Ribeit services for returning the spread and whether it is worth using them

A rebate is a return of part of the broker’s commission to the trader for each transaction; it is a kind of cashback of the money paid for opening an exchange transaction.

A spread rebate allows the trader to receive a portion of this commission back after the trade is completed.

This may be a fixed or interest income depending on the volume and frequency of trading operations.

This technique is one of the tools for attracting clients and can help reduce trading costs, increasing the trader’s overall profit.

The active development of Forex brokers and their affiliate programs has led to a completely new phenomenon, namely the emergence of the so-called “Rebate services”.

What are the rebate service payments based on?

Rebate services are special partners of brokerage companies who receive a reward for each attracted client and his trading activity.

It's no secret that every broker takes a commission in the form of a spread for opening a position. To increase the number of attracted clients and pay less for advertising, these affiliate programs were invented.

The essence of affiliate trading comes down to the fact that the broker shares part of the commission that is charged from the trader with the partner who attracted the person.

The essence of affiliate trading comes down to the fact that the broker shares part of the commission that is charged from the trader with the partner who attracted the person.

Thus, rebate services receive a reward if you register on their recommendation, and then give part of the reward to you.

At the same time, regardless of whether you opened a profitable or unprofitable transaction, the Rebate service will receive a reward for you.

Disadvantages of rebate services

Just think, rebate services share partner rewards with us, and it doesn’t matter whether my position is profitable or unprofitable, almost every novice trader thinks so.

However, the first condition we face is the requirement to open an account using the service’s affiliate link, and it does not matter whether you have previously registered with the selected brokerage company or not. Naturally, every trader wants to work only with a good company that has been personally verified by him, so the trader begins to register a new account with the same broker that he previously traded, but using the service’s affiliate link.

Ultimately, you can earn money from the rebate service, but when you want to withdraw your money from the broker's account, problems may arise. The fact is that only one account is allowed to be opened per person, so unscrupulous managers can take advantage of this loophole and refuse your withdrawal, accusing you of fraud.

The second drawback of rebate services is the opacity of commission payments.

Unfortunately, not everyone can boast of positive reviews. The fact is that most services make deposits into your account only once a week and may simply lose some of your transactions. For example, you may be denied part of the commission because you closed transactions earlier than a minute later or another condition that no one warned you about at the time of registering the rebate service.

There are also a very large number of simply scammers who are trying in every possible way not to pay you.

There are also a very large number of simply scammers who are trying in every possible way not to pay you.

The third drawback is the imposition of various “Kitchens”.

Almost every rebate service has its own top list of brokers with which it recommends working.

As a rule, all these brokers have a very large commission on major currency pairs, as well as a far from tarnished reputation. InstaForex broker, beloved by all rebate services, has a spread of 3 points or about $30 per lot, while brokers such as Alpari , RoboForex and Amarkets not only have smaller spreads, but also provide rebates themselves.

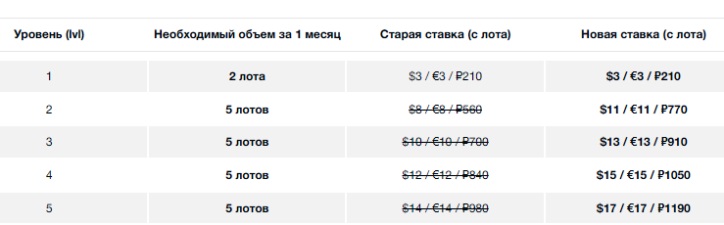

Here is an example of a spread return from the broker Amarkets:

Also, the last unpleasant incident of the IAFT rebate service was remembered by thousands of traders, since this company actively advertised MMSIS and put it in first place in all its ratings, offering super offers for the return of the spread.

Also, the last unpleasant incident of the IAFT rebate service was remembered by thousands of traders, since this company actively advertised MMSIS and put it in first place in all its ratings, offering super offers for the return of the spread.

In my opinion, it is better to trade with a broker with the lowest spread than to try to compensate for it through third-party firms. Comparison of spreads among brokers - https://time-forex.com/vsebrokery/sravnenie-foreks-brokerov