In which currency should you store money in 2024?

Strange as it may seem, you can lose money even without trading on the stock exchange, but simply by keeping a deposit in the wrong currency.

The currencies of the CIS countries regularly lose tens of percent of their value in relation to hard world currencies.

Moreover, the depreciation is so significant that the losses cover the profit from interest on the deposit for several years.

I was able to verify this from my own experience; at one time I kept a large sum of money on deposit for three years at 10% per annum. During this time, my earnings amounted to 30%, but after a sharp fall in the national currency, I lost 50% if I converted the money to the US dollar.

For this reason, it is recommended to keep money only in foreign currencies, even taking into account the low interest rates on deposits.

But there is another question: In what currency should you keep your money in 2024, since even the hardest currencies are subject to exchange rate risks?

Given the current situation, when answering this question, it is easier to name currencies that are not worth holding at the moment than to choose the most stable currency.

The best option, during a period of economic instability, would be Diversification or the creation of a currency basket.

That is, you do not store money in one currency, but distribute it between several, fortunately this is quite simple to do.

- In a bank - by opening several accounts in foreign currencies and receiving interest on them. Minimal risk and ease of implementation.

- With a broker - by opening purchase transactions on selected currencies, or by keeping money in an account and receiving interest. Large selection of currencies and high interest rates. List of brokers - https://time-forex.com/spisok-brokerov

Which currencies should you choose for long-term storage of savings?

Surprisingly, there are not so many options, because the currency must not only be stable, but also liquid; it is not possible to open a bank account in any currency.

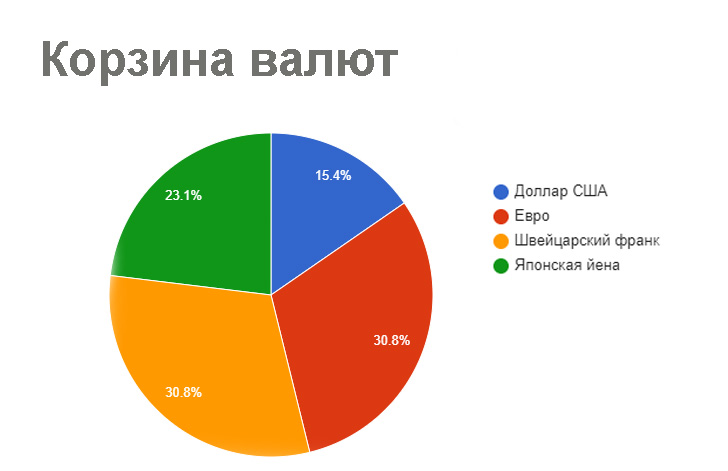

Therefore, when creating a currency basket, it is recommended to use such liquid currencies as the US dollar, Euro, Swiss franc and Japanese yen.

In this case, you should correctly distribute funds between the named currencies:

The American dollar is the least trusted right now, so you should invest a minimum of money in it. At the same time, the Japanese yen is quite promising and can significantly increase in price.

The American dollar is the least trusted right now, so you should invest a minimum of money in it. At the same time, the Japanese yen is quite promising and can significantly increase in price.

Traditionally, we invest part of the money in Swiss francs and the euro, which should grow after the ECB increases the discount rate.

This distribution will allow you to minimize losses from changes in rates and even receive interest on the funds on deposit . But you can create your own basket, based on your preferences and forecasts.