Advanced order management system

Trading in financial markets is a kind of competition between exchange participants, where money flows from each other depending on the result obtained.

Therefore, traders are constantly trying to find advantages in trading that would allow them to be one step ahead.

Some people find this advantage in a unique system that gives signals a little earlier than others or is highly accurate, while others get them thanks to excellent trading conditions.

One way or another, hundreds of factors can influence a trader’s performance, and any advantage that you have can radically improve your trading.

One of the important advantages can be the advanced order management system from Alpari .

It allows you to use additional functionality when working with orders, which is so necessary when implementing certain trading tactics.

Order settings

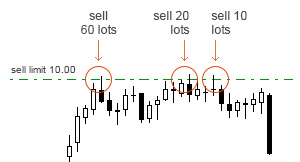

1. Partial opening of limit orders

It is no secret that when working with limit orders in all brokerage companies , the order is either opened in full immediately or not opened at all if there is not sufficient liquidity in the market.

In fact, by enabling this feature, you will be able to build your position as liquidity becomes available.

This means that if only a few contracts can be purchased in the market at the stated price, instead of canceling this order, the broker will purchase the available quantity and hold this order until it has collected the required number of lots or contracts at the stated price.

This means that if only a few contracts can be purchased in the market at the stated price, instead of canceling this order, the broker will purchase the available quantity and hold this order until it has collected the required number of lots or contracts at the stated price.

This function will be especially useful for large players, PAMM account holders who experience a lack of liquidity when trading exotic instruments.

2. Ability to enable market execution for pending orders

It is no secret that market execution of orders has both its advantages and disadvantages.

The key disadvantage is that during a sharp price movement, the order may not be executed at the stated price, but at an order of magnitude worse.

When working with pending orders, a problem arises that they may not be executed or simply canceled by the broker if slippage suddenly appears.

When working with pending orders, a problem arises that they may not be executed or simply canceled by the broker if slippage suddenly appears.

The market execution of limit orders guarantees that the trade will be opened anyway, even if the price is less favorable to you.

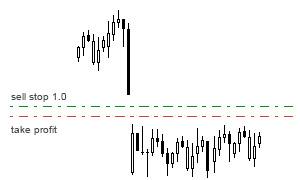

3. Protecting the opening of a pending order on time with a gap

A gap , or a more understandable definition, a quote gap is one of the most unpredictable phenomena that can cause the most unimaginable consequences.

The fact is that, despite the fact that price gaps are usually small, exceptions to the rules of tens or even hundreds of points may appear.

The problem is that if you placed a supposedly pending order in the middle of this gap, your trade will be opened not at the filled price, but at the opening price after the gap.

The problem is that if you placed a supposedly pending order in the middle of this gap, your trade will be opened not at the filled price, but at the opening price after the gap.

Therefore, in order not to fall into a similar situation, you can enable the function of canceling the execution of pending orders that are located inside a given price gap.

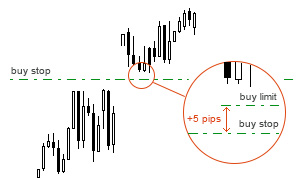

4. Automatic cancellation of a pending order when slipping by a specified number of points

It is no secret that quote slippage is present at any broker, since it often occurs due to greatly increased volatility.

Naturally, if its size is insignificant, the trader does not incur any losses, but there are situations when the execution price and the failed price are so different that executing such a transaction is completely meaningless.

Scalpers and pip traders especially often encounter this problem.

Scalpers and pip traders especially often encounter this problem.

Thus, thanks to the inclusion of such a function, you can set the amount of slippage acceptable for yourself and limit the opening of a transaction if it exceeds it. 5. Record the amount of slippage in the comments

Quote slippage can put a spoke in the wheels of your trading and significantly affect profitability, especially when it comes to scalping strategies.

Therefore, in order to understand how critical this phenomenon is, it is necessary to see its size and track its changes

The function of turning on the recording of the slippage amount allows you, firstly, to see this value without preliminary independent calculation, and also, secondly, to accumulate statistics in order to understand and evaluate the degree of its influence on the effectiveness of your strategy.

The function of turning on the recording of the slippage amount allows you, firstly, to see this value without preliminary independent calculation, and also, secondly, to accumulate statistics in order to understand and evaluate the degree of its influence on the effectiveness of your strategy.

Of course, most traders probably won't need an advanced order management system.

However, if you have a more professional approach to the trading process, it would be quite stupid not to take advantage of the obvious advantages over other traders that the Alpari broker .

You might also find it useful:

Script for setting trailing stop - http://time-forex.com/skripty/trailing-stop

Script for calculating stop loss and take profit - http://time-forex.com/skripty/skript-risk