Pending limit order on the exchange, is it worth using this type of order?

One of the most effective tools in stock trading are pending orders; they help implement a lot of simple strategies.

In fact, the use of such orders to open transactions allows you to automate trading only using the functionality of the trading platform without the use of third-party scripts.

In the metatrader 4 trading platform, we have two types of pending orders, Stop and Limit, and it is when working with limit orders that traders have a lot of questions.

Pending stop orders are logically understandable; the opening price of such an order is indicated further along the trend, that is, when setting a Buy Stop it should be higher than the current one, and when setting a Sell Stop it should be lower than the current price indicator.

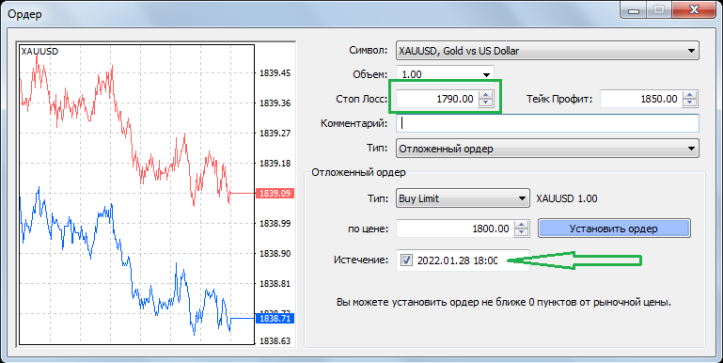

For example, you bet on buying gold, now the price is falling and is at $1815, but you assume that as soon as it reaches $1800 per Trinity ounce, it will immediately begin to rise and set a Buy Limit with an indicator of 1800.

Why are such orders needed? – to open a position at the best price and obtain maximum profit.

Risks of working with limit orders on the exchange

At first glance, it may seem that placing pending orders against the existing trend is quite dangerous, because we have always been told that it is impossible to trade against the existing trend.

But this statement is only partly true, because when placing an order, you can immediately specify the stop loss parameters:

That is, if we return to our example, with the purchase price of gold at $1,800, then in the same order you can specify a stop level of $1,790. And if after opening a buy position the price continues to fall, then a stop loss will be triggered at 1790. Which will protect our deposit from being drained .

True, it would not be superfluous to also set the expiration time of the order, because if a position is opened before the weekend, there is a high probability of a price gap occurring and the stop loss will be triggered at the price of the first quote, and not at the price we set.

We can say that using a limit order when trading on the stock exchange is no more dangerous than any other, if you do not forget to set the stop loss parameter when placing it. At the same time, such orders help to enter the market at the most convenient points in the price channel .