Carry trade (carry trade).

You can make money on Forex not only by guessing the direction of exchange rates, but also simply by using the difference in the discount rates of the currencies included in the currency pair.

Carry trade is a trading strategy in which the main profit-generating factor is the difference between deposit and loan rates in different countries. Depending on the direction of the transaction, this trading option can bring good profits.

Basic concept of Carry trade.

When carrying out operations with the purchase or sale of currency, the trader takes one of the currencies in the currency pair on credit, and the second is at his disposal. When carrying out intraday trading , interest on the use of funds and remuneration on the deposit are not paid, but if the transaction is postponed to the next day, such a thing as a Forex swap comes into play.

A swap can have either a negative or a positive indicator, depending on whether the interest on the loan or the interest accrued on the deposit is greater.

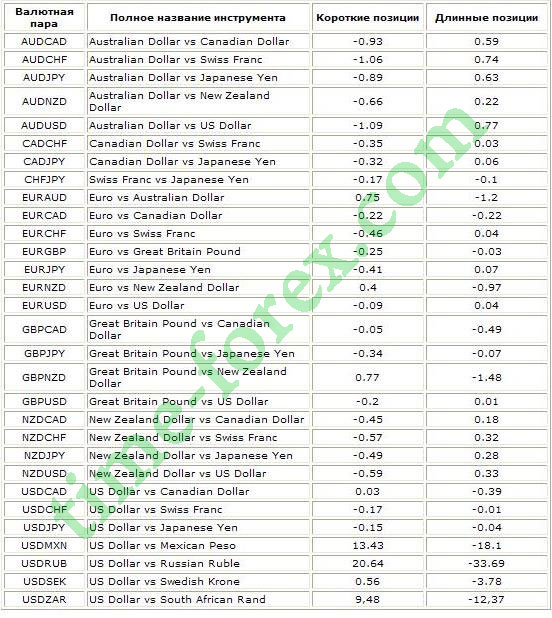

For example, if the EURAUD currency pair is used for trading, then the swap commission amount is -

When selling - +0.75% per annum, and when buying -1.2% per annum, that is, opening a purchase transaction and transferring it to the next day you, regardless of the direction of the exchange rate, will be credited with +0.75 per annum.

It seemed that you could earn money with such meager percentages, but we should not forget that when trading Forex leverage is used, and if its size is 1:100, then the amount of interest will increase 100 times and will already be 75% or 6.5 in month or 0.2% per day.

With a deposit of $10,000, that's about $200. Moreover, there are also more profitable currency pairs, for which the positive swap can reach up to +5%.

For example: by choosing a currency with the lowest interest rates for a loan, you can invest in a more profitable instrument, but in the currency of another country. In practice, this operation looks like this: you take out a loan in Euros at 9% per annum, transfer the funds received into rubles and place them on deposit at 20% per annum. If the rate remains at the same level over the year, you will earn 11% profit minus the bank commission for the exchange. The low percentage of profit is compensated by the fact that you work exclusively with other people's money. This is the simplest example of applying this strategy in real life.

Kerry trading strategy on Forex.

The main components of this trading strategy are:

1. Selection of a suitable trading instrument - the main condition for using this strategy is the choice of the appropriate currency pair, with a positive swap level.

2. The presence of a suitable trend direction or its complete absence, so that changes in the exchange rate do not cause losses for a given currency pair.

3. Low spread size - will increase the amount of possible profit.

This strategy is not often used when trading forex due to the high level of currency risk, but it still occurs.