Review of Alpari PAMM accounts for January

Investing in a PAMM account from Alpari is an excellent opportunity for an investor to increase their capital, and for a trader to attract investment.

a trader to attract investment.

However, we should not forget about the importance of such a concept as risk diversification, which means proper allocation of capital and creation of an investment portfolio.

If an investor always pursues the opportunity to earn money through his investment, then for the trader himself, investment accounts allow him to diversify the risks of his own trading in order to avoid losing all his funds.

One way or another, for both the first category of investors and the second, a competent mathematical approach is important, as well as a list of accounts under management, investing in which carries the smallest risks, but provides high returns.

According to our observations, the January holidays are a crisis period in the trading of the overwhelming number of managing traders.

That is why traders who successfully closed January with a profit along with good performance for the entire trading period are systematic and disciplined, which inspires confidence for every investor.

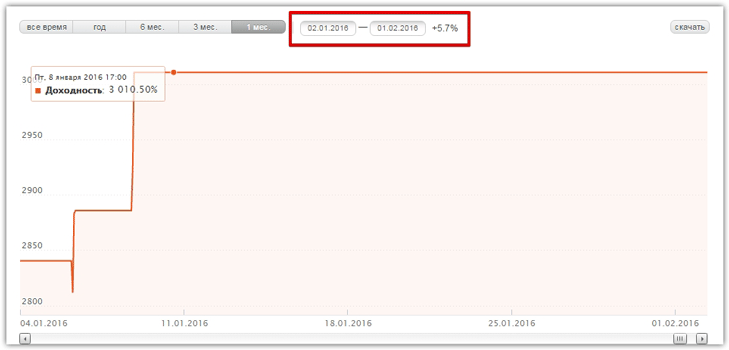

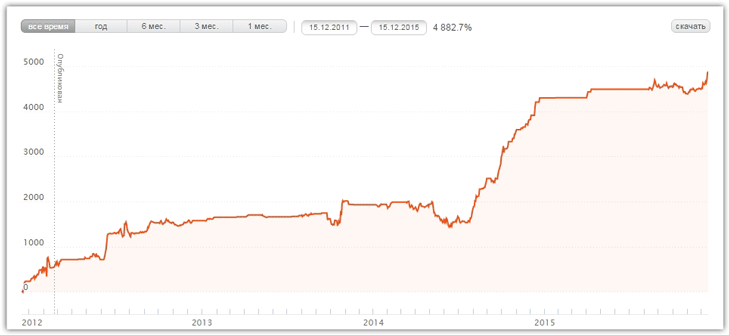

The first PAMM account that we want to offer is in first place in the Alpari ranking and has existed for more than three years. By the way, the Zapad PAMM account debunks many myths about the impossibility of long-term investing in the Forex market.

The total profit for 3 years and 11 months amounted to 3277 percent, and for the month of January the manager brought +5.7 percent to the total capital.

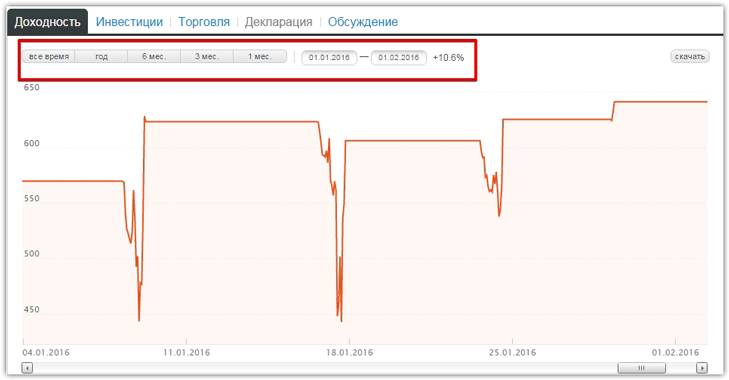

The second PAMM account with the symbolic name “Trustoff” has been successfully operating for 1 year and two months, but during this period the profitability has exceeded 600 percent.

The second PAMM account with the symbolic name “Trustoff” has been successfully operating for 1 year and two months, but during this period the profitability has exceeded 600 percent.

At this stage, this is one of the company's largest PAMM accounts, since the manager manages more than $2 million. The return for January was more than 10 percent, and the chart for January can be found below:

The third pamm account “Crocodile” closed the month of January with an indicator much higher than the two previous accounts, the profitability of which was 17.8 percent. If we talk about general indicators, the account has been successfully operating for 1 year 1 month, and its profitability for this period was 564 percent.

The third pamm account “Crocodile” closed the month of January with an indicator much higher than the two previous accounts, the profitability of which was 17.8 percent. If we talk about general indicators, the account has been successfully operating for 1 year 1 month, and its profitability for this period was 564 percent.

The Alpari PAMM system placed this account in sixth place in its ranking. The profitability chart for January is shown in the picture below:

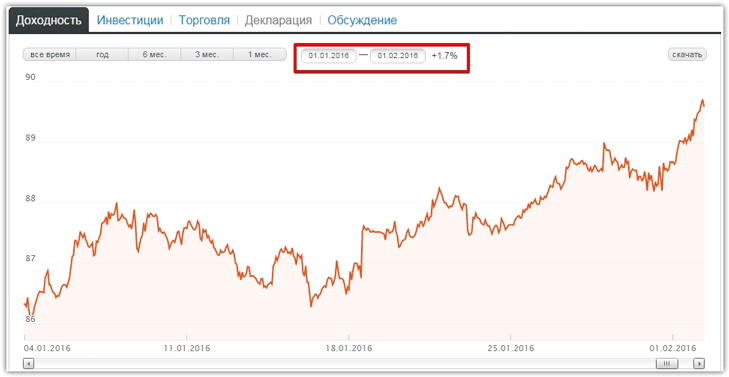

The fourth pamm account is called “Shooting-Star Trading” and is completely conservative with a low risk level. In total, the account lasted 2 years 4 months and brought its investors an increase of 97 percent. The Alpari rating system itself placed this account in a distant 20th place, and this despite the fact that the aggressiveness of this manager is extremely low compared to the overall profit indicator.

The fourth pamm account is called “Shooting-Star Trading” and is completely conservative with a low risk level. In total, the account lasted 2 years 4 months and brought its investors an increase of 97 percent. The Alpari rating system itself placed this account in a distant 20th place, and this despite the fact that the aggressiveness of this manager is extremely low compared to the overall profit indicator.

During the reporting month of January, the trader strictly followed the rules of his trading strategy and earned 1.7 percent. Below is a chart of the profitability behavior for January:

The fifth account we want to offer is relatively young and quite aggressive. The PAMM account “A0-HEDGE” lasted only 5 months, but managed to increase investors’ capital by 274 percent. For the month of January, the profitability was 36.5 percent, and the pamm itself is quickly acquiring investors. Profitability chart for January:

If we talk about the proposed rating https://alpari.com/ , then it contains both conservative managers with low returns and low risks, and aggressive traders with high returns and corresponding risks. However, the only thing that unites them is a systematic approach, which they demonstrated even on holidays.

If we talk about the proposed rating https://alpari.com/ , then it contains both conservative managers with low returns and low risks, and aggressive traders with high returns and corresponding risks. However, the only thing that unites them is a systematic approach, which they demonstrated even on holidays.