McClellan Oscillator

The technical indicator McClellan Oscillator is one of the most popular tools for studying market dispersion based on the number of falling and rising candles over a certain period.

studying market dispersion based on the number of falling and rising candles over a certain period.

The tool itself was developed back in 1969 and was actively used when trading on the stock exchange.

In the course of researching this oscillator, we encountered enormous difficulties, because, despite the popularity of the instrument, it is almost impossible to find it on the Internet.

Studying various forums on Forex topics, both Russian-speaking and English-speaking, we came to the conclusion that the indicator, to put it mildly, has sunk into history, and if we talk about the Forex market, we have not been able to find any evidence of its successful use.

Construction Features

The indicator is based on a rather complex formula, but to put it in simple and understandable language for most, the indicator is based on the difference between the fast and slow moving average with a period of 19 and 39. You can see the formula itself in the picture below:

Setting the indicator

As we have already noted, it is almost impossible to find the McClellan indicator for MT4 in its pure form, but on one of the foreign forums we found an incomplete version of the tool, which is tailored only for one type of trading signal, and not as described in the book where you can find 2 types of signals.

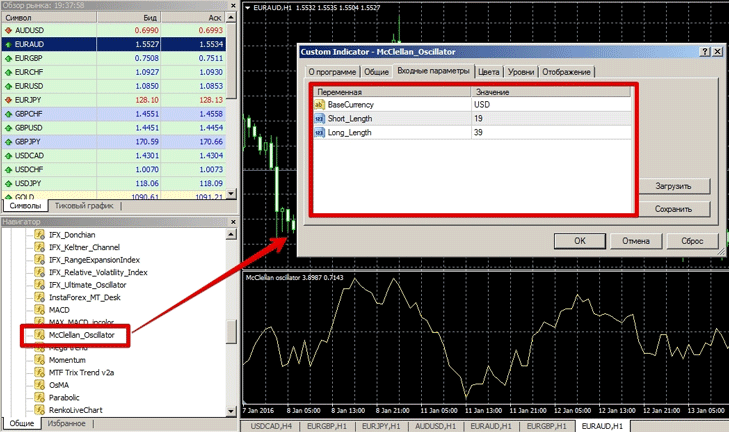

The installation process itself is in no way different from installing any indicator into the MT4 trading platform. Download the McClellan oscillator at the end of the article and through the data directory in the file menu of your terminal, place it in the indicators folder. After updating in the navigator panel, drag the indicator onto the chart. A settings window will appear in front of you:

Application options

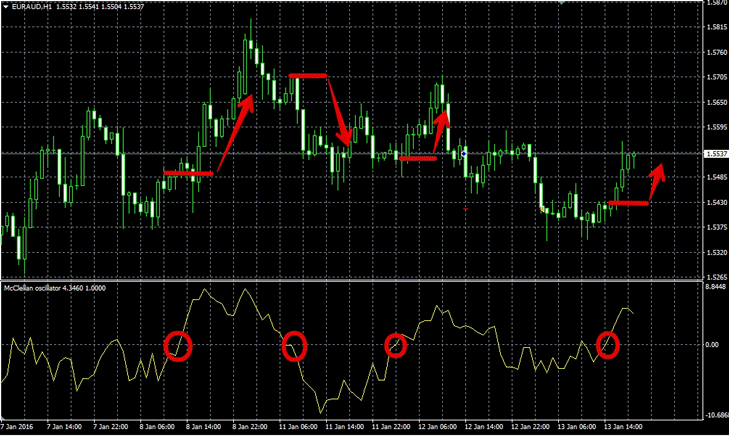

When using this version of the indicator, two types of signals can be considered. The first type of signal occurs when the signal line crosses 0, and the second is based on a typical pattern of all oscillators, namely divergence.

So, regarding the first type of signal, we enter to buy when the yellow line crosses the 0 level from bottom to top, and to sell when the indicator line crosses the 0 level from top to bottom. For more details, please see the picture below:

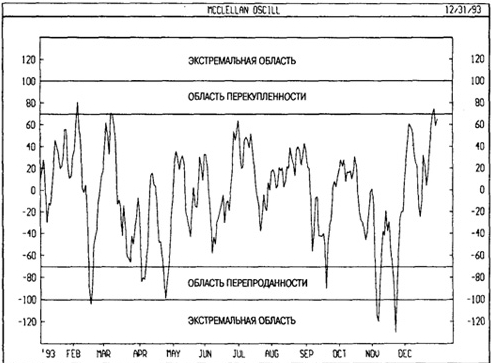

Also, if you work through specialized trading platforms for the stock exchange, as a rule, this indicator is built into them by default. The full version of this tool contains additional levels, which are often called overbought and oversold levels.

Also, if you work through specialized trading platforms for the stock exchange, as a rule, this indicator is built into them by default. The full version of this tool contains additional levels, which are often called overbought and oversold levels.

If we talk about signals, you need to sell when the indicator line leaves the oversold zone, and sell when the indicator line leaves the overbought zone. In the figure below you can clearly see these zones:

Summarizing, we can clearly say that the McClellan indicator does not have ultra-precise signals, and it has all the disadvantages that are inherent in any indicator from the group of oscillators.

Summarizing, we can clearly say that the McClellan indicator does not have ultra-precise signals, and it has all the disadvantages that are inherent in any indicator from the group of oscillators.

Therefore, it is not recommended to use it alone, but should be combined with other effective technical analysis tools.