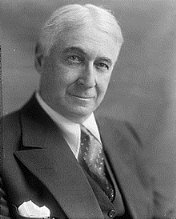

The story of a financier - Bernard Baruch. Man facing the crowd

In his writings, Bernard Baruch wrote that despite the fact that each individual may have high intelligence and reason sensibly, the moment the crowd begins to move, almost everyone without exception follows it.

On the stock exchange, the herd instinct manifests itself in all its glory, because a trend is a reflection of the mood of the crowd, so to speak, the realization of its expectations.

Bernard Baruch in his book gave a clear answer to how he managed to achieve success on the stock exchange - he ceased to be part of the crowd. He bought when everyone was selling and sold when everyone was buying.

Fear, panic and the herd instinct force one to take rash actions, and when everyone lost en masse, Baruch earned millions.

early years

The future genius was born in 1870 in South Carolina, the city of Camden. He grew up in a quite wealthy family, since his father at that time was an outstanding surgeon who laid the foundation for the rehabilitation of patients with the help of physiotherapy.

Organized crime and the constant murder of blacks were not a safe environment for a child to live in, so when Baruch turned 10 years old, the whole family, having saved up money, moved to a safer New York at that time.

Bernard Baruch was a very talented and hardworking child who wanted to make a career as a trader.

After he graduated from a local New York college, he immediately went to work for a stock exchange company.

Bernard started from the very bottom, namely, he was paid only $3 a week for the fact that he transferred various orders to banks and also to the trading platform.

However, the guy was very savvy and very interested in the stock exchange, so the company noticed him and made him a trader who executed clients’ orders.

A little later he became a partner in the brokerage firm of A. Housman & Co. and began to own an eighth of the shares that he had to buy at the time of becoming a partner.

Bernard decided to go out on his own in 1898, and with the help of excellent connections gained while working as a broker, he managed to buy a place on the stock exchange floor.

However, instead of success, he constantly lost money, losing deposit after deposit.

At one point, he came to his father for help, who gave him 500 dollars and said that this was the last money he had saved for a rainy day.

When Baruch came to the trading place, he could not make transactions, because it seemed to him that he would lose them again, because before he was confident in himself, but still suffered failures.

After a long pause, he began to act, but he was already making deals against the crowd and was right.

Unprecedented growth

The last 500 dollars taken from his father began to actively bring Baruch money, and quite a lot of it.

Being an ardent speculator, he managed to accumulate quite a solid income, which he wisely invested in the Texasgulf company, becoming its co-founder.

It is worth noting that the company was engaged in equipment and repair services for oil producing companies, and since oil production was just developing at that time, Baruch turned from an upstart trader into a millionaire in a matter of years.

A little later in 1903, Bernard and his brother opened their own company, Baruch brothers. It is worth noting that at that time trust and hedge funds were actively popular, but Baruch was a loner and did not like to work in a team.

He made all transactions and purchases of precious securities personally, for which he was nicknamed “Lone Wolf.” After purchasing Hentz, the largest trading company with a huge representative network, Baruch became the undisputed leader in the stock exchange world.

Political ambitions

During the US presidential elections, Baruch supported Woodrow Wilson with his funds, who later made him his adviser, and then a member of the committee on the procurement of weapons for national defense.

It is worth noting that at the outbreak of the First World War, Baruch owned shares in a huge part of military factories, which gave him the opportunity to earn more than 200 million dollars.

Bernard Baruch died on June 20, 1965 at the age of 94. His friend and comrade-in-arms was Churchill himself; Bernard was one of the most influential people in the world. Baruch left behind a fortune of more than $1 billion.