What is affected by an increase in the base interest rate, the economy and the exchange rate of the national currency?

Recently, the US Federal Reserve raised the base interest rate from 1.5% to 1.75%.

This has not happened in the United States economy since 1994, so many people are interested in the question of what an increase in the discount rate could lead to, and how such a decision will affect the exchange rate of the US dollar in relation to other world currencies.

For a more complete understanding of the situation, you first need to understand what changes lead to an increase in the discount rate and what processes it affects.

Money becomes more expensive - Central banks increase lending rates for commercial banks, which in turn increase interest rates on loans for households and companies.

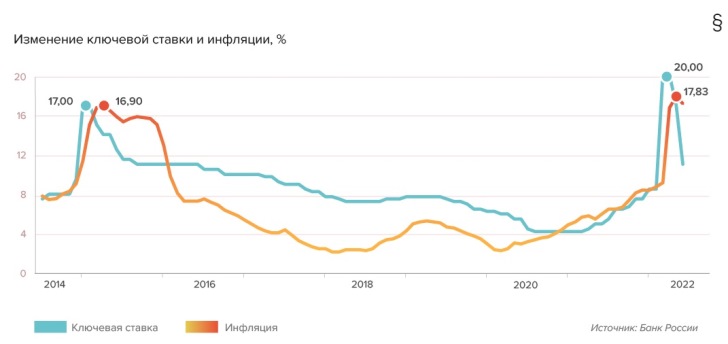

The figure below clearly shows how inflation in Russia is decreasing after the Central Bank increased the rate:

And this means that such a step, first of all, will stop or at least slow down prices in the American market.

Business activity - the rise in cost of monetary resources leads to the fact that companies reluctantly take expensive loans with high interest.

Business stops expanding production using borrowed funds, business activity falls, which leads to increased unemployment.

Real estate prices - if loans become more expensive, then the number of people willing to use them to purchase real estate will decrease.

And this means a decrease in demand for real estate, which, at a minimum, will lead to a slowdown in price growth in the US real estate market or, at maximum, to a decrease in prices:

The exchange rate of the national currency - since after an increase in the base rate it becomes more expensive to receive money, the national currency begins to strengthen.

That is, we can assume that the US dollar will continue to strengthen against the euro and other world currencies.

Perhaps not as much as happened in a similar situation with the Russian ruble, but it is still possible to predict a drop in the euro/dollar exchange rate to values close to 1 to 1.

However, this does not mean that we urgently need to get rid of the euro and buy American dollars; strengthening the dollar relative to other world currencies is not beneficial to the American economy and perhaps in the near future the Fed will take steps to weaken it.