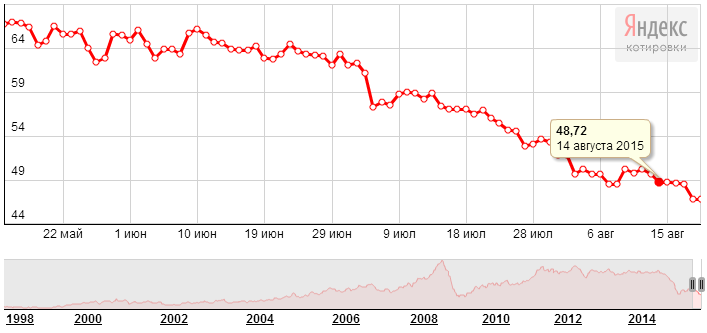

Dynamics of oil prices 2014-2015.

For almost every trader who has been working on the stock exchange for many years and tracks major global instruments such as gold and oil, 2014 was a turning point in their worldview. Oil throughout the world is rightly called black gold, considering that its reserves may be depleted over time.

global instruments such as gold and oil, 2014 was a turning point in their worldview. Oil throughout the world is rightly called black gold, considering that its reserves may be depleted over time.

Almost every country in this world, in one way or another, depends on fluctuations in oil prices. Whatever one may say, the entire industry is somehow dependent on refined oil products, and therefore directly on the oil itself.

Even the recent collapse of the ruble in Russia is associated with a fall in the price of black gold. So what was the turning point in the consciousness of traders? Why can't so many of us simply accept such a rapid decline in oil prices?

The movement of oil prices has always been associated with some kind of crisis in the Middle East. For example, during the war in Iraq, the price of oil grew rapidly, a similar situation has always been with Iran and many conflicts in the countries where the main production takes place.

The constant instability of these regions led to the fact that for a long time there was a very high demand for oil on the market, which the producing countries could not fully fill due to conflicts and destroyed production sites.

Therefore, those who have been trading on the Forex market for a long time should simply restructure their consciousness and understanding of things and remember one, but simple rule: If there is a military conflict in the main oil producing countries, then it will grow rapidly, and not vice versa as happens with currency .

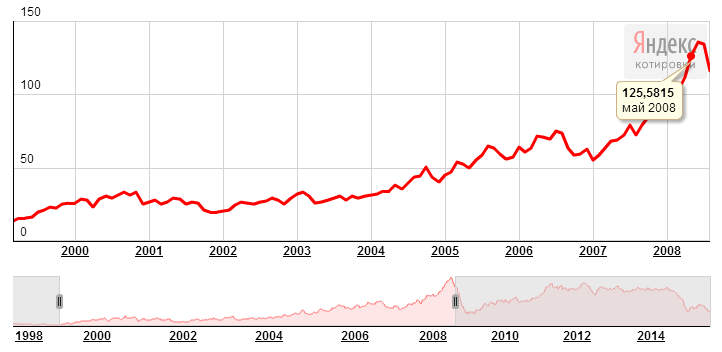

From 2000 to 2008, the price of oil grew rapidly and, starting from $15 per barrel in July 2008, it reached $133 per barrel. During this period, many stockbrokers became simply millionaires and could not even imagine that oil would ever begin to fall. For eight years, we have all witnessed stable growth in oil.

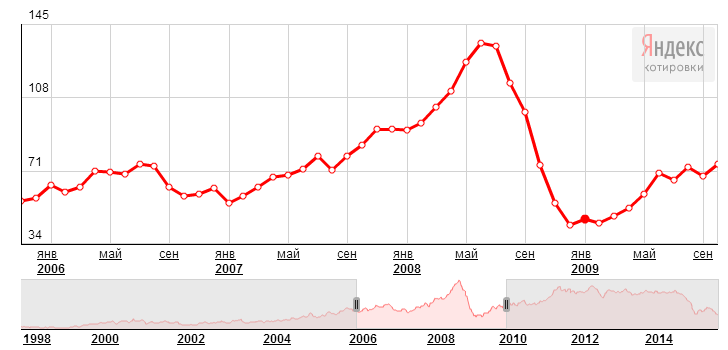

However, such growth simply could not last forever and in June 2008, a collapse in oil prices began thanks to Saudi Arabia, which was able to provide demand for the product. As you understand, when an exporting country tries to maintain its place in the market, it constantly increases production, therefore, as many analysts believe, supply simply begins to become greater than demand.

