New markets, why investments in the Indian economy are more promising

It seems to most people that there are no other stocks other than the securities of American companies that we constantly hear about in the news.

But there are other markets, including developing ones, that have great prospects for growth and payment of dividends.

Today, Europe and the USA are going through hard times; most experts predict an imminent collapse of their stock markets, so investors are increasingly looking towards new assets.

At the same time, the most interesting alternative destinations are countries such as China and India.

The question naturally arises: what to choose for investing money, China or India?

Despite the fact that there are many interesting companies in China today, there are many reasons why you should already refrain from investing in the Chinese economy:

Economic war with the USA: The conflict is growing every day, the United States government is constantly thinking about how to weaken China by introducing new sanctions. If sanctions are strengthened, most producers will lose their markets and, as a result, their shares will fall in price.

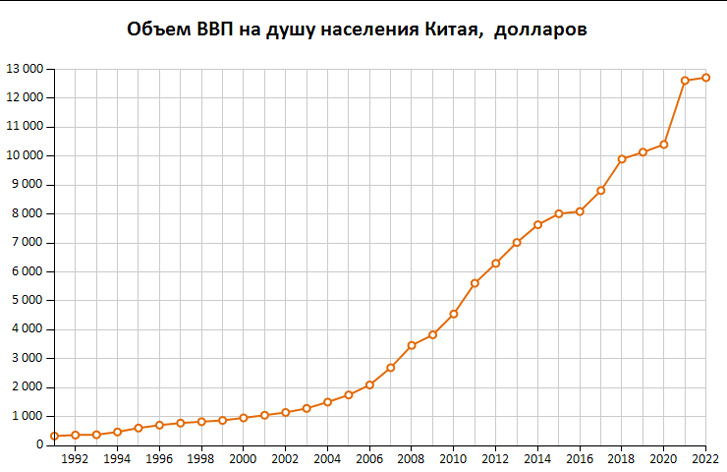

Slower economic growth: China's GDP grew 3.0% in 2022, the lowest in three decades.

In 2023, there will be some acceleration in GDP growth, but the indicators are still far from pre-Covid levels.

Supply Chain Issues: China is a major producer of goods for the global economy. However, due to the COVID-19 pandemic and other factors, supply chains in China have been disrupted, causing prices to rise and production to decline.

Political risks: The Chinese government is increasingly interfering in the country's economy, which creates uncertainty for investors.

Due to these factors, the outflow of American investment has increased significantly in recent years, and investors from other countries are also reducing their investments.

Well-known American companies are transferring production to other countries, including India, and this is causing a significant blow to the Chinese economy, which has already begun to decline.

India as the best alternative to China

In recent years, there has been growing investor interest in shares of Indian companies. This is due to a number of factors including:

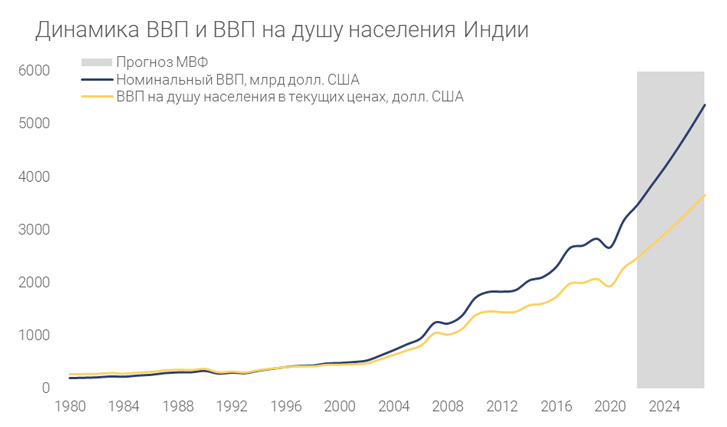

Stable Economic Growth: India is one of the fastest growing economies in the world. Its GDP grew by 8.7% in 2022, the highest in eight years.

Young and growing population: India has a population of over 1.4 billion people, of which about 60% are under 35 years of age. This creates a large market for goods and services, which contributes to the growth of Indian businesses.

Openness to foreign capital: The country seeks to attract foreign capital to develop its economy. The government has introduced a number of reforms aimed at facilitating foreign investors' access to Indian markets.

High Returns: Indian stocks tend to provide higher returns than Chinese stocks. This is because Indian businesses are still in the growth stage and have a lot of potential for growth.

Today the largest Indian companies are:

- Reliance Industries

- Indian Oil

- Oil & Natural Gas

- State Bank of India

- Tata Motors

- Bharat Petroleum

- Rajesh Exports

Their shares can be purchased from the following brokers - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka

Of course, investing in any stock comes with risk. However, taking into account the above factors, it can be concluded that buying shares of Indian companies is a more profitable strategy than buying shares of Chinese companies.