Which timeframe is better

Timeframe is a time period that characterizes the movement of the exchange rate over a certain period of time.

The effectiveness of opening positions and many other nuances will depend on how correctly you have determined which timeframe is best suited for you.

Each option has its own characteristics and requirements for leverage, deposit size and the applied strategy for working on Forex.

There are several options for dividing the timeframe depending on the chosen strategy for working on the Forex currency market; each option is based on the amount of funds at the trader’s disposal, the availability of free time for trading and experience in the foreign exchange market.

Choosing a timeframe is a rather complex process; when implementing it, you should carefully analyze your work strategy and all its tactical aspects.

You should first decide whether you will work exclusively during the day or transfer positions to the next day.

1. Which time frame is better for intraday and which for long-term trading

Intraday trading - involves opening and completing a transaction within one business day, in this case you do not need to conduct a complex analysis of long-term trend trends, it will be enough to just monitor the main news for the selected currency and focus on the readings of technical indicators.

When calculating the profitability of transactions, only the amount of the spread commission that the broker takes when opening a position is taken into account and there is no need to include the size of lending rates in the calculation. This is the most suitable and at the same time simple option for a novice trader.

Long-term trading – implies that an open transaction will last for at least several days. In this case, when transferring a position to the next day, a special swap fee is withdrawn from the account, which is based on the difference in lending rates for the currencies included in the currency pair.

The main advantage of trading on long time frames is high profitability and low time costs. It is especially beneficial to use this trading option in the presence of a protracted trend movement in one direction.

The disadvantages include increased requirements for the size of the deposit, since during the trading process price rollbacks may occur, which will lead to the loss of an unsecured transaction. Typically, this option is used by more experienced traders who are able to make a long-term forecast for the movement of currency pairs.

When determining which timeframe is better, one should not forget about the time division, and it is on its basis that many of the strategies are built.

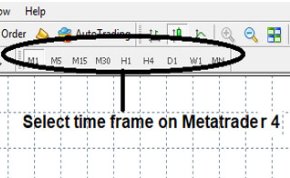

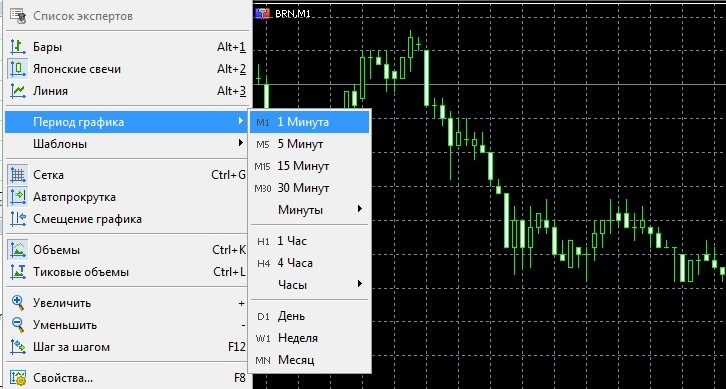

2. Timeframe duration

Super short - ticks or M1, in this case the scalping strategy is used, it is based on the conclusion of short transactions, in the range from a few seconds to a few minutes. An increase in profit is achieved through large trading volumes and the maximum number of transactions completed within one day.

Often trading is carried out simply on intuition or using special indicators; the main thing is to catch short-term movements and then close the deal on time.

At the same time, maximum requirements are imposed on the speed of order execution and the size of the spread. It is not recommended for use by novice traders, since at first glance everything is simple, but in reality it is scalpers who drain deposits more often than others.

Deposit Acceleration strategy, the maximum recorded record for which was 10,000% per annum.

Short – M5, M15, M30 time frames, trading on them is a little easier than in the previous version, trading no longer puts such pressure on the psyche and can be used as a signal to open positions forex news.

Average – H1, H4 – when choosing this option, a market analysis is already required, at least in the current session or during the previous day. It is determined which factor caused the current trend and what is the likelihood of it changing in the near future.

Long - D, W and MN, not every instrument is suitable here, because you need to be absolutely sure that the price will continue to move in this direction throughout the entire time period. As a rule, trading is carried out on slightly volatile currency pairs, but with good predictability.

You will find examples of strategies for trading on various time periods at the link - http://time-forex.com/strategy

In order to definitely make your choice, try opening trades of different durations on a demo account, then conduct a comparative analysis of their success, so based on the results obtained you can judge which timeframe is best suited for you.

You should also not forget about the asset you are trading; for stocks, long time frames are more interesting.

In currencies, many people prefer day trading, and the time to maintain futures trades is often limited by the time the contract expires.