter a false breakout than a real price breakout.

As a result, traders who trade blindly for a breakout sooner or later begin to lose their deposit. For what reason does this process occur?

How to identify a false breakout

Before we proceed directly to the definition of a false breakout, let's take a deeper look at the terms, and most importantly, the reasons for its occurrence.

A false breakout is a breakthrough of the price level of support or resistance by a fraction of points, after which the price rolls back to certain starting points.

Simply put, this is a situation in which a breakthrough of the price mark does not lead to further continuation of the price movement in the direction of the breakdown, but, on the contrary, to its return to the price channel.

A second, more logical question arises: what is the actual reason?

A second, more logical question arises: what is the actual reason?

In fact, there may be several of them.

Firstly, a false breakout often occurs due to the actions of large players. However, you should not think that someone with a multi-billion dollar capital is playing against you. To achieve certain goals, a major player simply has to gradually accumulate positions, opening them in different volumes at many points.

Naturally, many begin to pick up this movement, after which either the real realization of the goal occurs when the market approaches a more favorable price, or a reset of positions. One way or another, the price at such moments is stormy, and as a result false breakouts appear.

The second reason is much more banal, and it is connected, of course, with the inappropriate behavior of the crowd. The fact is that when an impulse appears in the market, everyone unconditionally perceives it as a chance to make money by opening a trade in its direction.

It would seem that the market is active and nothing foreshadows trouble.

But a huge number of players open positions at the last moment, which leads to the fact that the price can move by inertia for some time. Then fear appears because players, afraid of losing the profits they have already made, begin to close their positions and get rid of the asset, which undoubtedly pushes the price back.

From these two reasons a completely logical question follows: how to determine a false breakout?

When it comes to the stock market, study the volume. The fact is that there is no large capital or money supply behind false breakouts. In the Forex market, this situation is a little worse, since the trader does not see the real volume, but instead the tick volume.

However, even tick volume perfectly demonstrates whether there is real capital behind the breakout or not. Trading false breakouts

The main mistake that everyone makes when working with levels is, of course, haste and the desire to enter the market at the very moment of the breakthrough.

However, it is necessary to understand that until the breakout itself, you will never know with one hundred percent certainty whether it is false or real.

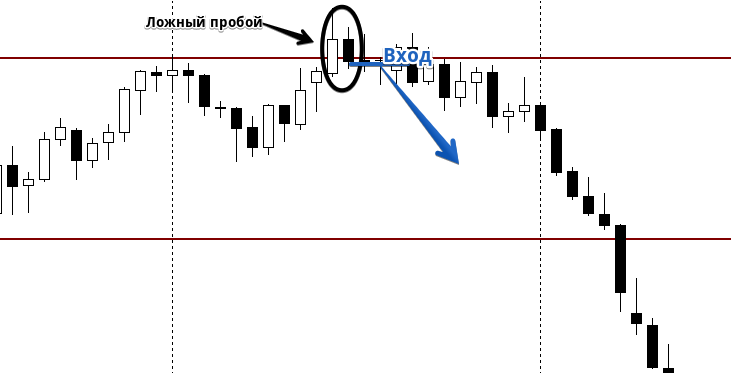

Therefore, in order to determine what type of breakdown you are dealing with, the first thing you need to do is wait for the candle to close. Most false breakouts have a long shadow, which only indicates that the price does not have the potential to move further.

However, to see it you need to wait until the candle closes. It happens that the breakdown occurs with a full-fledged, full-bodied candle.

In such cases, it is necessary to wait until the second candle closes after the breakdown. If the breakout is false, the price will rush to the starting point. Thus, trading with false breakouts is actually no different from trading on a rollback from levels, since all trades are opened to return to the starting point of the impulse.

When we fix a false breakout up, we open a sell position, and when we fix a false breakout down, we open a buy position.

Also, a false breakout can occur not only at horizontal levels, but also at vertical ones. A similar situation can be encountered when trading along a trend line or price channel. The algorithm of actions is almost identical.

Also, a false breakout can occur not only at horizontal levels, but also at vertical ones. A similar situation can be encountered when trading along a trend line or price channel. The algorithm of actions is almost identical.

More information about Japanese candles - http://time-forex.com/ys

False breakout indicator

It is quite easy to identify a false breakout; the main thing is not to doubt your own conclusions.

The doubt is expressed in the fact that instead of trading the false breakout that arose as a result of a puncture by the shadow, it begins to move the drawn line along the new shadow. The false breakout indicator will help you deal with doubts, or, to be more specific, any level indicator that does the markings for you.

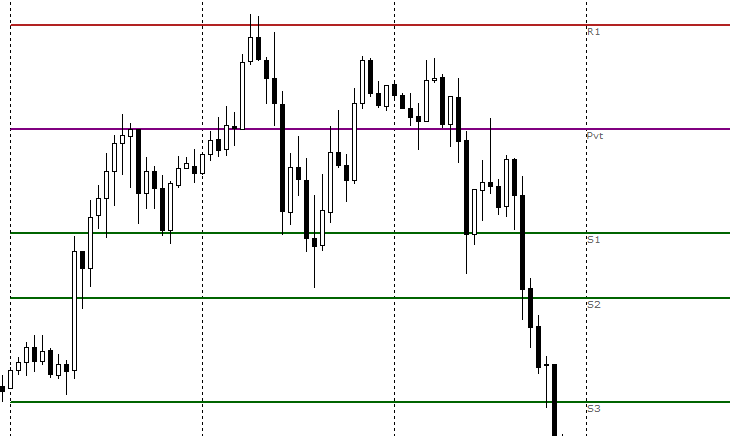

Such tools can be Pivot , Murray levels, or simply indicators of support and resistance.

They make markup according to a strict algorithm, which will completely eliminate your doubts about it. For example, you can observe below the work of one of these Pivot levels indicators below:

In fact, the situation with false breakouts of levels is much simpler than many who have encountered them in practice think.

However, knowing the basic principle of the appearance of this phenomenon, you will be able to open a deal contrary to the opinion of the majority and earn a significant profit from it.

Download the false breakout indicator .

You will find other necessary indicators - http://time-forex.com/indikators