Benjamin Graham is not only a great theorist, but also a successful practitioner

A man who became a legend among traders, famous traders and investors, who managed to develop the maximum system for assessing the value of shares, and most importantly, the prospects for their future course.

Benjamin was born on May 8, 1894 in England, his first name was Grossbaum, the future investor had Jewish roots.

The family was quite wealthy and intelligent, but still, in 1895, the parents decided to move to the United States, which became fateful in Graham’s life.

Unfortunately, a few years after the move, the father died, which worsened the family’s financial situation and the mother had to raise other people’s children, for which she opened a private boarding house.

Benjamin himself studied quite well, and this allowed him after school to receive a scholarship to study at Columbia University, which he completed safely and successfully a few years later.

The first job of a twenty-year-old boy was the position of an assistant in one of the brokerage companies in New York, which he preferred to the position of a professor at the same Columbia University.

Quite a considerable amount considering that at that time Ben was only 25 years old and the year was 1919.

The secret to a successful career was excellent analytical and mathematical abilities, because it was not for nothing that Graham was invited to teach mathematics at the university.

Convinced of his strengths and abilities, Benjamin, at the age of 32, decided to create his own investment fund; in those days, such companies were called partnerships.

The company successfully existed for decades, bringing profit to its founder and survived the crisis of 1929.

In parallel with his investment activities, Benjamin Graham taught finance at his native Columbia University, thanks to which many future financiers consider him their teacher.

He also wrote several books, one of which, Security Analysis, is still considered the best guide for novice investors. Many works have been published devoted to the analysis of the financial condition of an enterprise and the assessment of expected profits.

He also wrote several books, one of which, Security Analysis, is still considered the best guide for novice investors. Many works have been published devoted to the analysis of the financial condition of an enterprise and the assessment of expected profits.

Benjamin Graham Strategy

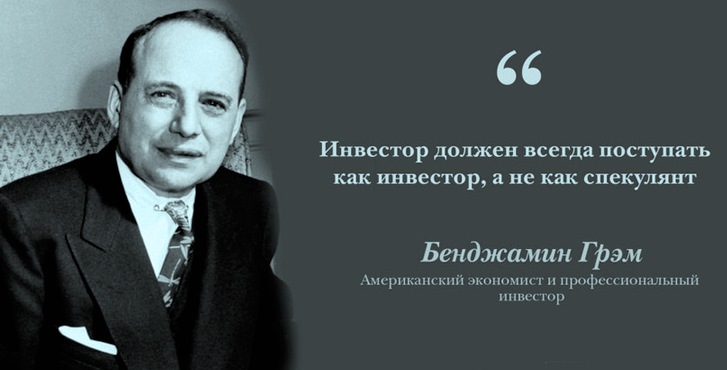

Benjamin Graham is a classic investor who prefers to invest in stocks rather than speculate in securities.

This is the principle on which his approach to stock trading is based, which is based on a fundamental analysis of the enterprise itself that issued shares to the market.

Moreover, the investor believes that when conducting an analysis, one should pay attention not only to the company’s assets and liabilities and the amount of dividends paid, but also to who runs it and what people are top managers.

His student Warren Buffett , who surpassed his teacher and managed to earn a fortune of 85 billion US dollars.