Bid and Ask in stock trading and other areas of application

In stock trading, the terms "bid" and "ask" are used to indicate the price at which an asset is willing to buy or sell.

The bid price represents the highest price at which an asset is purchased, and the ask price represents the lowest price at which an asset is sold.

In simpler terms, these prices can be described as follows:

Ask is the price at which you are selling a currency, stock, gold or other commodity, the higher

Bid is how much you will get if you want to sell something yourself, lower

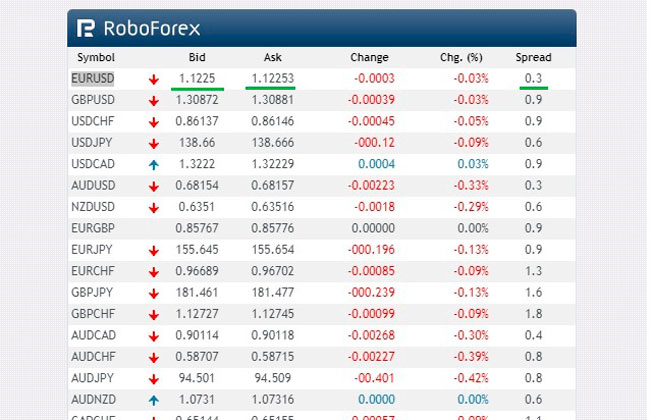

These indicators are indicated in the quotation table - https://time-forex.com/kotirovki , quotations are located in the trading platform or on specialized websites.

The difference between the ask and the bid is called the spread, and is often the commission of the organization acting as an intermediary in the transaction:

For example, in our figure, you can buy euros for US dollars at a price of 1.12253, and sell dollars for euros at 1.12250, meaning the broker's commission spread is 1.12253 - 1.12250 = 3 points with a five-digit quote.

The spread may vary depending on the asset's liquidity. Liquidity is the ability of an asset to be quickly and easily sold at market price. The more liquid the asset, the smaller the spread.

This is because if there are more participants in the market willing to buy and sell an asset, this will make prices more stable.

Supply and demand have a significant impact on the spread size; when there is a shortage of an asset, the spread begins to grow and the difference between the ask and bid increases.

This is clearly demonstrated in the example of currency exchange: when the national currency collapses against the US dollar, the number of buyers far exceeds the number of those willing to sell the dollar, with the difference between the bid and ask reaching up to ten percent:

The terms "bid" and "ask" are used in all markets where assets are traded, including stock markets, foreign exchange markets, and derivatives markets.

These concepts are important tools for understanding pricing and making buy or sell decisions.

Where are the terms bid and ask used in practice?

Stock market: Stockbrokers use these terms to refer to the price of stocks, bonds, and other securities.

Foreign exchange market: currency quotes can be found not only on the currency exchange, but also in everyday life, at a bank's exchange office, or at a brokerage firm dealing in foreign exchange transactions.

Derivatives market: Derivatives are financial instruments that derive their value from another asset. For example, stock futures contracts give traders the right to buy or sell shares at a specified price in the future.

A trader who buys a stock futures contract is effectively entering into a deal with the seller of the futures contract to buy or sell the stock at a specified price in the future.

Depending on the direction of the transaction, the price at which the trader receives the futures contract will be called the bid or ask price.