What will happen to the dollar exchange rate against other currencies in 2020

While Europe is slowly beginning to cope with the consequences of the coronavirus infection, the United States is increasingly breaking morbidity records.

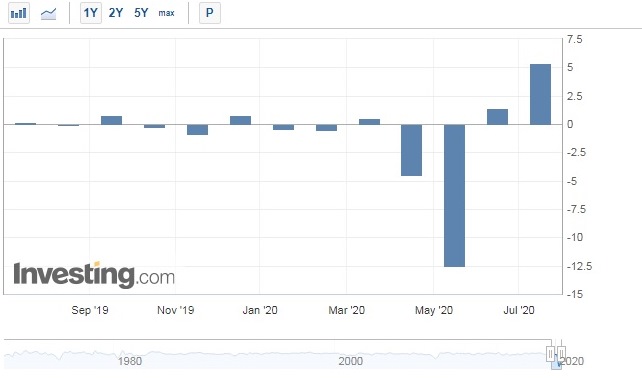

This state of affairs cannot but cause a recession in the economy, the indicators of which are at a rather low level.

The unemployment rate continues to be quite high; it has decreased slightly over the past two months and is now around 11%.

But this is still quite a lot considering that on average, unemployment in the United States in previous years rarely exceeded 3.5%.

However, it should be noted that the industrial production indicator increased noticeably in June 2020, and this indicates the beginning of a positive trend, and that unemployment will soon decline.

Against the background of the fall of the dollar against the euro, goods produced in the United States have become significantly cheaper, which only contributes to an increase in demand and an even greater stimulation of production.

It is expected that as soon as Trump manages to cope with the unrest and launch mass production of the coronavirus vaccine, the situation in the United States will begin to improve dynamically.

It is expected that as soon as Trump manages to cope with the unrest and launch mass production of the coronavirus vaccine, the situation in the United States will begin to improve dynamically.

What will the US dollar exchange rate be in the second half of 2020?

In the best case, the EUR/USD currency pair will continue to rise to 1.20 euros per US dollar, and after positive news appears (and they will certainly appear), it will begin to decline to 1.10 and will remain there until the end of the year:

It is possible that the decline could happen a little earlier, it all depends on how the circumstances develop this week.

It is possible that the decline could happen a little earlier, it all depends on how the circumstances develop this week.

Presumably, the dollar is currently under more pressure from the turmoil than from economic factors.

So, the situation is quite ambiguous and we can only wait to see whether the dollar will go above 1.16-1.17 or begin to fall below 1.15 dollars per 1 euro.

At the same time, according to most analysts, the probability of growth is still higher than the probability of decline.