How to reduce taxes by trading cryptocurrency

For many investors involved in cryptocurrency trading, it becomes an unpleasant surprise when they have to pay a considerable amount of taxes.

It would seem that if you trade cryptocurrency, you are not at all obliged to pay anyone anything, but in fact, any profit, including from trading cryptocurrencies, is subject to taxation.

Tax liability arises as soon as you exchange cryptocurrency for regular money and it goes into your account or you receive cash.

We discussed the taxation of cryptocurrencies in more detail in this article - https://time-forex.com/kriptovaluty/nalogi-kriptovaluty and today we’ll talk about how you can avoid paying taxes on earnings with cryptocurrencies.

Available options for optimizing cryptocurrency taxation

Today, there are several options for reducing taxes on profits from trading cryptocurrencies:

Completely legal - withdraw only the profit received to your personal bank account, and the main amount continues to be stored in crypto wallets.

In this case, you will pay income tax only on the amount of income, this greatly simplifies the calculation process. Since if the entire amount of your funds is credited to your account, you will have to explain for a long time that only a part is profit, and you had the rest of the money before.

Do not withdraw money - that is, pay directly with cryptocurrency for the goods or services you receive.

Today, quite a few services and the largest online stores accept payments in cryptocurrency, for example, Amazon or Subway, Burger King, KFC. As a result, you save about 15% of the money spent this way.

Cryptocurrency cards - such cards are opened on cryptocurrency exchanges, they can be quickly topped up with almost any cryptocurrency and used almost like a regular debit card.

The method is quite controversial since when opening a card you have to indicate all your data, including your country of residence. And then depending on your luck, whether the exchange leaks information about your transactions or not depends on the amounts on the card and the policy of the exchange itself.

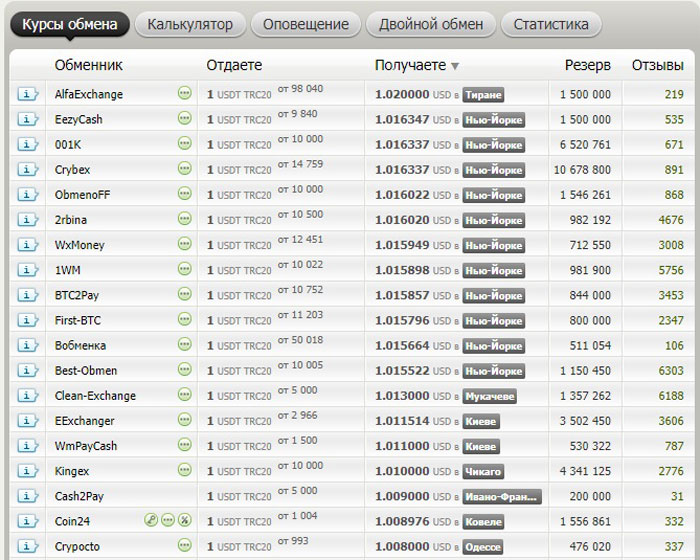

Online exchange is today the most reliable way to transfer crypto into cash without advertising your identity.

For these purposes, you can use services like https://www.bestchange.ru/ thanks to the exchange, you can quickly convert digital money into cash at the exit rate.

You just need to choose which asset and where you want to exchange, and then make the exchange.

Exchange offices - these services work on the principle of ordinary exchange offices that we are used to seeing on our streets.

To carry out the exchange, you need to transfer cryptocurrency to the specified account, and then receive cash in the selected currency. At the same time, you can anonymously exchange an amount of no more than 1000 US dollars; for larger exchanges you will need to provide a document.

Payment services – currently there are a lot of payment services; they are not banks, which means they do not submit reports for their clients.

Such services also issue their own debit cards, which can be used to pay for goods and services in regular stores.

Entrepreneurial activity is another option through which you can almost legally reduce your taxes.

Since usually the amount of income tax is several times higher than the amount of tax for an entrepreneur, for example in Ukraine the income tax is 18%, and for an entrepreneur 5%. True, you will have to imitate the activity in order to explain where the funds come from.

In general, unless we are talking about very large amounts, maintaining anonymity when transferring cryptocurrency into cash is not difficult. With some effort, you can cash out amounts over $10,000.

At the same time, at the end of the year, you yourself can indicate the required amount in your tax return and pay taxes in order to fully legalize the profit received.