The Sharpe Ratio will help you choose the best PAMM account

Almost every investor who practices PAMM investing constantly faces the problem of choosing between managers who demonstrate relatively similar profitability and risk dynamics over a given period of time.

the problem of choosing between managers who demonstrate relatively similar profitability and risk dynamics over a given period of time.

The same problematic situation faces traders who decide to choose one of two strategies that generally show almost identical results, although they use radically different approaches to determining entry points.

The Sharpe ratio was invented by Nobel laureate William Forsyth Sharpe in 1966 to compare the performance of investors' investments in various funds.

This ratio takes into account the expected return on an asset minus the risk-free return that can be obtained by purchasing government securities, bonds, or a simple bank deposit.

Now let's understand the meaning of this formula. S is our desired Sharpe Ratio, R is the fund or investment's return, Rf is the risk-free return on the investment, and Si is the standard deviation of the return.

The Sharpe ratio itself doesn't tell us much, so it's commonly used for benchmark comparisons, specifically comparing the resulting figure with the same figure from an investment in another fund.

Sharpe ratio when comparing PAMM accounts

If we talk about the formula that we described above, then practically no one will have any difficulties with calculating the profitability indicators, but with the standard deviation of profitability, everything is quite complicated.

When comparing two PAMM accounts, for example with the broker Alpari , this missing number can be taken from the characteristics of each manager.

So, let's look at a simple situation and compare the risk of investing in two different accounts. For example, we'll use real PAMM accounts belonging to Mikhail B and Uspexx. Both of these traders demonstrated approximately the same annual returns, amounting to 36.6 and 36.8 percent, respectively.

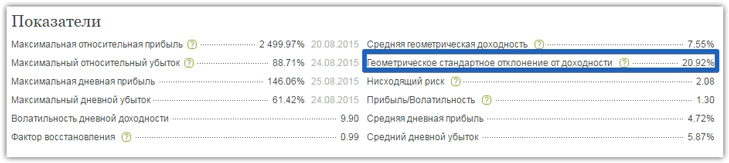

To compare the two strategies used by traders, we first go to the personal information of trader Mikhail B, where we take the missing value for the standard deviation of returns for our Sharpe formula.

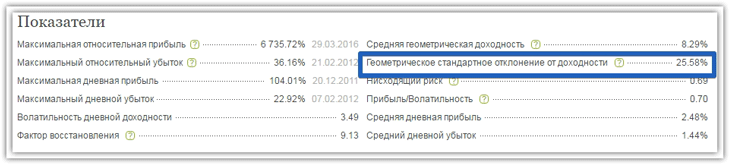

Next, we perform the same action and take for the Sharpe formula the value of the standard deviation from the return of only the Uspexx account manager.

So, let's calculate the Sharpe ratio for Mikhail B's PAMM account. Recall that the formula is: S = (R - Rf) / si. Rf is the average dollar bank deposit, which is equal to 22 percent. The Sharpe ratio for Mikhail B = (36.6% - 22%) / 20.92% = 0.69

Sharpe ratio for the Uspexx account = (36.8% - 22%) / 25.58% = 0.58

Analyzing the results, we can conclude that investing in the PAMM account of trader Mikhail B is slightly safer than in the account of trader Uspexx.

However, you should also know that if the Sharpe ratio is less than 1, this indicates the ineffectiveness of investing in such PAMM accounts, since it is much safer to make a bank deposit than to risk for such a return.

Therefore, in conclusion, both of these PAMM accounts turned out to be unsuitable for investment, although at first glance their profitability was attractive.

The Sharpe Ratio in Evaluating a Trader's Trading Strategy

When evaluating two trading strategies with virtually identical annual returns, the Sharpe ratio formula is simplified by an order of magnitude. First, the guaranteed return on investment is eliminated from the formula, and the currency pair's volatility also acts as the standard deviation.

So, the Sharpe formula for determining the effectiveness of a trading strategy looks like this: Annual return in pips / volatility of the currency pair in pips. In this formula, the volatility of an instrument refers to the distance the price has traveled in pips in one year.

Now, let's say you earned 600 pips using this strategy, even though the instrument's annual volatility was 300 pips. Therefore, according to the formula, the Sharpe ratio = 600/300 = 2, indicating the high efficiency of your trading strategy.

In conclusion, it is worth noting that the Sharpe ratio is a simple method for determining the effectiveness of a PAMM account manager's trading strategy or personal trading strategy based on a simple mathematical formula.