What is 1 lot of gold equal to, and other important indicators when trading on the stock exchange?

For thousands of years, gold has been one of the most popular assets, the precious metal is widely used for investment and is a guarantee of currencies.

In ordinary life, we are accustomed to the fact that the weight of a precious metal is measured in grams, kilograms and tons.

But on the exchange, the weight of gold is measured in troy ounces and standard lots; these are precisely the measures of measurement used in quotes and exchange transactions.

What is one troy ounce equal to and the features of its calculation - https://time-forex.com/info/troy-ounce

In order to trade gold professionally, you need to know such concepts as quote, lot, point, spread and swap.

Knowing that one troy ounce is equal to 31.1034768 grams, you can easily calculate that 1 lot of gold will be:

31.1034768 x 100 = 3110.34768 or 3.11034768 kilograms

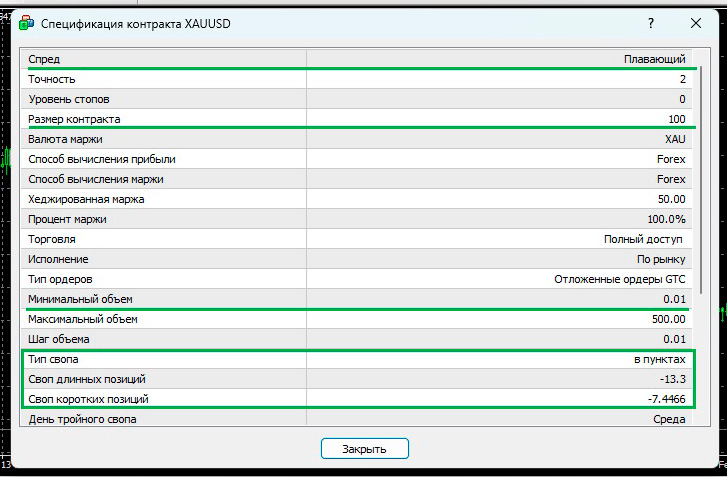

In addition, the above asset specification indicates the minimum transaction size, which is 0.01 lot or 1% of 1 lot of gold.

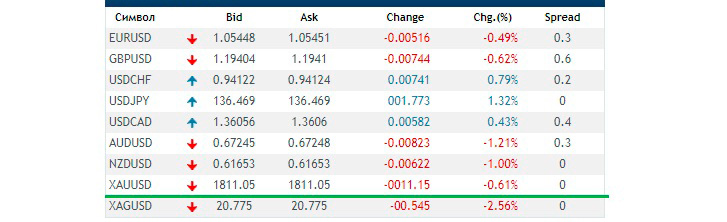

Quote – displays the price of the precious metal at the current moment, consists of two symbols.

In the first place is the precious metal itself XAU, and in the second place is the currency in which its value is expressed USD, EUR, GBP, etc.:

That is, the quote itself will have the following form - XAU/USD price in American dollars, XAU/EUR price in euros, XAU/GBP price in British pounds. Current gold quote - https://time-forex.com/kotirovki

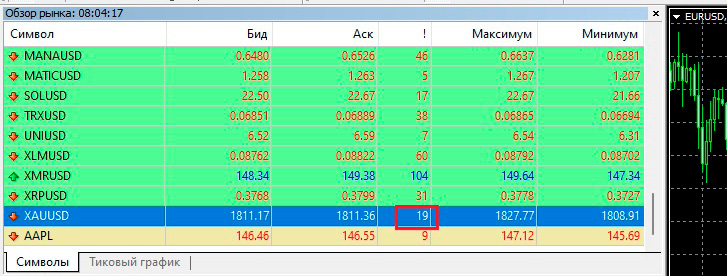

Typically, a precious metal quote has two decimal places; the last decimal place in the XAU/USD quote will indicate the price change in points.

That is, at the current price of 1811.0 5 dollars per 1 ounce, a change of +1 point will mean an increase in the price in the quote to 1811.0 6 US dollars per ounce.

Spread is a commission that is charged when opening a transaction on a precious metal; this is the difference between the Bid and Ask prices:

The spread is written off in any case, regardless of whether you open a buy or sell deal.

When trading on exchanges, the commission is much lower than if you sell and buy gold in real life; on average, the spread at a brokerage company is no more than 0.02%.

Swap is a fee for transferring a transaction to the next day, charged if you do not close the transaction before 24:00 on the opening date.

The swap size for XAU/USD is about 0.3% per month of the volume of the open position and depends on the direction of the transaction.

Exchange trading in gold takes place using a special program, a trading platform, where transactions of a given volume in lots are opened.

Before starting work, you need to open an account with one of the brokers - https://time-forex.com/spisok-brokerov