In what currency should you store money in 2022, dollar or euro?

Almost everyone in their life has encountered a situation where they have to lose money due to a wrong choice.

This happens especially often if you incorrectly choose the main currency in which the money will be stored.

In case of an error, you can, so to speak, out of the blue, lose several tens of percent of your funds, even if the money is kept in hard currency.

Today, the most popular currencies are the US dollar and the euro, but in 2022 the dollar exchange rate has strengthened significantly against the euro and now many people are asking the question - In which currency is it better to store money?

I thought about a similar question because I myself suffered from the fall of the euro. Most of my money was in this currency for purely technical reasons, since it was more convenient and cheaper for me to withdraw profits from the trader’s account in euros.

And now the question has arisen again: in what currency should we continue to store money, should we leave everything as is, or is it better to convert euros into dollars?

Will the euro fall further against the US dollar?

The plan for further action depends on this, because if the euro continues to fall, you can lose even more, and if it begins to restore positions, then it’s worth converting your existing dollars into euros now and making money on the exchange rate:

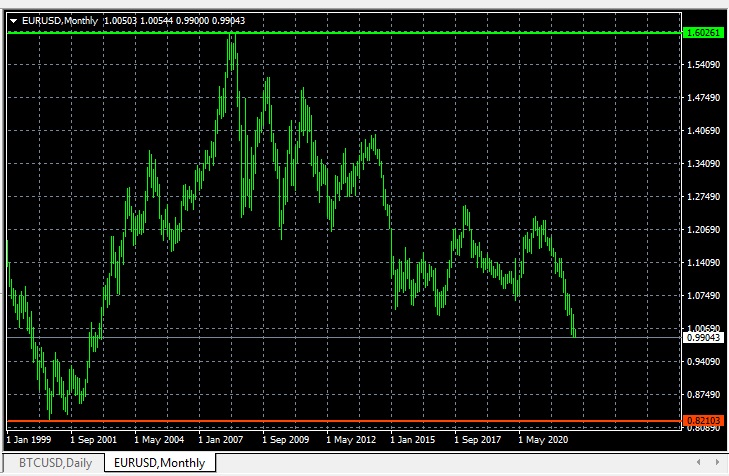

When analyzing the chart of the EURUSD currency pair, it is clear that the price has dropped almost to its minimum, recorded in 2001 at 0.83 US dollars per 1 euro. At the same time, the historical maximum price is almost 1.60 dollars per 1 euro.

In my opinion, there are much more arguments that the European currency will begin to rise than that it will continue to fall.

Firstly, the military conflict in Ukraine will end in the coming year or will move to a frozen stage, and this is the main reason why the euro has fallen.

Secondly, a strong dollar is not beneficial for America, because it negatively affects the price of American goods on world markets and sooner or later measures will be taken to artificially reduce the exchange rate of the US dollar.

And thirdly, the economy of the United States is far from going through its best hours, and pre-election political instability will lead to an even greater deterioration of the situation.

The decline in the popularity of the American dollar is also observed on the Forex exchange; the number of transactions to buy the dollar has noticeably decreased recently; traders prefer to sell this monetary unit.

Therefore, when choosing now which currency to store your money in, it is better to transfer most of your savings into euros and wait for the start of an upward trend.

The recommendation is relevant if you are going to keep money for quite a long period, but if you plan to spend it in the near future, then it makes no sense to exchange one currency for another.