Forecast of the euro dollar exchange rate for the fall of 2024, which currency to give preference to

The most liquid and convenient currencies for storing savings today are still the euro and the American dollar.

As an alternative, you can, of course, use Swiss francs, but they have less liquidity and sometimes problems arise with their exchange, so the dollar and euro are still the priority currencies.

At the end of April 2024, the rate of the EURUSD currency pair is around 1.07 US dollars per euro, but many skeptics predict a quick fall in the value of the euro and a 1 to 1 price decline, as was already the case in 2022.

But is it worth it now to get rid of the euro and urgently exchange them for American dollars, so as not to lose on the exchange rate due to the fall of the euro?

Euro dollar forecast for the second half of 2024

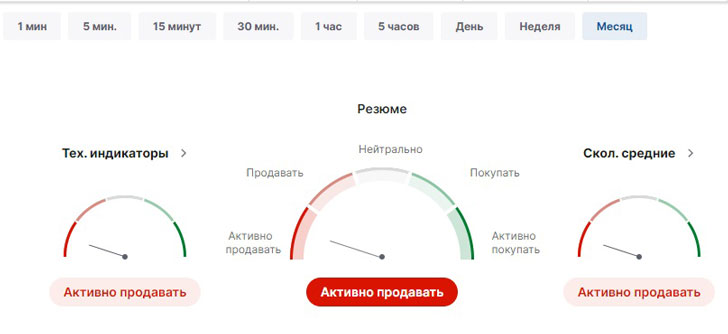

If you trust technical analysis indicators, then most of them advise you to now actively sell the EURUSD currency pair by exchanging the euro for the dollar:

The indicators are also supported by most analysts, predicting a decline in the exchange rate after changes in interest rates. It is assumed that the higher the discount rate on the dollar, the more the price of the EURUSD currency pair falls.

But not everything is so simple in this matter; there are many prerequisites for a significant fall in the exchange rate of the US dollar.

Seasonality of the euro exchange rate

In summer, traditionally, the demand for European currency increases; summer is the holiday season, and vacationers outside the euro zone en masse flock to Italy, Spain, France, and Croatia, exchanging the currencies of their countries for the euro.

Therefore, in the summer the euro will begin to strengthen or, at least, will move in the range of 1.05 - 1.10 dollars per 1 euro.

But the most interesting thing will begin in the fall of 2024, as we know, the exchange rate of the national currency is most influenced by events within the country; the US presidential elections will be held this fall.

There has not been such strong opposition between Republicans and Democrats for a very long time, which means the struggle for the presidency will be fierce.

In the fall of 2024, mass unrest may occur in the United States, which will turn into major clashes between supporters of Republicans and Democrats.

In anticipation of these events, the US dollar will begin to weaken starting in October 2024, and possibly even earlier. Large financial players understand all the risks and are trying to reduce the share of American dollars in their assets.

If we talk about specific numbers, then depending on the scenario of events, the EURUSD currency pair may rise in price to 1.15 and higher.

Therefore, now you should think carefully about whether it is worth buying the US dollar or whether it is better to bet on another currency.

At the same time, do not forget about stablecoins, the rate of which is pegged to the US dollar; if the dollar becomes cheaper, then these coins will fall in price. Closer to autumn, it is advisable to get rid of these assets.

A fall in the dollar will traditionally cause demand for gold; you can open a purchase deal for gold right now with the following brokers - https://time-forex.com/vsebrokery/brokery-zoloto-serebro