Is it worth investing in weapons stocks now?

As sales statistics show, since the beginning of the pandemic, the demand for weapons in the world has increased significantly; for example, Smith & Wesson Brands increased its sales of weapons in 2020 by 2.5 times.

People began to arm themselves en masse in order to independently try to ensure their safety in turbulent times.

The outbreak of hostilities in Ukraine again spurred the demand for weapons, but unlike previous years, anti-aircraft missile systems, armored vehicles, and military aircraft are now in high demand.

What is happening at the moment with the price of shares of arms companies that produce and sell weapons, should we expect profit from such investments?

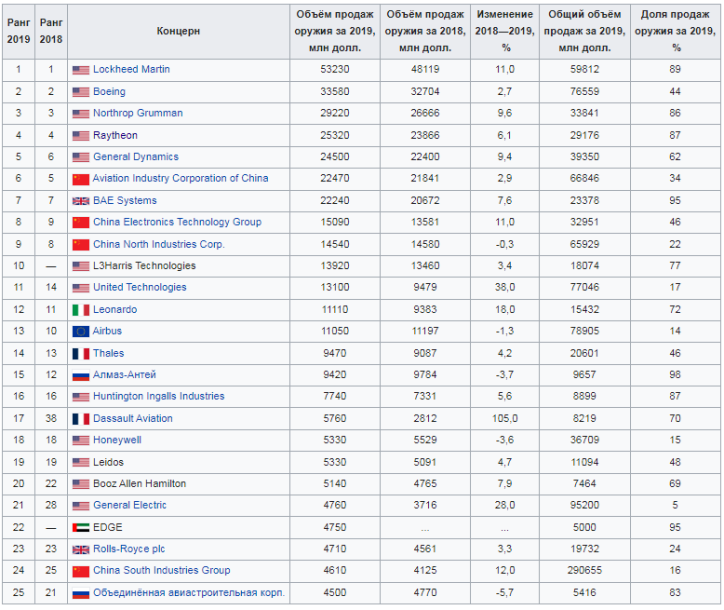

Wikipedia provides a list - List of the largest military-industrial companies :

From which it is easy to identify corporations in which the sale of weapons is a priority and, using their example, learn how the price of shares of arms companies behaves.

Let's take, for example, the well-known Raytheon Technologies Corp company, which is a manufacturer and developer of Patriot air defense systems, Stinger MANPADS, missiles for aircraft and ships, as well as military radars.

That is, we can say that Raytheon Technologies Corp produces products for which there has been increased demand since February 24, 2022. Therefore, the shares of this particular weapons company can serve as an example.

Raytheon Technologies Corp securities are traded on the stock exchange under the symbol RTX:

As you can see on the RTX chart, the price of shares reacted quite vigorously to the outbreak of hostilities on February 24, 2022, and by the end of February the price rose from 90 to 104 dollars per share. True, after that there was a traditional rollback and now the price of the security is $101.

Now we can safely predict a further increase in prices against the backdrop of growing arms sales, the arms race has begun again in the world and most states are increasing their military spending.

It is the products of Raytheon Technologies Corp that are one of the most popular, which will lead to an increase in sales and, accordingly, profits in the first half of this year.

In addition, dividends on shares of Raytheon Technologies Corp are planned to be paid on June 17, 2022, so until May 18, the demand for purchases will only grow.

It is difficult to count on a quick end to hostilities in Ukraine, so shares of the military-industrial complex will only grow in the first half of 2022. This is confirmed by the fact that many investment funds also invested in this market segment.

You can buy shares from the following brokers - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka