How to trade gold in the MetaTrader 4 terminal

Raise any first-grade student from his desk and ask him to name at least one expensive metal, he will immediately say gold.

metal, he will immediately say gold.

All of us in our lives have at least once thought about buying this precious metal, and not necessarily in bullion. Any housewife knows that as long as she has at least one piece of gold jewelry in the house, she won’t mind any extreme situation, because at any moment she can find money.

Thus, from childhood we are inadvertently taught to invest in gold, because no matter how much humanity mines it, it always grows in price.

Until recently, investing in gold was extremely difficult. At the household level, everyone tried to buy expensive gold products, and businesses, despite all the commissions and costs, tried to buy bars made from this metal from state banks.

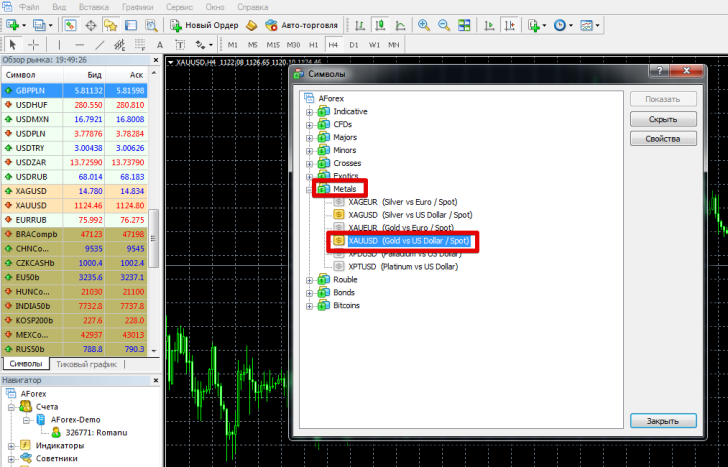

The trading process is no different from the currency trading we are all used to, and even unlike buying gold as a commodity, it is much more profitable, since the bank does not skin you, as is often the case. If you enter the MT4 trading terminal, you can find it in the symbols panel and it is called XAU/USD.

Essentially, if we look at the set of symbols, it turns out that you are buying gold for dollars. In addition to simply investing in the form of a purchase, you can make money on price fluctuations.

If you do not see this currency pair in your trading terminal, then I recommend entering the symbols menu, opening the metals tab and simply clicking on gold. After these simple manipulations, this tool will appear in the list:

And now, actually, I would like to discuss with you how to analyze this currency pair, what factors influence it and what actually moves the gold rate.

And now, actually, I would like to discuss with you how to analyze this currency pair, what factors influence it and what actually moves the gold rate.

Many investors and traders note that gold is a highly volatile instrument and very difficult to predict. And in truth, there are a lot of fundamental factors , but before you start trading gold in the MT4 trading terminal, you should know that the first players who run this market are the Central Banks of states.

To maintain the financial stability of any monetary unit, Central banks hold gold reserves, while actively conducting various speculations with it. For example, gold grows during a crisis, as investors try to save their money by buying this metal.

As you know, the Swiss economy is very much tied to the banking sector, therefore, without owning deposits, the Swiss franc exchange rate is directly related to the gold rate. Therefore, if you are facing a major crisis, then capital, as a rule, goes to Switzerland, which means that the cost of gold rises. A significant factor when analyzing the possible exchange rate for precious metal is data on production volume.

According to the latest data, China is in first place in production, Australia is in second place, Russia is in third place, then the USA, Peru, South Africa, Canada, and Mexico. By analyzing the gold production reports of these countries, it is possible to detect a possible price change with a high probability. Many traders keep the Australian dollar under special control, since it is a kind of indicator.

If the Aussie rises, the price of gold also rises, and if the Aussie falls, gold also loses in price. However, for a more detailed analysis, traders use reports from major gold mining companies. For example, the top five major gold mining companies are headed by the Canadian company Barrick, which produces an average of 190 tons of gold per year.

In second place in production is the American company Newmont, which produces an average of 150 tons of gold per year. The top three is closed by the South African company AngolGold Ashanti, which produces an average of 130 tons of gold per year. In fourth and fifth place are two Canadian companies Goldcorp and Kinross with an average annual production of 80 tons.

Why did I list this? The fact is that these companies are developing gold deposits around the world, so by analyzing them you will always be aware of the possible development of the price of gold. Do not forget that gold is actively growing during the crisis, so you can see the following picture: a fall in the main indices - an increase in the XAU/USD currency pair.

Many note that gold is also affected by the price of oil, since it has a global impact on the economies of all countries. It is worth clarifying the fact that the purchase or sale of gold occurs in dollars, so it is worth monitoring in detail the main indicators of the American economy and political statements.

When trading gold in the MT4 trading platform, you have access to various technical and graphical analysis tools, which also actively work on this asset.

Before you start trading gold in the MT4 trading platform, you should familiarize yourself with the trading conditions of the broker, since, as a rule, different brokers charge different commissions, and the spread in general is so high that you would lose your money on it.

You can download the trading platform from one of the brokers - https://time-forex.com/vsebrokery/brokery-zoloto-serebro