Correlation of oil and gold, relationship between the prices of these two assets

Using correlation in stock trading is one of the most popular and simple strategies that even a novice trader can use.

Oil and gold are two key assets in financial markets that attract the attention of traders and investors around the world.

Both resources are critical to the global economy, and their prices are often influenced by similar factors, such as geopolitical instability, inflation and exchange rates.

This creates a correlation between oil and gold prices, which can be used in stock trading strategies.

What is correlation and how does it work

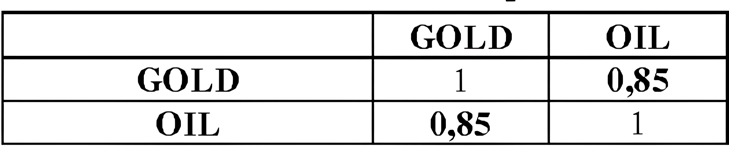

Correlation is a statistical relationship between two assets. It is measured in the range from -1 to +1. If the correlation is close to +1, it means that asset prices are moving in the same direction. If it is closer to -1, assets are moving in opposite directions. A correlation around 0 means that there is no relationship between assets.

However, the correlation is not constant and may change depending on economic and political factors.

Why are oil and gold correlated?

Inflation and economic instability. Gold has traditionally been considered a "safe haven" during periods of economic uncertainty. When the economy faces risks, investors buy gold to preserve capital.

At the same time, oil as a key energy resource also affects the economy: high oil prices can cause inflation to rise, which stimulates the demand for gold.

Changes in the value of the dollar. Oil and gold prices are usually denominated in US dollars, which makes them sensitive to changes in the exchange rate of the US currency. When the dollar falls, both assets tend to rise in price as they become more attractive to holders of other currencies.

Geopolitical risks. Conflicts in the Middle East, trade wars and other geopolitical events can simultaneously affect both oil and gold prices. Increasing instability is driving up oil prices due to supply risks, and gold is becoming more expensive as a safe-haven asset.

Geopolitical risks. Conflicts in the Middle East, trade wars and other geopolitical events can simultaneously affect both oil and gold prices. Increasing instability is driving up oil prices due to supply risks, and gold is becoming more expensive as a safe-haven asset.

How to use the oil-gold correlation in trading

Understanding the relationship between oil and gold can help traders make more informed decisions when trading the stock market. Here are some strategies you can use:

Trading based on changes in one asset. If oil prices rise sharply, this could signal a possible rise in gold prices. In such a situation, you can consider buying gold. Similarly, when the price of oil falls, you can expect gold to decline, which provides an opportunity to sell or take profits.

Risk hedging . The correlation between oil and gold allows these assets to be used for hedging .

For example, if a trader expects oil prices to rise, but wants to protect against possible downside risks, he can open a long position in oil and a short position in gold. This helps reduce losses if the forecast turns out to be wrong.

Use of macroeconomic data. When analyzing oil and gold, it is important to consider macroeconomic indicators such as inflation rates, interest rates and oil reserve data.

These factors can affect both assets simultaneously, increasing their correlation. For example, if inflation rises, this could lead to a simultaneous rise in gold and oil prices.

It is also worth considering that historical correlation does not guarantee that the same patterns will repeat in the future. It is important to combine correlation analysis with other methods such as technical and fundamental analysis .

The oil and gold correlation is a useful tool for traders to better understand the price movements of these assets and use their relationship in trading. However, for successful trading it is important to take into account many factors influencing their dynamics, and not rely solely on correlation.

Regular analysis of macroeconomic data, political conditions and market trends can help you make more informed decisions.