Currency pairs for making money on swap using the Carry trade strategy

Most newcomers to Forex perceive the commission for transferring positions to the next day only as an additional expense.

But swap can be both negative and positive, using which you can earn money. It all depends on the difference in discount rates between the currencies in the currency pair and the direction of the transaction.

If we recall the principle of swap calculation, we can say that during a purchase transaction you purchase the base currency and take the quoted currency on credit.

That is, in the case when you buy a currency with a higher interest rate and a positive swap value appears.

Currency pairs for Carry trade in 2022-2023

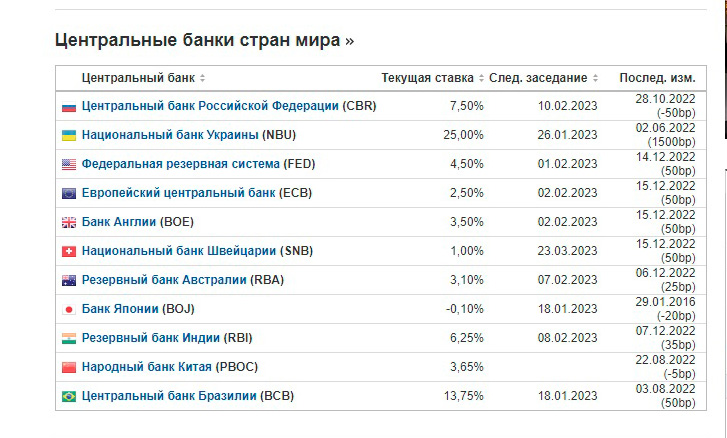

2022 was a record year for changes in discount rates of national banks; due to increased inflation rates, most national banks raised their interest rates:

Therefore, the list of pairs that are traditionally used for the Carry trade strategy has also changed. There are two options for selecting a suitable currency pair to make money on swaps.

In the first case, we simply study the table of central bank interest rates:

Then we select the currencies with the largest difference in rates and determine the direction of the transaction for which a positive swap will be charged.

For example, on the US dollar the rate is 4.5%, and on the Japanese yen -0.10%, that is, we need to buy the dollar for the yen. In other words, making purchase transactions on the USD/JPY currency pair can result in up to 4.5% per annum.

The biggest difference is observed if the currency pair consists of a hard currency and an exotic currency , in which case the difference can be more than 10%.

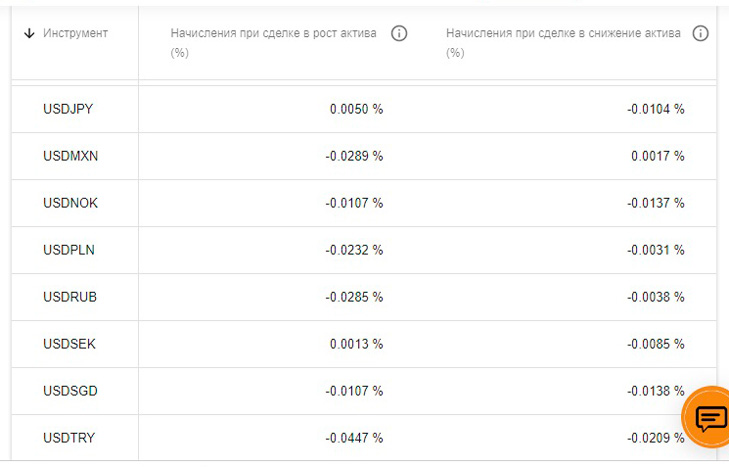

A more accurate option is the broker’s specification for currency pairs, which usually indicates the swap for a particular currency pair per day:

This option is more accurate, since brokers calculate the swap using their own formulas and therefore the amount of the fee for transferring a position may differ from company to company.

If we talk about currency pairs that are suitable for Carry trade today, they are:

USD/JPY – buy trade

EUR/CAD – sell trade

EUR/MXN – sell trade

EUR/PLN – sell trade

USD/CHF – buy trade

That is, if you want to get additional income through a positive swap, then you should wait for the indicated trend direction and only then open a deal.

In addition, you can also clarify the current swap value directly in the metatrader trading platform by looking at the specification for the selected asset. Since this indicator changes frequently, the trading platform will display the most current swap value.