What does it mean to “Take profit on the stock exchange”?

Most people without economic or financial education confuse the concepts of profit and income, assuming that they are quite similar things.

In fact, Income is all the funds received from the sale of goods or services, and profit is income minus the cost and expenses associated with its receipt.

That is, if we consider the concept of profit in relation to stock trading, then income can be considered the amount received as a result of a successful transaction.

But profit should be called only the remainder of the funds after you subtract all the additional commissions and expenses that were spent on the implementation of this transaction.

At the same time, many beginners are interested in what it means to take profits on the stock exchange?

The easiest way to understand the meaning of this expression is by the example of an open transaction in a trader’s trading platform:

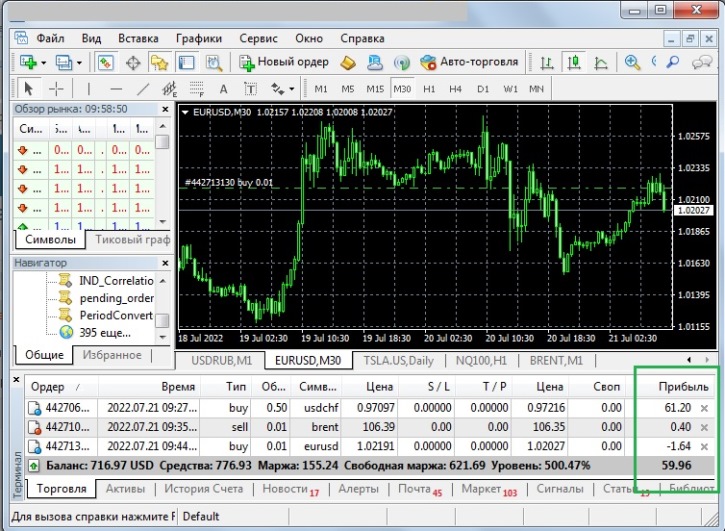

On the “Trade” tab, all opening transactions are displayed here, and in the “Profit” column, accordingly, the profit as a result of these transactions.

But the profit value in this column is not constant, but dynamic; it changes depending on where the price is moving, that is, the indicator can increase or decrease.

In order to lock in a profit on the stock exchange, you simply need to close a profitable transaction, after which the result will no longer change. And only in this case the profit will be fixed.

Accordingly, if you close a losing trade, then we can say that you have recorded losses.

Closing a transaction and fixing profit is carried out not only in the above way, but also over the phone or automatically using a stop order, the essence does not change, and fixation will happen in any case.

It should be noted that there can be many open transactions at the same time and if you need to record the entire achieved financial result, then to do this you should close all existing transactions.