S&P 500 stock index and how to trade it on the stock exchange

The S&P 500 stock index is one of the most important and recognized indicators of the state of the American economy and the stock market.

It includes the 500 leading US companies with the largest capitalization, S&P (Standard & Poor's) these tools create a complete picture of the state of American business.

The Standard & Poor's index is used by financial analysts to evaluate a country's economy and by traders to make money on its price fluctuations.

The S&P 500 trades from 9:30 a.m. to 4:00 p.m. Eastern Standard Time (EST) Monday through Friday.

Key characteristics of the S&P 500:

- The index currently includes 503 US companies, selected based on their market capitalization.

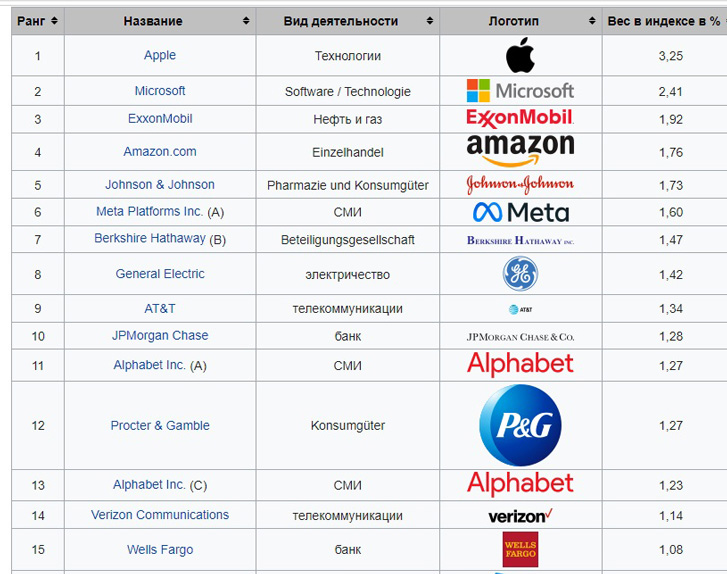

- The companies included in the index represent various sectors of the economy, including technology, healthcare, finance, media, and telecommunications.

- The S&P 500 is a weighted index, meaning that companies with larger market capitalizations have more weight in the index.

The List of Companies was created in 1957 and has since become one of the most recognized indicators of the financial health and economic development of the United States.

Top companies in Standard & Poor's:

This tool has become the basis for the creation of many other indexes and is one of the most widely used tools around the world.

Trading the S&P 500 Index on the Metatrader 5 platform represents a unique opportunity for traders to interact with one of the world's leading markets.

On this platform, traders can analyze the performance of the index, use various trading strategies and track market changes in real time.

Understanding S&P Trading Principles

The S&P 500 is a stock index that includes the 500 largest US companies traded on the New York Stock Exchange and NASDAQ.

It is considered one of the most accurate indicators of the health of the American economy and therefore attracts the attention of many investors.

When the economy worsens, trading volumes and company profits fall, company shares begin to fall in price, and with them the price of the S&P 500 falls.

If the economy improves, it stimulates purchasing power, resulting in higher profits and dividend payments, which causes stock prices to rise and therefore the value of the S&P 500 index to rise.

Why investors choose the S&P 500 index to trade

Investors choose a trading instrument for several reasons.

First, it covers a broad cross-section of the American economy, making it an excellent tool for portfolio diversification.

Second, the S&P 500 has high liquidity, which means investors can easily buy or sell it in the market.

Finally, Standard & Poor's trading is possible through the MetaTrader 5 trading platform, providing convenience and flexibility for investors.

Basic Strategies and Recommendations for Trading the Standard & Poor's Index

There are several strategies that investors can use when trading the S&P 500 index. One of them is the buy and hold , which involves investing in the index for the long term when the economy is up.

True, at present, most experts recommend opening long-term sales transactions, since the state of the American economy causes great concern.

True, at present, most experts recommend opening long-term sales transactions, since the state of the American economy causes great concern.

Another popular strategy is news trading. Because the S&P 500 index is closely tied to the U.S. economy, major economic news can cause significant price movements.

To improve trading efficiency, it is recommended to use the economic calendar and news feed.

In conclusion, trading the S&P 500 Index can be a profitable strategy for many investors. However, like any investment strategy, it requires careful planning and analysis.

Features of using the MetaTrader platform for S&P trading

MetaTrader is a universal and very popular trading platform that provides traders with all the necessary conditions for successful work on the exchange.

One of its main advantages is a wide selection of trading instruments, among which the S&P 500 stock index occupies a special place.

MetaTrader 5, the latest version of the platform, includes enhanced features that make Standard & Poor's trading more convenient and efficient.

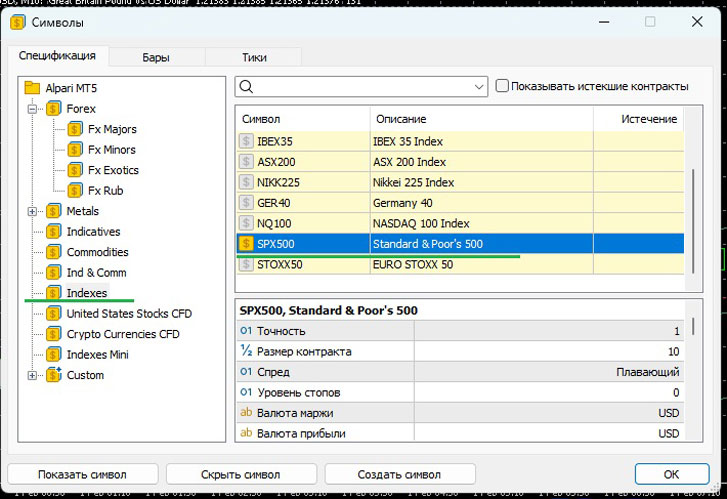

The guide to setting up and trading S&P500 on MetaTrader includes several simple steps:

- Registration with a broker in the arsenal, which has MT5

- Download and install the MetaTrader 5 platform.

- Opening a demo account to familiarize yourself with the functionality of the platform and test strategies.

- Selecting the S&P 500 index from the list of trading instruments.

- Chart settings: selecting time frames, adding indicators and other analytical tools.

- Opening the first trade, setting stop losses and take profits.

Using MetaTrader for trading gives traders the opportunity to gain access to one of the world's leading indices, as well as take full advantage of the platform, including its analytical tools and automated advisor trading .