Important points when trading cryptocurrencies

Recently, cryptocurrency trading has significantly changed its nature and has moved from specialized exchanges to the Forex market.

If previously everything came down to buying and holding Bitcoin until the maximum price value, now currency exchanges have equated crypto to ordinary monetary units.

Trading liquid cryptocurrencies on an exchange has many advantages, but is fundamentally different from the initial transactions with digital money.

And so, let's move on to the most important points of cryptocurrency trading:

1. Speculative trading - first of all, it should be noted that if you bought crypto in a trader's trading terminal, this money cannot be withdrawn to your wallet.

On the one hand, this is a minus, but on the other hand, it is a huge plus since you can make a transaction in a fraction of seconds.

For example, with $1,000 you can buy $10,000 worth of bitcoins

3. Lot size - if for other currencies 1 lot on the exchange is equal to 100 thousand of the base currency, then for the BTC/USD currency pair one lot is equal to only one bitcoin.

4. Volume restrictions - unfortunately, on one account you can conclude a transaction with a maximum volume of 10 lots, or in our case, 10 bitcoins. There is also a limitation on minimum volumes of 0.01 lot, so to speak, one hundredth of a bitcoin.

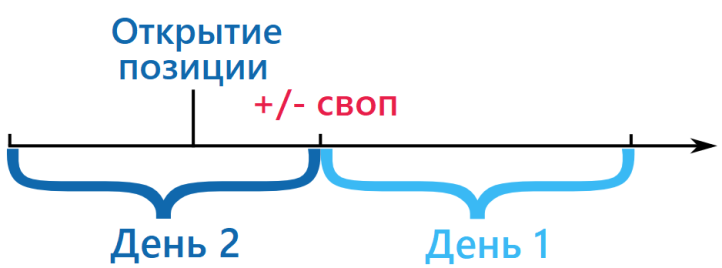

5. Commission for transferring positions - as with other currencies, there is also a swap, that is, if you leave your transaction for more than a day, a commission will be charged on it. Its size is approximately 2.5% per month of the transaction size.

At the same time, be careful, from Wednesday to Thursday the commission increases three times.

6. Spread - as always, selling is more expensive and buying is cheaper. If you buy a crypto currency and immediately sell it, the difference will be about $20. Read what a spread is here - http://time-forex.com/terminy/spread-forex

6. Spread - as always, selling is more expensive and buying is cheaper. If you buy a crypto currency and immediately sell it, the difference will be about $20. Read what a spread is here - http://time-forex.com/terminy/spread-forex

7. Trading time – trading is carried out around the clock, but there is a break from 12 to 1 am, so be careful.

7. Trading time – trading is carried out around the clock, but there is a break from 12 to 1 am, so be careful.

8. Trading in the platform - those who have worked with MetaTrader 4 know how functional this program is; here, in addition to analyzing charts, you can place pending orders, place stops, use robots, etc. It is simply impossible to describe all the functionality in a nutshell - http

: / /time-forex.com/knigi/instruksyy-metatrader-4

9. Brokers – that is, those through whom you can make transactions in crypto currency http://time-forex.com/kriptovaluty/brokery-kriptovalut

As you can see for yourself, there are quite a lot of nuances in trading cryptocurrencies on the foreign exchange exchange, but it’s worth it. Thanks to a professional trading terminal, you get a lot of opportunities with which cryptocurrency trading will become many times more successful.