Top 5 world financiers

In any field there are the most successful, the best, and of course stock trading is no exception.

The most successful traders have earned huge fortunes amounting to billions of dollars.

Most of the people who have achieved success in trading began to engage in stock trading literally from scratch and managed to achieve success only thanks to their work.

Therefore, their experience is a valuable lesson and example for traders who also want to become one of the world's top financiers.

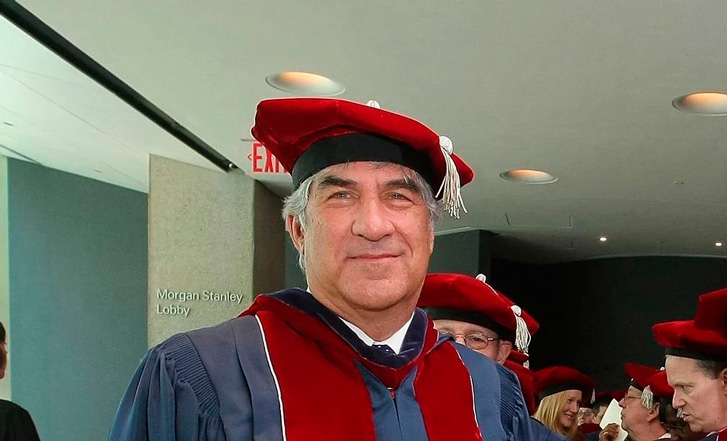

- Paul Tudor Jones

Basic information:

- Born: 1954 in Tennessee, USA.

- Current net worth: $7.5 billion.

- Main trading instrument on the market: Commodities

Jones made money writing financial articles for his father's newspaper while a student at the University of Virginia.

After graduating in 1976, he had many options, even an invitation to attend Harvard Business School, but Jones turned down all these offers. He decided to go into commodities trading instead, which turned out to be the best choice.

Under the tutelage of Eli Tallis, an experienced cotton trader, Jones acquired the skills necessary to become a commodity broker with E.F. Hutton & Co. at the age of 24.

In 1980, Paul Tudor Jones founded Tudor Investment Corporation, his own hedge fund. This fund focuses on money market interest rate volatility.

Today the fund manages approximately $11 billion in assets. The basis of Jones's most successful trade was that he correctly predicted the stock market crash of 1987.

Because of this, he decided to go short selling futures contracts and made a profit of 125.9% or $100 million in just one day.

Paul Tudor Jones advises new forex traders: “The most important rule is to defend yourself well, not actively attack.” When starting a new position, Johnson always recommends having a backup plan in case something goes wrong.

- George Soros

Basic information:

- Year of birth: 1930, Hungary.

- Current net worth: $6.7 billion.

- Main trading instrument on the market: Forex (Currency)

George Soros is a man who deservedly ranks among the top financiers in the world. Born and raised during the Nazi occupation, when the only goal of Jews was to survive. And it was during this difficult time that his most important investment philosophy was formed: “First survive, then make money.”

Having started his career while still a student at the Singer & Friedlander School in London, George Soros achieved his first profitable results.

Then, having acquired a number of assets, he founded his own hedge funds. His first hedge fund was Double Eagle (1969), later renamed Quantum.

From 1970 to 2000, he managed this fund with great success, achieving an average return of 30% per annum, and in the best times up to 100% per annum. Quantum Fund is considered the most successful investment fund in the history of the world economy.

He then used the profits from this fund to found Soros Fund Management (1973), which averaged an annual return of 20%, making it one of the most profitable hedge funds in world history.

In managing these two funds, George Soros developed a unique trading technique, in particular, he uses his unique understanding of economic trends to identify market inefficiencies and eliminate them through large leveraged trades.

And it was this trading technique that led to his greatest success in 1992, when he earned the nickname "The Man Who Broke the Bank of England."

At the time, the pound was artificially rising under the European Exchange Rate Mechanism (ERM), George Soros predicted that the British government would have to devalue its currency and this would lead to the depreciation of the British pound.

Taking a whopping $10 billion short position on the British pound helped George Soros make a $2 billion profit in just 1 month.

This is undoubtedly the biggest deal in the Forex market and ensures that George Soros remains among the top financiers in the Forex market.

Since Black Wednesday, George Soros has continued to invest, trade and increase his assets, becoming one of the richest forex traders.

George Soros advises novice traders: “The market is always in a state of uncertainty and change, money is made by ignoring the obvious and betting on the unexpected.”

- Bruce Kovner

Basic information:

- Year of birth: 1945, New York, USA.

- Current net worth: $6.6 billion.