However, there is a second version of this collapse, which is blamed on America after negotiations with the sheikh of Saudi Arabia. To be honest, I don’t know which version is plausible, but by November 2008, the price of oil reached its minimum, reaching $43 per barrel.

Starting in January 2009, the price of oil began to gain back and this lasted until a new maximum of $124 per barrel was formed in 2012. As you understand, the asset has been growing rapidly for four years. For many who come to the market, it seems that oil is always rising. So from March 2012 to July 2014, oil was in the range from 102 to 111 dollars per barrel; to put it simply, it was kind of sideways.

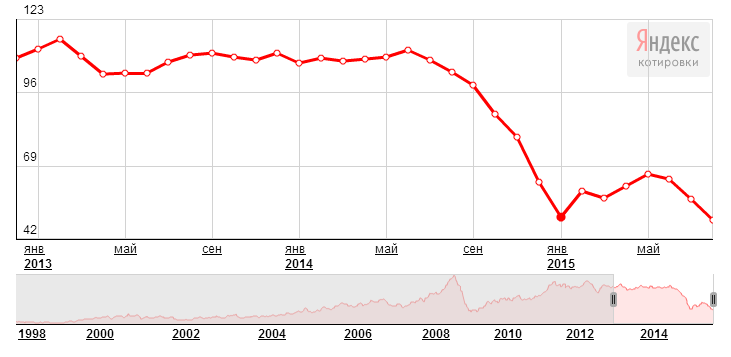

The asset was stable, since the situation in the world was more or less stable. However, in July 2014, a break in this calm came and the price plummeted downwards without any pullbacks. Many analysts wrote that the price of oil should rise, since there was a situation with Syria, an active threat from the Islamic State and new endlessly continuing rounds of war, which, according to the classics of the genre, should have forced the countries on the borders of which the threat to reduce oil production, which would lead to its increase in price.

However, 2014 simply turned upside down all conceivable and unimaginable assumptions of traders about the movement of the price of oil, when it managed literally from July 2014 to January 2015 to collapse right up to $50 per barrel, without any rollbacks.

Many people attribute this fall to the conflict between the United States and Russia, since, as we know, the Russian budget is directly tied to the price of oil, so with the fall in oil, the ruble also collapsed. Also, against the backdrop of worsening relations due to the war in Ukraine, the US President went to negotiations in Saudi Arabia.

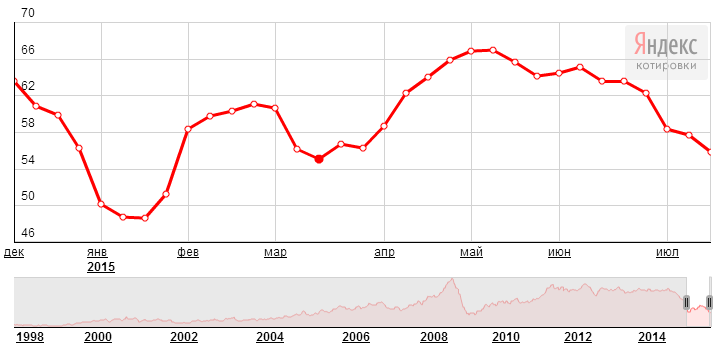

After the negotiations, the largest oil exporter made a statement that they would not reduce production but would increase it even if the price per barrel was $35. Then, as you probably all saw, the price of oil began to stabilize and starting from January 20, 2015 to May 11, there was a price rollback which amounted to $66 per barrel.

Before the asset had time to gain momentum, new high-profile news appeared, the essence of which was that sanctions on oil trading had been lifted from Iran. Against the backdrop of this news, as well as the decision of exporting countries not to reduce production, the rollback ended and the price continued to move downwards.

Today, the price per barrel is approximately $47, and if Iran actively enters the sales markets, the asset will clearly go down to at least $30. Moreover, against the backdrop of military operations that are so actively taking place in the Middle East, the price of oil is far from its real price, but has become politicized.

Therefore, the conclusion suggests itself that 2014-2015 became the most unpredictable years for traders, since all the usual laws that had been moving oil all this time were simply violated. Thanks for your attention, good luck!