How significant is the scalping commission on Forex and how to minimize it

I am often asked how important is the size of the scalping commission from a broker when trading on Forex or the stock exchange.

I usually answer that the size of the spread has almost no effect on the outcome of the transaction, because now brokers open positions almost free of charge, with rare exceptions, for some assets.

But after I had to trade using scalping on Forex, my opinion changed dramatically; in this strategy, size still matters.

Until this moment, I only suspected how much a broker earns, but here all the assumptions exceeded any expectations.

Scalping commission size using a specific example

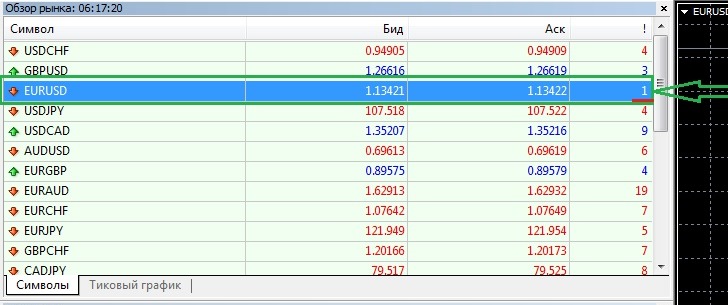

For trading, we chose one of the most liquid currency pairs with a minimum spread and which almost always has a normal trend, well, at least one that is sufficient for our strategy.

As you may have guessed, this is the EURUSD pair; at the selected broker, the spread size on average ranges from 0 to 5 points in the fifth digit, you will agree that it is quite a bit.

True, no matter how hard I tried, the average commission size still did not drop below 3 points:

Trading was carried out with a deposit of $100, a volume of 0.1 standard lot or 10,000 euros, that is, in this situation, 3 commission points equaled 0.3 dollars per transaction.

Trading was carried out with a deposit of $100, a volume of 0.1 standard lot or 10,000 euros, that is, in this situation, 3 commission points equaled 0.3 dollars per transaction.

Not so much if you take into account the volume of opened positions of 10,000 and not so little in relation to a deposit of $100.

More than 70 trades were opened during the day, and they managed to earn about $20.

I can’t say that the result was impressive, but for a deposit of $100 it’s pretty good. But the most interesting conclusion was made after calculating the commission paid to the broker for opening orders.

Its size was about 21 dollars. That is, we can say that I paid the broker for opening orders 21% of the initial deposit amount.

And if we analyze the situation as a whole, we can say that an average spread of 6 points, instead of 3 points, would lead to a significant loss. Well, scalping on exotic currencies with a spread of 15 points makes no sense at all.

It is clear that in trading everything is purely individual, but this is exactly the result I got.

Therefore, if you decide to engage in scalping, and even more so pipsing, choose a broker with a low spread and the most liquid currency pair at the moment.

Well, don’t get carried away with leverage, trading even with a leverage of 1:100 is already quite difficult. In addition, it should be remembered that 70 transactions per day is far from the limit, and along with the number of orders, the size of the scalping commission paid increases proportionally.