- Main trading instrument on the market: Commodities

Before becoming a trader, Bruce Kovner was engaged in a fairly wide circle of activity, politics, city administration and teaching

Bruce began his trade career when he was 32 years old, in 1977, when a family friend introduced him to financial markets.

He began with an intensive self-study program on the history and nature of money, commodity and debt markets. After more than a year of research, Kovner borrowed $3,000 from his Master Charge credit account and began trading futures. Specifically, he bought soybean futures and made his first profit of $22,000.

Having achieved success with his own capital, Kovner joined Commodities Corporation (now part of Goldman Sachs) as a senior trader. Here he earned millions of dollars for the company and established himself in the market.

In 1983, Kovner founded Caxton Associates to manage his hedge fund. He focused on trading financial and commodity markets based on macroeconomic conditions.

Over 28 years under Kovner's management, Caxton has become one of the largest and most successful macro hedge funds in the world, with assets of $12 billion and average annual net returns of more than 21%.

Prior to founding Caxton Associates, he also had an unparalleled track record in both the commodities and stock markets, with returns of 90% over 10 years. This is truly a remarkable achievement that very few professionals are capable of.

After leaving Caxton Associates in 2011, he founded investment firm Cam Capital in 2012, managing his personal wealth through stock trading and trading activities.

In more than 20 years of managing his fund, Bruce Kovner lost only in 1994.

Bruce Kovner is an excellent macro analyst. He believes that only by understanding the economy, understanding its workings and the flow of capital, can traders/investors be successful.

In addition, controlling emotions and maintaining discipline before opening a position is also one of the mandatory skills that a trader needs.

- Stanley Druckenmiller

Basic information:

- Born: 1953 in Pennsylvania, USA.

- Current Net Worth: 6.4

- Main trading instrument on the market: Forex (Currency)

From an early age, Druckenmiller showed a passion for business and finance. This passion led him to study English and economics at Bowdoin University. After completing his studies, Druckenmiller worked at the National Bank of Pittsburgh.

He earned a decent salary as head of equity research but left in 1981 to start his own firm, Duquesne Capital Management.

Druckenmiller's investment acumen and extensive knowledge of capital markets caught the attention of George Soros. In 1988, Soros hired him as chief portfolio manager of the Quantum Fund. During this time, he made one of the greatest deals in history. One bet on the British pound earned $2 billion in just one month. It is said that Soros and Druckenmiller were the couple that “broke” the Bank of England.

After leaving Quantum Fund in 2000, Druckenmiller went on to run Duquesne Capital and amassed a $12 billion fortune.

Much of his wealth comes from his investment firm Duquesne Capital Management and his work with the Quantum fund.

Druckenmiller currently makes his personal investments in energy stocks, the New York Times and other securities.

Much of Druckenmiller's trading and investing strategies focus on maximizing opportunities when they are right and minimizing losses when they are wrong. His investment style also goes against the principle of "Don't put all your eggs in one basket." Instead, he says, “I like to put all my eggs in one basket and then watch the basket very carefully.”

- Joe Lewis

Basic information:

- Year of birth: 1937, London, England.

- Current net worth: $5.2 billion.

- Main trading instrument of the market: Forex (currency)

Joe Lewis is a British trader with an inspiring success story. He began working at the age of fifteen, helping his family in the catering business.

Having inherited the business, he, with the ability and experience of a natural businessman, took every opportunity to help the family business model expand and grow.

But he eventually sold it for £30 million, making him a millionaire before his trading career even began. Lewis then moved to the Bahamas with all his earnings and devoted himself entirely to his career as a forex trader.

The deal that made Joe Lewis billions of dollars was the Bank of England's Black Wednesday deal. Joe Lewis is also reportedly a member of the elite club of legendary traders such as George Soros, Julian H. Robertson Jr. Together with George Soros, he made billions of dollars from this deal.

Not stopping there, three years later Joe Lewis made a similar short sale, but this time the victim currency was the Mexican peso. Mexico ran up a huge trade deficit in 1994, prompting speculators to bet that the peso, which clearly lacked government support, would collapse. In early 1995, the peso collapsed, and speculator traders like Joe Lewis made huge profits.

Joe Lewis' trading strategy and style changed significantly after Black Wednesday. Before the Bank of England deal on Black Wednesday, he was considered a rational, methodical trader and only took calculated risks.

His previous trades were typically limited to a few million dollars, but after successfully selling sterling, this number grew into the billions of dollars thanks to a strategy of betting heavily on poorly positioned coins.

Joe Lewis advises new traders to remain humble and boast about “just getting rich” as a barrier to the success they desire.

We hope that the information presented on how traders who now form the top financiers earned their capital will become an example to follow and serve as the basis for your success.