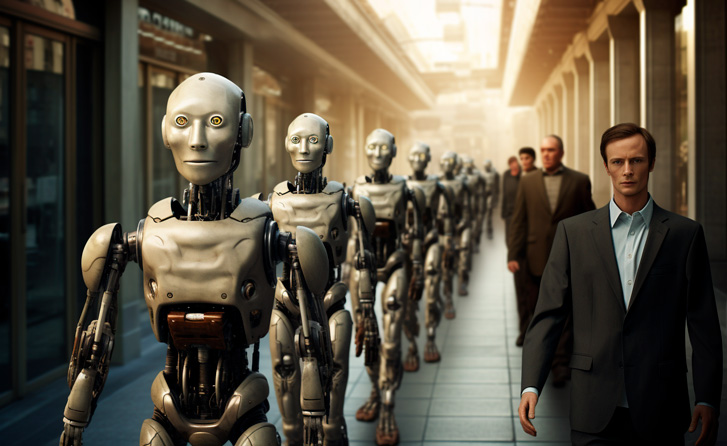

Investors increasingly want to use ChatGPT in their work; can AI replace the trader?

The advent of artificial intelligence has revolutionized many areas of human activity; programs like ChatGPT successfully write texts, draw pictures, translate texts, and analyze finances.

Because of this, many professionals doubted their future, fearing that their jobs would eventually be taken over by artificial intelligence.

Can the influence of AI spread to such an area of activity as biz trade? To study this issue, a survey of traders from one of the largest brokerage companies was conducted.

The study revealed that 40% of traders surveyed are already ready to use ChatGPT to make analytical forecasts or create trading strategies . And some investors are now using AI recommendations in their work.

What do investors expect from artificial intelligence?

Most of those surveyed want specific recommendations for buying securities, that is, for ChatGPT to tell which shares are worth buying now in the hope that the price will rise.

At the same time, the level of trust in such recommendations depends on the age and gender of investors; traditionally, the opinion of AI is more trusted by young investors under 45 years of age. Older people and women are more skeptical and prefer to rely on their own conclusions.

At the same time, both groups are confident in the further increase in the value of securities of companies working on the creation of AI.

Will Chat GPT take away a trader's job?

With the growing popularity of programs like ChatGPT, you yourself begin to think about the future of the trader’s profession; will it turn out that over time artificial intelligence will completely replace the trader?

In my opinion, the first category to suffer will be those managing investment funds or PAMM accounts .

Why give away half the profit if you can pay once for an advanced robot that will replace the manager.

Analytics specialists may also be left without work; AI is already doing a pretty good job of analyzing data, and after a while it will completely surpass humans in this matter.

Naturally, changes will affect trading using advisors, which will become more effective and less risky.

Even now, about 3 trillion US dollars are managed by trading robots, and according to forecasts, by 2027 this figure will grow to 6 trillion US dollars, and this does not take into account the introduction of AI.

What to do in this situation?

The best solution would be to start studying trading using advisors; this will allow you to study the issue even before the advent of “smart trading robots”.

And as soon as these robots appear, you can start using them in your trading; I don’t think that the algorithm for their work will be much different from existing advisors .